All Content

The COVID-19 Relief Bill Contains Over $100 Billion in State Aid After All

The $900 billion coronavirus relief package provides nearly $82 billion for the Education Stabilization Fund, $14 billion for mass transit, and $10 billion for state highways,

3 min read

COVID-19 Relief Package FAQ

The latest $900 billion coronavirus relief bill extends and modifies several provisions first enacted in the CARES Act, Congress’s $2.2 trillion pandemic relief law that was passed in March. With this package, lawmakers will have responded to the coronavirus and related economic hardship with a record-setting $3 trillion of fiscal support.

14 min read

Tax Extenders Hitch a Ride on Omnibus and COVID-19 Relief Deal

Tax extenders are no stranger to hitching a last-minute ride on year-end legislation. This year they made another last-minute appearance, finding a hold in their own division of the 5,593-page bill to fund the government through the fiscal year and provide additional coronavirus relief through March.

2 min read

Congress Passes $900 Billion Coronavirus Relief Package

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

8 min read

Pandemic Highlights the Need for Better Tax Policy for Entrepreneurs and Small Businesses

As Congress works to provide another round of emergency economic relief, it is a good time to step back and consider how tax policy affects entrepreneurs and small businesses.

3 min read

Gross Receipt Taxes Become Part of New Jersey’s Recreational Marijuana Legalization

By the time marijuana is sold to a consumer, local taxes could be applied four different times—by one or more localities.

5 min read

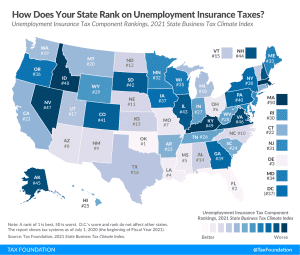

Where State Unemployment Compensation Trust Funds Stand in December

With 2020 nearing its close, state unemployment compensation trust funds continue to struggle under the weight of so many pandemic-created beneficiaries, though some funds are beginning to stabilize as people increasingly return to work.

3 min read

State Tax Collections Down 4.4 Percent Through September, While Local Tax Collections Rise

Combined state and local tax collections were down only $7.6 billion across the period, representing a total state and local tax revenue decline of 0.7 percent compared to the first nine months of 2019.

6 min read

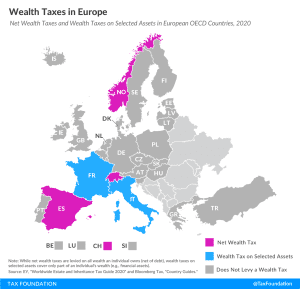

Wealth Taxes in Europe, 2020

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

3 min read

Arkansas Lieutenant Governor Looks to Eliminate Income Tax

Lt. Governor Griffin’s goal to eliminate the income tax is a commendable one that should be considered with cautious optimism, though with the understanding that even a well-designed process may end up putting more weight on an already uncompetitive sales tax. In the meantime, there is plenty of space for incremental improvements in Arkansas’s income tax that will make the state more competitive.

4 min read

Senate Policymakers Release $908 Billion Bipartisan COVID-19 Relief Proposals

A bipartisan group of lawmakers released two compromise relief bills to address the COVID-19 pandemic, totaling about $908 billion: The Emergency Coronavirus Relief Act and the Bipartisan State and Local Support and Small Business Protection Act.

4 min read

Details and Analysis of State and Local Aid Under the Bipartisan State and Local Support and Small Business Protection Act of 2020

On Monday, members of the bipartisan Gang of Eight negotiating an end-of-year pandemic relief package announced that they had settled on language and had divided the package into two bills: a pandemic aid package and a $160 billion state and local support package.

6 min read

Tax Foundation Response to OECD Public Consultation Document: Reports on the Pillar One and Pillar Two Blueprints

The Tax Foundation response to the OECD public consultation document on the reports on the OECD Pillar 1 and OECD Pillar 2 blueprints.

2020 Spanish Regional Tax Competitiveness Index

The Regional Tax Competitiveness Index (RTCI) for Spain allows policymakers, businesses, and taxpayers to evaluate and measure how their regions’ tax systems compare. This Index has been designed to analyze how well regions structure their tax system. Additionally, it serves as a road map for policymakers to reform their tax systems and make their regions more competitive and attractive for entrepreneurs and residents.

7 min read

Individual and Business CARES Act Tax Provisions Due to Expire on December 31

Any additional relief to address a temporary economic crisis should be temporary, targeted toward those most in need, and consistent with good long-term tax policy.

3 min read

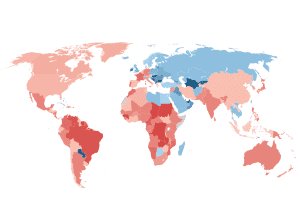

Corporate Tax Rates around the World, 2020

Corporate tax rates have been declining in every region around the world over the past four decades as countries have recognized their negative impact on business investment. Our new report explores the latest corporate tax trends and compares corporate tax rates by country.

22 min read