Vapor products, also known as electronic cigarettes, have become a common sight at gas stations, convenience stores, and stand-alone vapor shops since their market debut in 2007. Their desirability to customers is based on their ability to deliver nicotine without combustion and inhalation of tar. There is currently no federal excise tax on vapor products, but some states and localities have enacted their own vapor taxes at varying rates.

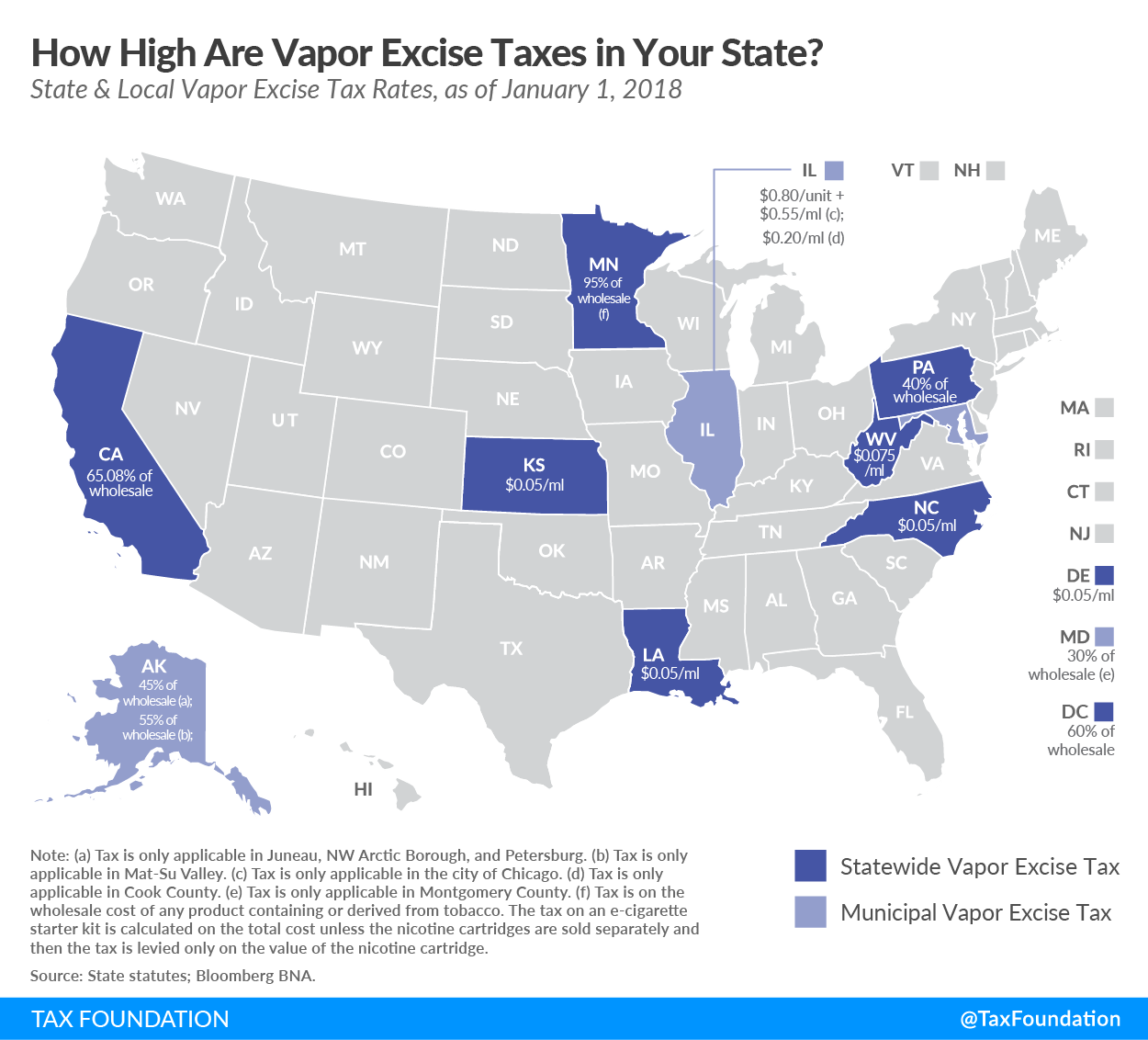

Eight states and the District of Columbia levy a statewide excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

on vapor, and three states are home to localities that have started to apply excise taxes to the products. This week’s map shows where state and local vapor taxes stand as of January 1, 2018.

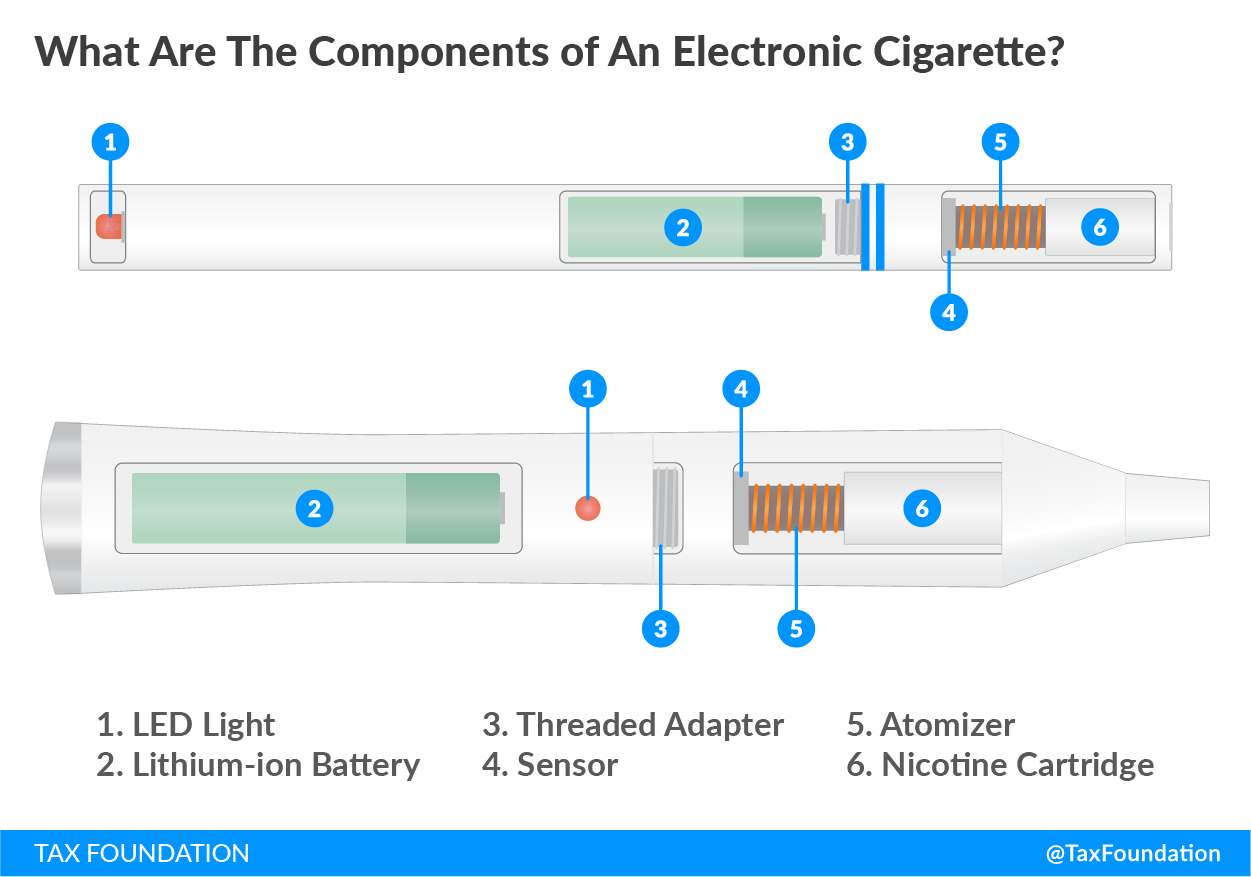

Taxation methods of vapor products vary across states and localities. Some taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. a percentage of the wholesale value while others tax per unit or milliliter of e-liquid. One notable advantage to taxing the products based on volume (per milliliter) as opposed to based on price (ad valorem) is that volume taxes do not apply to the delivery device when the e-liquid and electronic device are sold together. As an allegory, this would be like taxing a pipe, when an excise tax really only should apply to the pipe tobacco.

Of the states that tax the wholesale value, Minnesota is the highest by far (95 percent), followed by California (65.08 percent). Chicago levies the highest per unit tax ($0.80) plus a per milliliter rate ($0.55). Louisiana, North Carolina, Kansas, and Delaware have the lowest per milliliter rate ($0.05).

There is a broader conversation about the relative risk of vapor products compared to traditional cigarettes. Recent research from Public Health England shows that vaping is 95 percent less harmful compared to smoking cigarettes. Advocates of lower or no taxes on vapor products argue that high taxes could discourage current cigarette smokers from using vapor as a tool for quitting traditional cigarettes. Proponents of higher taxes assert that the health risks of vapor usage are unknown and any chance of young people picking up the habit is not worth the risk.

Read our comprehensive study “Vapor Products and Tax Policy” here.

Share this article