All Content

Tax Trends at the Dawn of 2020

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min read

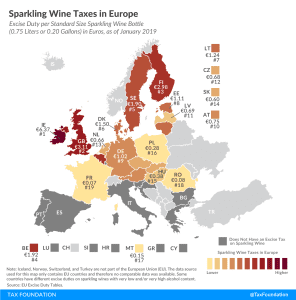

Sparkling Wine Taxes in Europe

1 min read

Virginia Governor Looks to Excise Taxes

The proposed budget reflects a growing trend as policymakers across the country look to excise taxes as long-term solutions to budget woes. While excise taxes can be a part of the revenue picture, they are not a sustainable revenue source due to their narrow base, which is easily affected by changes in consumer behavior or market conditions.

2 min read

State Tax Changes as of January 1, 2020

This year was a significant one for state tax policy, and the wide range of changes taking effect January 1, 2020, reflects the scope and intensity of that activity. With states continuing to grapple with issues like the taxation of international income and collections obligations for remote sellers and marketplace facilitators, the coming year is unlikely to be any quieter.

23 min read

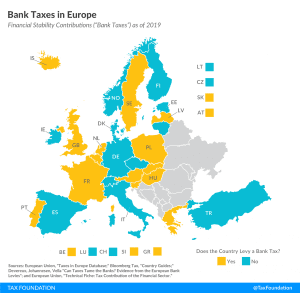

Bank Taxes in Europe

2 min readGILTI and Other Conformity Issues Still Loom for States in 2020

Even two years after enactment of the federal Tax Cuts and Jobs Act (TCJA), many states have yet to issue guidance explaining how they conform to key provisions of the law, particularly those pertaining to international income.

27 min read

Lawmakers Agree to Let Extenders Live On

2 min read

Expensing Provisions Should Not Favor Physical Over Human Capital

Investments in worker training and education can increase productivity and economic output as growth in human capital accumulates, though the time horizon for these effects is longer than that of physical capital accumulation.

3 min read

Evaluating Mark-to-Market Taxation of Capital Gains

The success of any mark-to-market system lies in its ability to accurately value tangible and non-tangible (or non-tradable) assets such as intellectual property and brand-value recognition. Administrative regulations, guidance, and enforcement are the Achilles’ heel of any plan to annually tax accrued gains.

17 min read

Two Years After Passage, Treasury Regulations for the Tax Cuts and Jobs Act Surpass 1,000 Pages

Treasury released final regulations on the base erosion and anti-abuse tax (BEAT), which is meant to dissuade firms from engaging in profit shifting abroad. Other high-profile releases from 2019 include final regulations guiding enforcement of Section 199A, commonly known as the pass-through deduction; final regulations on enforcing the new tax on global intangible low-tax income (GILTI); and final regulations on state-level workarounds to the $10,000 limit on the state and local tax deduction (SALT).

5 min read