All Content

Arkansas Chips Away at Tax Reform

3 min read

Analysis of the Cost-of-Living Refund Act of 2019

We estimate that a new proposal to expand the EITC would reduce federal revenue by $1.8 trillion and decrease long-run GDP by 0.29 percent, while boosting labor force participation for low-income tax filers by 822,788 full-time equivalent jobs.

10 min read

The Top 1 Percent’s Tax Rates Over Time

In the 1950s, when the top marginal income tax rate reached 92 percent, the top 1 percent of taxpayers paid an effective rate of only 16.9 percent. As top marginal rates have fallen, the tax burden on the rich has risen.

5 min read

Tax Foundation Response to OECD Public Consultation Document: Addressing the Tax Challenges of the Digitalization of the Economy

Though the challenges to international tax policy are many, the OECD has a chance to work toward a system that creates fewer distortions and negative economic effects than the current one. However, given the policies on the table, it will certainly take quite an effort to avoid further complexity of international tax rules that creates challenges to global trade and economic prosperity.

What Happens When Everyone is GILTI?

Secretary Mnuchin, Finance Minister Le Maire, and other tax policy leaders should encourage the OECD and their own research staff to perform serious economic analysis on the alternatives for changing international tax rules before moving forward. It would be quite unfortunate for the world to learn the wrong lessons from U.S. tax reform.

3 min read

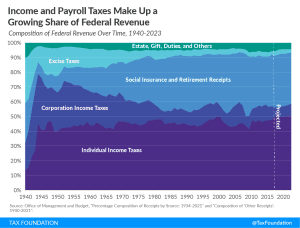

The Composition of Federal Revenue Has Changed Over Time

The federal income tax and federal payroll tax make up a growing share of federal revenue. Individual income taxes have become a central pillar of the federal revenue system, now comprising nearly half of all revenue.

2 min read

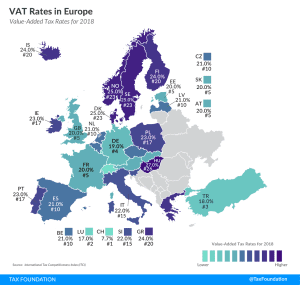

VAT Rates in Europe, 2019

4 min read

The Case for Universal Savings Accounts

21 min read

Evaluating Education Tax Provisions

Research shows that the current menu of education-related tax benefits is not effectively promoting affordability or the decision to attend college. Lawmakers wishing to provide education assistance should reconsider whether the tax code is the best tool to achieve that goal.

21 min read