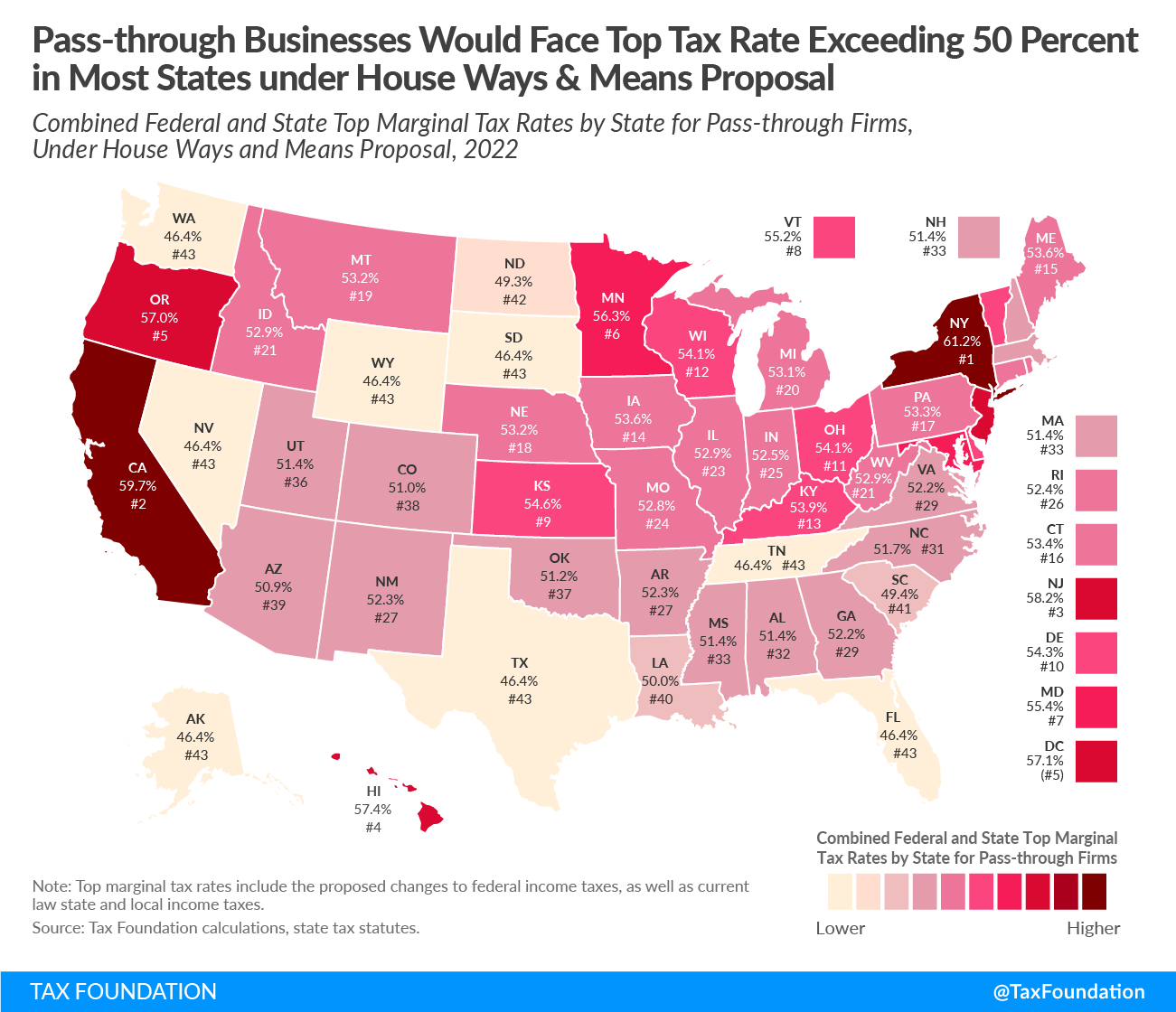

Under the House Democrats’ reconciliation plan, the top taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate on pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income would exceed 50 percent in most states.

Pass-through businesses, such as sole proprietorships, S corporations, and partnerships, make up a majority of businesses and majority of private sector employment in the United States. The owners of these firms pay individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. on income derived from these businesses. The marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. s vary for pass-through firms depending on the state where they operate, as states tax individual income differently.

The House Democrats reconciliation plan would raise the top marginal tax rate on ordinary income from 37 percent to 39.6 percent. Additionally, high-income taxpayers would face a 3 percent surcharge on their modified adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” (adjusted gross income minus any investment interest expense) in excess of $5 million.

The plan would make additional adjustments to business taxation. Currently, qualifying pass-through firms may use Section 199A, commonly known as the pass-through deduction, to deduct 20 percent of their qualified business income from federal income tax. However, the pass-through deduction is subject to limitations for firms earning above certain income limits that operate in a “specified service trade or business” (SSTB) and other guardrails that limit the size of the deduction. The plan would further limit the deduction by setting the maximum allowable deduction to $500,000 for joint filers and $400,000 for single filers.

Finally, the plan would amend the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. of net investment income tax (NIIT) to include income derived from the “active” part of a business, for joint filers with more than $500,000 in taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. and single filers with more than $400,000 in taxable income. The NIIT currently applies a 3.8 percent to investment, or “passive,” income such as capital gains, dividends, and interest income. The combination of these four tax increases would result in a top federal tax rate on pass-through business income of 46.4 percent (which is also the top federal tax rate on ordinary income under the proposal).

Top marginal tax rates faced by pass-through firms after the changes would vary by state—ranging from 46.4 percent in states with no state and local income tax, like Wyoming and Florida, to 61.2 percent in New York. These combined rates include federal, state, and local income taxes in addition to payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. . Under this reconciliation plan, 41 states would see their top marginal income tax rate exceed 50 percent.

Raising the top marginal tax rate on pass-through business income reduces the after-tax return on investment for those firms, reducing incentives to invest and hire.

Pass-through businesses are responsible for a large share of employment in the U.S. In 2019, pass-through firms made up over half of every state’s private sector employment. The share of private sector employment provided by pass-through firms ranges from 55.3 percent in Hawaii to 77.7 percent in Utah.

It may be claimed that the proposed tax increases only impact a small percent of firms, but economically it is more important to consider the share of business income that is affected. Our estimates indicate that more than half of pass-through business income would face a tax increase under these proposals.

As pass-through firms constitute a large share of employment and economic activity, many states would be impacted significantly by the increases in business taxation under the House Democrats reconciliation plan. Given that many states already impose high tax rates on business income, policymakers should keep in mind the combined tax burden levied on these businesses when considering changes to federal tax policy.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe