The individual income tax is one of the most significant sources of revenue for state and local governments. In fiscal year (FY) 2016, the most recent year of data available, individual income taxes generated 23.5 percent of state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections, just less than general sales taxes (23.6 percent).

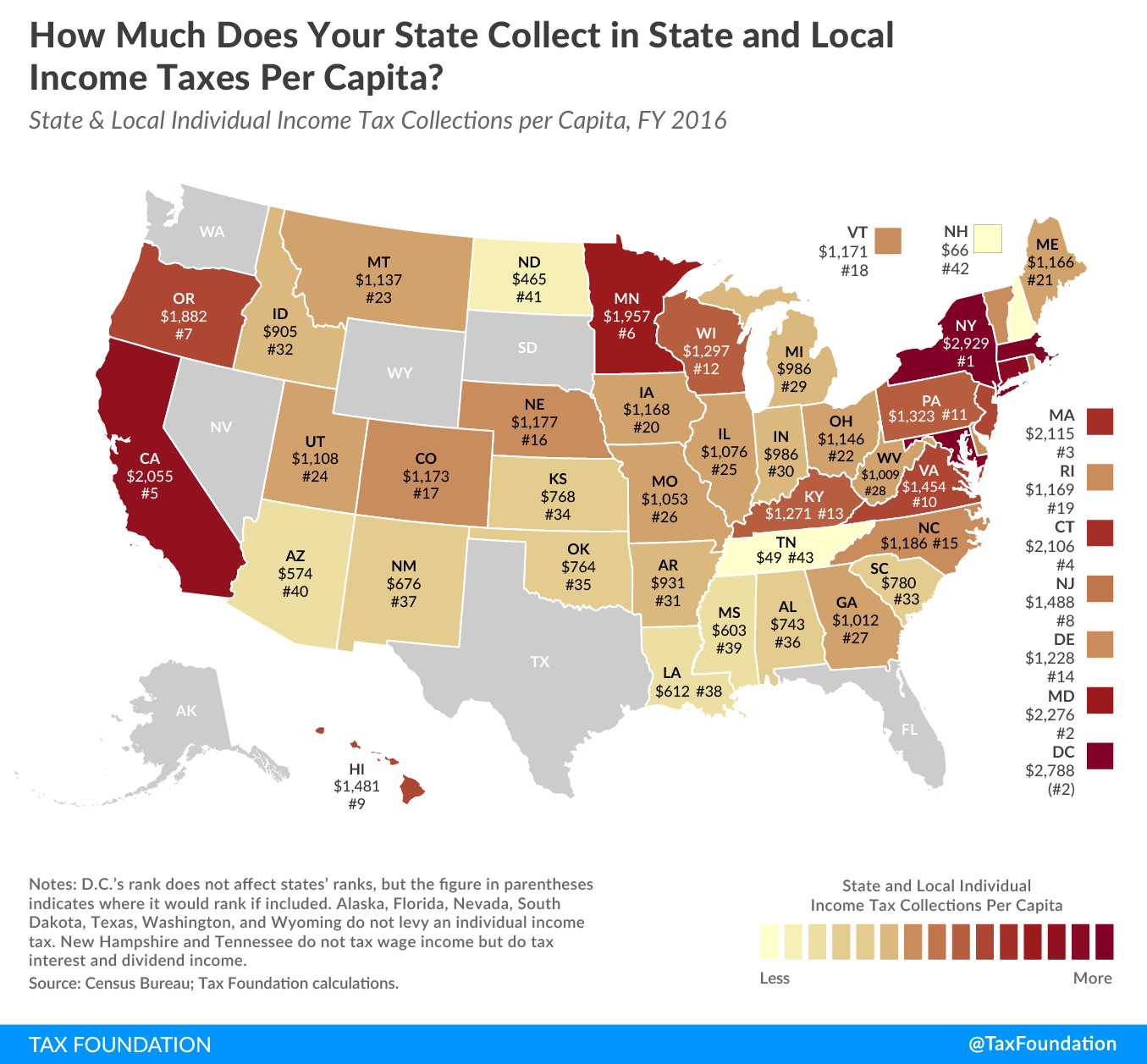

The map below shows combined state and local individual income tax collections per capita for each state in FY 2016. Forty-one states and the District of Columbia levy broad-based taxes on wage income and investment income, while two states—New Hampshire and Tennessee—tax investment income but not wage income. Tennessee’s tax on investment income—known as the “Hall tax”—is being phased out and will be fully repealed by tax year 2021. Seven states do not levy an individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. : Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

On average, state and local governments collected $1,164 per capita in individual income taxes, but collections varied widely from state to state. Collecting the most per capita were New York ($2,929), the District of Columbia ($2,788), Maryland ($2,276), Massachusetts ($2,115), Connecticut ($2,106), and California ($2,055). States collecting the lowest amount of individual income tax collections per capita tax investment income but not wage income: Tennessee ($49) and New Hampshire ($66). Of the states that tax wage income, lowest collections per capita were in North Dakota ($465), Arizona ($574), Mississippi ($603), Louisiana ($612), and New Mexico ($676).

Note: This is part of a map series in which we examine per capita state tax collections.

Note: This is part of a map series in which we examine per capita state tax collections

- How High are State and Local Tax Collections in Your State?

- How Much Does Your State Collect in Sales Taxes Per Capita?

- How Much Does Your State Collect in Corporate Income Taxes Per Capita?

- How Much Does Your State Collect in Property Taxes Per Capita?

- How Much Does Your State Collect in Excise Taxes Per Capita?