The latest inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. report confirms that prices for just about everything continue to rise, with the Consumer Price Index (CPI) up 8.2 percent over the last year and many categories up even higher, including food (11.2 percent) and energy (19.8 percent). While not part of the CPI, another measure of inflation (call it the Taxpayer Price Index?) is also surging: federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections are up 21 percent over the last year, according to the latest data from the Congressional Budget Office (CBO). Federal tax collections hit a record high of $4.9 trillion in nominal dollars for the fiscal year (FY) 2022 that ended September 30, which is $850 billion more than last year’s $4.05 trillion in collections (also a record).

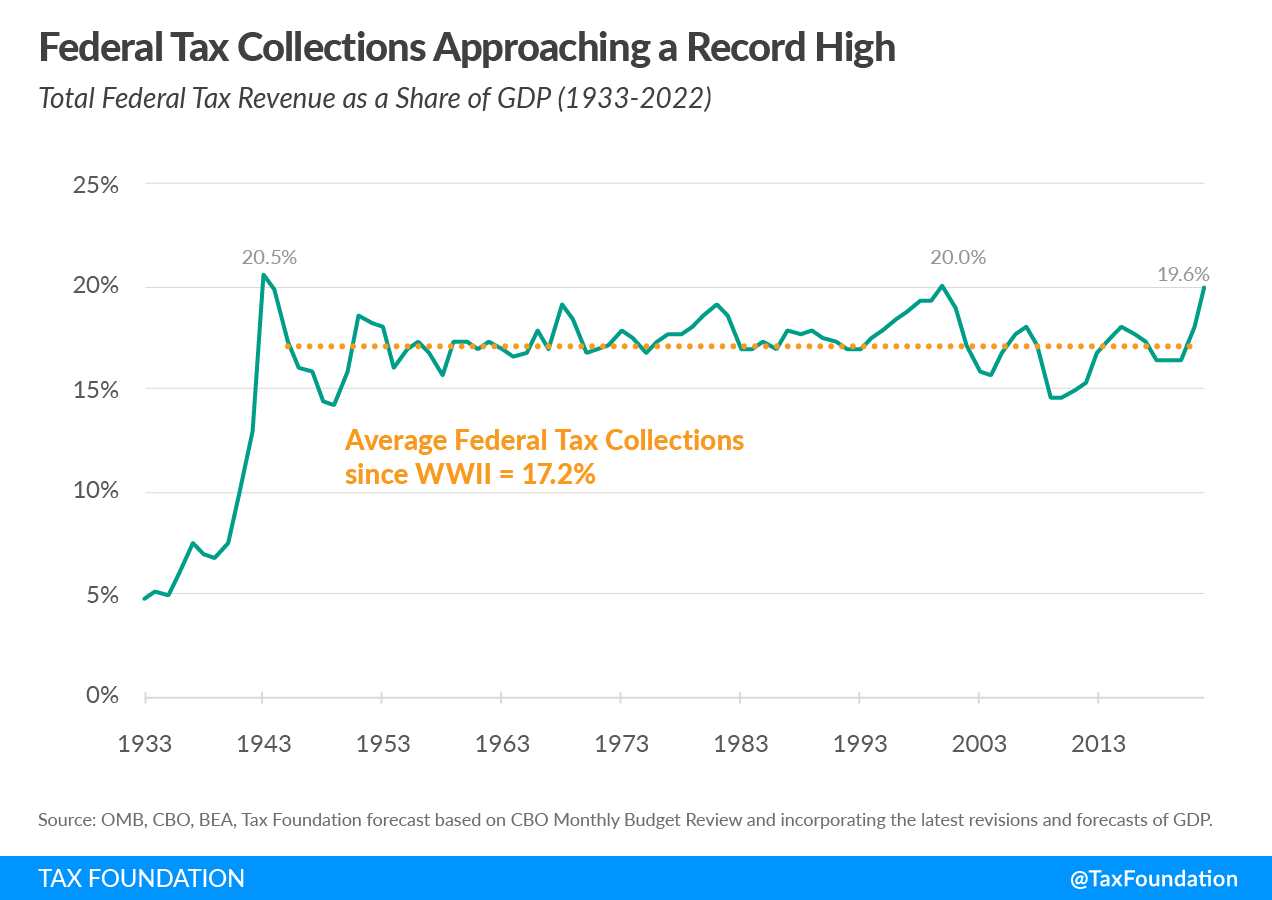

As a share of GDP, federal tax collections are at a multi-decade high of about 19.6 percent in FY 2022, up from 17.9 percent last fiscal year and approaching the last peak of 20 percent set during the dot-com bubble in FY 2000. There are only two other years in U.S. history when federal tax collections exceeded this year’s level, both during World War II: in 1943, federal tax collections reached 20.5 percent of GDP before falling to 19.9 percent in 1944. Compared to average federal tax collections in the post-war era of 17.2 percent of GDP, this year’s collections are set to exceed that level by 2.4 percentage points.

Looking more closely at federal tax collections in the current fiscal year, individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. collections surged the most, up 29 percent from $2.0 trillion last year to $2.6 trillion this year. This is perhaps partly due to capital gains resulting from last year’s booming stock and housing markets. Payroll taxes are up 13 percent from $1.3 trillion last year to $1.5 trillion this year, while corporate taxes are up 14 percent from $372 billion to $425 billion. Other revenues are up 13 percent from $316 billion to $356 billion.

Extreme economic volatility in recent years makes it difficult to assess how tax collections have been impacted by the Tax Cuts and Jobs Act (TCJA) enacted in 2017. Among other changes, the TCJA reduced the corporate tax rate from 35 percent to 21 percent. Corporate and other federal tax revenues were relatively low in 2018 through the first year of the pandemic but have since rebounded with the economy and inflation. Average federal tax collections in the five years since the TCJA’s enactment are about 17.3 percent of GDP, higher than the 16.7 percent forecasted by the CBO following its passage, higher than most years before the TCJA, and higher than the post-war average of 17.2 percent.

Note that current tax collections do not reflect the tax changes enacted last month as part of the Inflation Reduction Act (IRA), which mostly goes into effect beginning January 1, 2023. We estimate the IRA will increase gross revenue by about $28 billion in 2023, offset by $39 billion of tax credits, which is small relative to the budgetary effects of inflation and the rebounding economy.

It remains to be seen where tax revenue will go from here, but it clearly depends on the direction of the economy and inflation—and how potential policy changes affect both. This highlights the need for policymakers to at least try to account for these effects when weighing various policy trade-offs.

Regarding spending in FY 2022, the CBO reports that despite the surge in tax collections, federal outlays far exceeded that amount. Total outlays were $6.3 trillion, resulting in a deficit of $1.4 trillion. Thus, spending was about 25.1 percent of GDP—a level only exceeded during the height of the pandemic in 2020 and 2021, and during World War II.

These sobering numbers should give our elected officials pause. Record federal tax collections on top of surging prices—essentially an additional inflation tax paid by everyone who uses dollars—should not be used as a justification for more spending. Indeed, excessive spending in response to the pandemic is driving inflation, and rather than ramping up expensive relief programs (e.g., student loan forgiveness), we should be winding them down. Taxpayers should demand that pandemic emergency spending end now that the pandemic emergency is over, and that their tax dollars be used more judiciously or returned to them.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe