As public opinion increasingly favors the legalization of recreational marijuana, a growing number of states must determine how to taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. legal sales of cannabis.

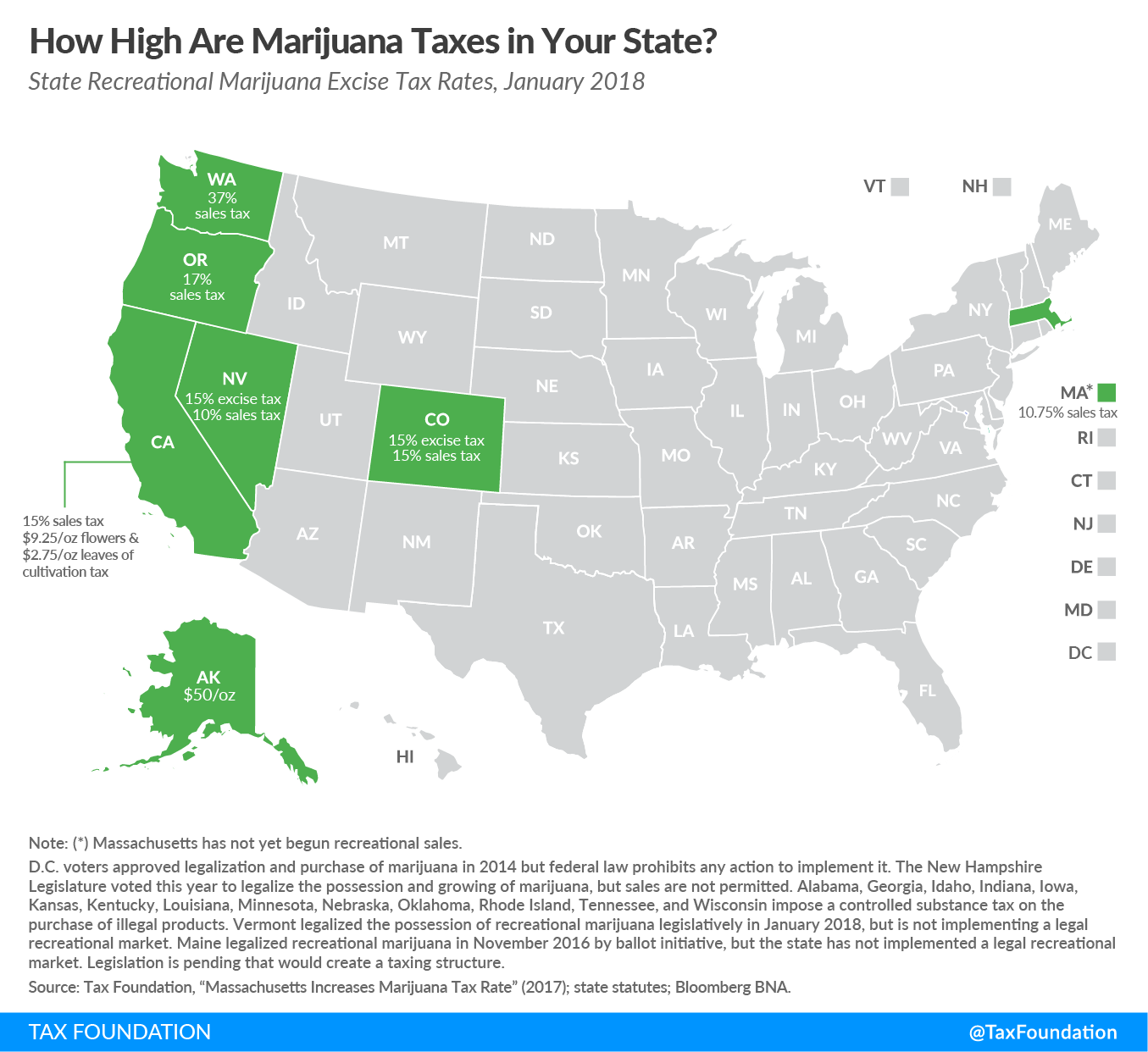

To date, nine states (Alaska, California, Colorado, Maine, Massachusetts, Nevada, Oregon, Vermont, and Washington) and the District of Columbia have legalized recreational marijuana, but only seven of these jurisdictions have legal markets. The map below highlights the states that have implemented legal markets and levy taxes on recreational marijuana.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeOf the states with legal markets, Alaska is the only state that does not impose some form of sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. on end-users. In each of the other states, taxes levied on the sale of marijuana far exceed the general sales tax rate levied by that state:

- In Alaska, which has no states sales tax, marijuana growers pay a tax of $50 per ounce when selling the product to marijuana dispensaries or retailers. While the cost of taxes paid is passed on to customers in the form of higher prices, end-users do not pay a sales tax when purchasing marijuana.

- In California, cultivators pay a per ounce of product tax at a rate of $9.25 per ounce of marijuana flowers and $2.75 per ounce of leaves. In addition, retailers collect from customers a 15 percent excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on the average market price of the product.

- Colorado imposes a 15 percent excise tax on the sale of marijuana from a cultivator to a retailer. In addition, the state levies a 15 percent sales tax (up from 10 percent in 2017) on retail sales to customers.

- Maine legalized recreational marijuana in 2016 by ballot initiative but has not yet established a legal market. Pending legislation would tax sales of marijuana at a rate of 10 percent and levy an excise tax on cultivators at a rate of $335 per pound of flower, $94 per pound of marijuana trim, $1.50 per immature plant or seedling, and $0.30 per seed. Governor LePage, however, has vowed to veto the legislation.

- Massachusetts, concerned its previous ballot initiative approved rate of 3.75 percent was too low, raised the excise tax rate to 10.75 percent in 2017.

- Nevada imposes an excise tax on the sale of marijuana by a cultivator to a distributor. This rate is set at 15 percent of the Fair Market Value as determined by the Nevada Department of Taxation. In 2017, Nevada created a new 10 percent sales tax paid by consumers.

- Oregon, which does not have a general sales tax, levies a 17 percent sales tax on marijuana.

- Washington levies a 37 percent sales tax on recreational marijuana.

Vermont legalized the possession of marijuana this year but did not create a legal market. D.C. also allows for possessing and growing of marijuana but does not allow for sales in a legal market.

Share