Sales tax rates are talked about frequently, but policymakers spend less time focused on sales tax bases—the basket of transactions that the sales tax applies to in a given state. That’s a shame, because there are three big problems with sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. bases today, and policymakers have an opportunity to fix these issues.

Public finance experts generally agree that a properly-structured retail sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. should apply to all final consumption so that you have a broad base and can levy a low rate. However, in practice most states have sales taxes that fall short of this ideal on three counts:

- They do not tax services

- They exempt many final consumer goods that should be taxed

- They tax business-to-business transactions that should be exempt

Let’s unpack each of these problems one by one.

Most states do not comprehensively tax services as an accident of history

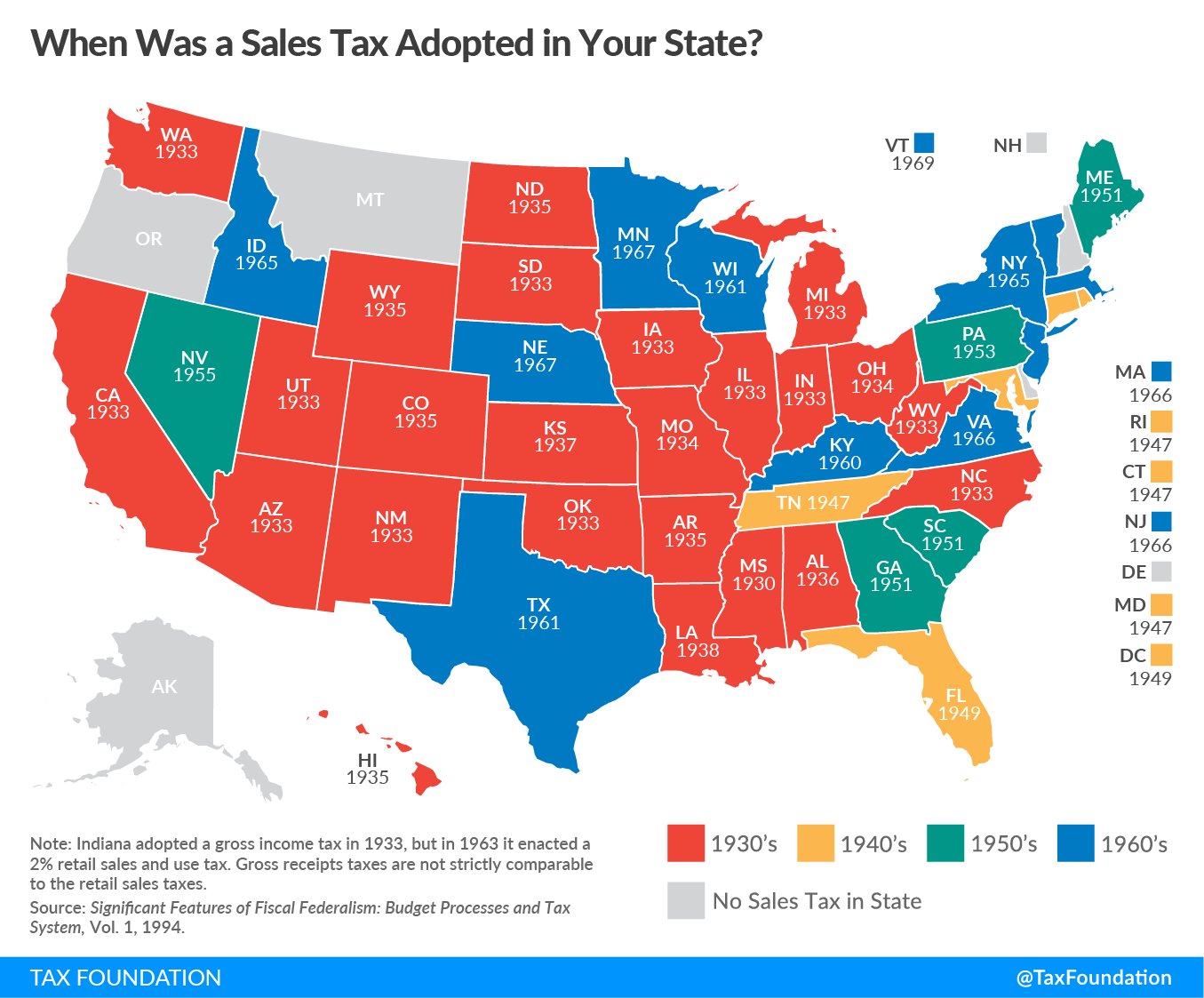

The first sales tax was enacted in Mississippi in 1930 as a reaction to falling property tax revenues during the Great Depression. At the time, the consumer economy was predominantly transactions of goods. As a result, when the drafters wrote the sales tax statute, it only applied to transactions of tangible personal property, the goods sector. Forty-four states and D.C. followed Mississippi in enacting sales taxes in the following decades, and all but three (Hawaii, New Mexico, and South Dakota) for the most part adopted a goods-only tax structure.

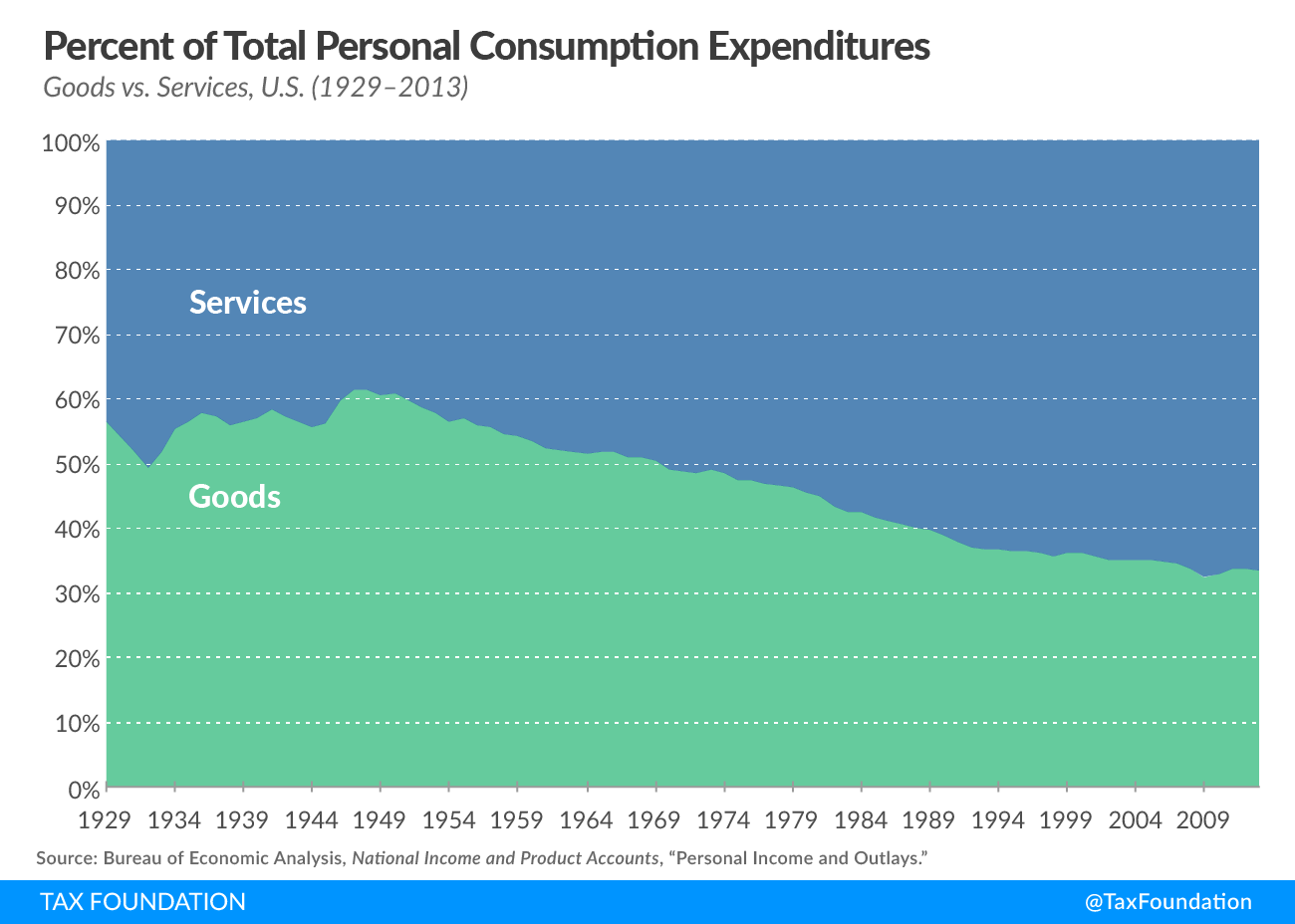

This was a sufficiently broad base for a few decades, but since then the American economy has transformed to include far more services. Services now represent approximately two-thirds of consumption, and largely go untaxed by state sales taxes.

This has resulted in upward pressure on sales tax rates over time as the sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. continues to narrow and sales taxes bring in less revenue as a percentage of the economy. The proper solution is to broaden the sales tax base to include services, and use the revenue from that base broadening to lower the sales tax rate, or the rates of other more economically-damaging taxes.

Some states have moved in this direction relatively recently, but none in a comprehensive way that changes the default treatment of services. Most states still have a default of taxing all goods unless they have an enumerated exemption, and a default of taxing no services unless they are enumerated as taxable.

Most states exempt some final consumer transactions for political reasons

Frequently, it is argued that since some goods are “necessities,” they should be sales tax-free. In most cases this manifests itself as exemptions for particular goods like groceries, clothing, and medication.

These exemptions, while well-intentioned, have the effect of significantly narrowing the tax base, as groceries, clothing, and medication make up a large percentage of consumption, with groceries and clothing alone making up 10 percent of personal consumption expenditures in 2016, according to the Bureau of Economic Analysis.

While many argue that these exemptions are necessary to protect low-income individuals, these exemptions of course are enjoyed by anyone purchasing these products, even high-income individuals. A better, more targeted solution is to include these products in the sales tax with the interest of maintaining a broad tax base at heart, and then providing targeted relief to low-income individuals either through a credit on their income tax return, or through spending programs.

| Note: States with no sales tax (DE, MT, NH, and OR) are listed as “not applicable” (n.a.) within Table 17. Alaska has a local option sales tax. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: 2017 State Business Tax Climate Index. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Groceries | Clothing | Prescription Medication | Non-Prescription Medication | Gasoline | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | Taxable | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alaska | Taxable | Taxable | Taxable | Taxable | Taxable | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arizona | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arkansas | Alternate Rate | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| California | Exempt | Taxable | Exempt | Taxable | Alternate Rate | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Colorado | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Connecticut | Exempt | Taxable | Exempt | Exempt | Alternate Rate | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Delaware | n.a | n.a | n.a | n.a | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Florida | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Georgia | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | Taxable | Taxable | Exempt | Taxable | Taxable | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Idaho | Taxable | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Illinois | Alternate Rate | Taxable | Alternate Rate | Alternate Rate | Taxable | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indiana | Exempt | Taxable | Exempt | Taxable | Taxable | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Iowa | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kansas | Taxable | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kentucky | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Louisiana | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maine | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maryland | Exempt | Taxable | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Massachusetts | Exempt | Exempt | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michigan | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Minnesota | Exempt | Exempt | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mississippi | Taxable | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Missouri | Alternate Rate | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Montana | n.a | n.a | n.a | n.a | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nebraska | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nevada | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | n.a | n.a | n.a | n.a | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Jersey | Exempt | Exempt | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Mexico | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | Exempt | Exempt | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Carolina | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Dakota | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ohio | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma | Taxable | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oregon | n.a | n.a | n.a | n.a | n.a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pennsylvania | Exempt | Exempt | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rhode Island | Exempt | Exempt | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South Carolina | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South Dakota | Taxable | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tennessee | Alternate Rate | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Texas | Exempt | Taxable | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Utah | Alternate Rate | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Vermont | Exempt | Exempt | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Virginia | Alternate Rate | Taxable | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| West Virginia | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wisconsin | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wyoming | Exempt | Taxable | Exempt | Taxable | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| District of Columbia | Exempt | Taxable | Exempt | Exempt | Exempt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Many states do not fully exempt business inputs (which are not final consumption and should not be taxed)

While the previous two problems deal with the sales tax base being too narrow, this last one is an area where the sales tax base can be overly broad, taxing transactions that are not final consumption. In the process of making final goods and services, businesses will often buy raw materials from each other to create products. These business inputs, or business-to-business transactions, are not final consumption, and so should not be taxed by the sales tax.

When states do tax business inputs, the costs of those taxes cascade, or “pyramid” down the production chain and embed themselves in the final price of the consumer product. Consumers end up paying the tax in the form of higher prices — they just do so in a nontransparent way. The picture below shows how a carton of milk could be taxed multiple times throughout its production chain if business to business taxes are applied.

Taxing business inputs disproportionately harms industries with long production chains, and consequently can encourage vertical integration for tax reasons even if it makes no business sense.

If states were to fix these three problems, they would have not only a broad-based but a “right-sized” sales tax system that taxes each dollar of consumption once and only once. This would result in stable revenue, and would allow for a low rate that brings in ample funding for government services.

For more on your state’s sales tax base, see the tables in the back of our latest State Business Tax Climate Index.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe