The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Transatlantic Tensions: What the German Election Could Mean for International Tax & Trade Policy

As the third-largest economy in the world, with an influential voice within EU policymaking, and the United States among its most important trading partners, Germany’s next government will play a particularly important role in deciding the direction of European tax, trade, and transatlantic policy.

6 min read

Distributed Profits Taxation Would Be a Good Role Model for the EU’s 28th Regime

In a recent speech at the Davos Economic Forum, European Commission President Ursula von der Leyen announced plans to create a single set of rules for corporate law, insolvency, labor law, and taxation, under which companies could seamlessly operate across the European Single Market.

7 min read

Expensing: It Pays to Be Permanent

As lawmakers work through the reconciliation process, permanently enacting improvements to deductions for capital investment and research and development (R&D) costs will create an economically powerful package.

8 min read

New Efforts on Taxing Endowments Raise Questions on Neutrality and Revenue Collection

Republican policymakers in Congress are considering options to raise revenue as part of their expected legislative package in 2025. One such option involves raising the tax rate on university endowments first put in place as part of the TCJA in 2017.

4 min read

New Jersey and Utah Are Latest States to Consider Reforming Economic Nexus

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read

Enhancing Arkansas’s Safe Harbor for Remote Work Employees: A Step Toward Modernization and Reform

By streamlining, simplifying, and reducing tax burdens for remote and nonresident workers, a newly proposed bill could make Arkansas a more attractive state for both employees and employers.

4 min read

Five Things to Know About Trump’s Global Minimum Tax Order

This week, the incoming Trump administration issued a day-one executive order on the global minimum tax agreement known as Pillar Two, which seeks to ensure multinational corporations pay at least 15 percent in income tax.

6 min read

Mexico Proposes Best-Designed Alcohol Tax System in the World

The proposed ad quantum tax would be the system that most closely follows the global best practices for alcohol taxes we previously outlined.

4 min read

Governor Moore Proposes Major Tax Changes in Maryland to Address Chronic Budget Deficits

Facing a projected $3 billion budget deficit in fiscal year 2026, with forecasts of a growing gap over the next five years, Governor Wes Moore (D) has included about $1 billion in proposed tax increases in his budget proposal.

7 min read

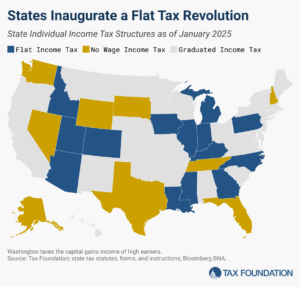

The State Flat Tax Revolution: Where Things Stand Today

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read