As the federal government looks to pass an extenders package, various excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. provisions are on the table. Excise taxes are placed on specific products or activities instead of on a general taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. base, like income or sales. Because excise taxes disproportionately burden low-income people, lawmakers should use excise taxes properly.

Excise taxes can be used to price an externalityAn externality, in economics terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either production or consumption of a good or service and can be positive or negative. or discourage consumption of a product that imposes costs on others. They can also be employed as a user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them. to generate revenue from people who use particular government services, revenue which should be used to maintain that government service.

When a consumer buys a product, they do not necessarily consider how using that product might impact others. In economics, this impact is called an “externality.” For example, if a person buys a pack of cigarettes, they may not consider that the negative impact on their health could drive up the cost of health care for others. An excise tax can function as a method to recoup some of the cost of this externality, as the revenue can fund increased Medicare or Medicaid costs. In this way, an excise tax can more accurately price a product to reflect the costs that its use imposes on society.

The role of excise taxes as a user fee is best understood in the context of a gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. . The more you drive, the more you use government-funded roads. The federal gas tax acts as an estimation of how much a person is using these roads, and charges them a user fee according to the amount of gasoline they consume. While there are issues with using gas as a proxy for road use (think electric cars, variances in fuel efficiency, or alternative uses for gasoline), the gas tax and other user fee excise taxes can be a noninvasive method to approximate how much a person utilizes government services and target frequent users for funding.

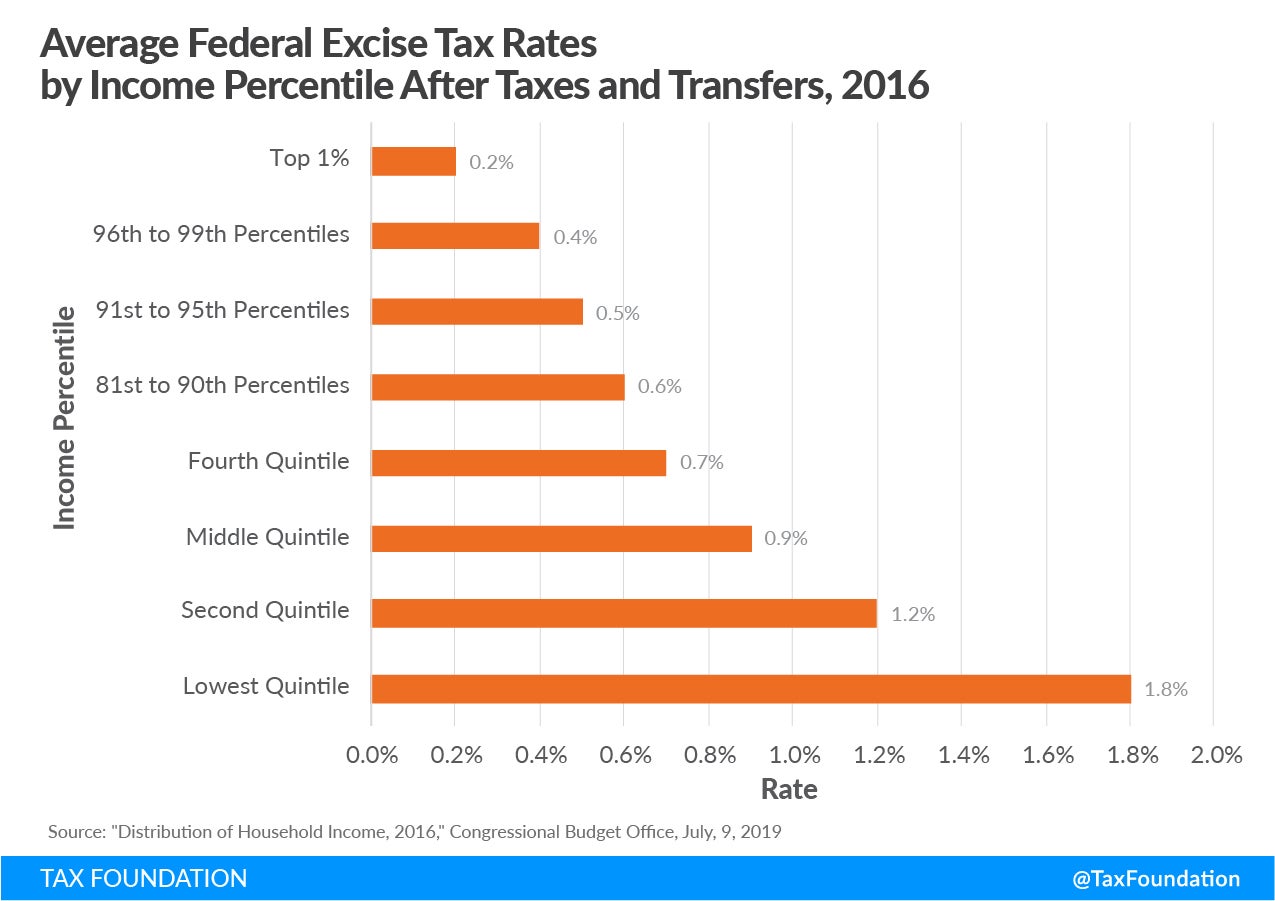

Excise taxes affect people differently across the income spectrum. As visualized in the graphs below, the distribution of federal excise taxes is regressive. In 2016, the top 1 percent of earners faced an average effective federal excise tax rate of 0.2 percent, while the bottom 20 percent of earners faced a rate of 1.8 percent. While high-income earners will pay more excise taxes in dollar terms, the extra cost makes up a lower portion of their overall spending.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeExcise taxes discourage certain behaviors at the margin but are not likely to eliminate a behavior entirely. A small increase in price will have the least effect on heavy consumers as their demand is more inelastic, or less affected by changes in price. In response to a tax increase, a heavy smoker might choose to smoke one fewer cigarette over the course of a day, but probably won’t quit entirely.

Additionally, the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. of some excise taxes tends to be narrow and inaccurately targeted. For example, if an excise tax on soda is justified by its high sugar content, then the tax should be on sugar in general to account for 1) other products with high sugar content and 2) the variable amount of sugar—and affiliated cost to society—in different sodas. Aiming for the broadest base possible when designing excise taxes would allow for a lower rate, lowering their burden on low-income taxpayers.

In effect, a higher price can act as a proxy for information, allowing a person to make a more informed decision while paying for the impact their choice imposes on others. By understanding excise taxes as user fees or a price on externalities, lawmakers can more effectively achieve policy goals while minimizing the impact of regressive taxA regressive tax is one where the average tax burden decreases with income. Low-income taxpayers pay a disproportionate share of the tax burden, while middle- and high-income taxpayers shoulder a relatively small tax burden. es.

For more information, see the footage from our “Talking Tax” event featuring an expert panel on excise taxes.