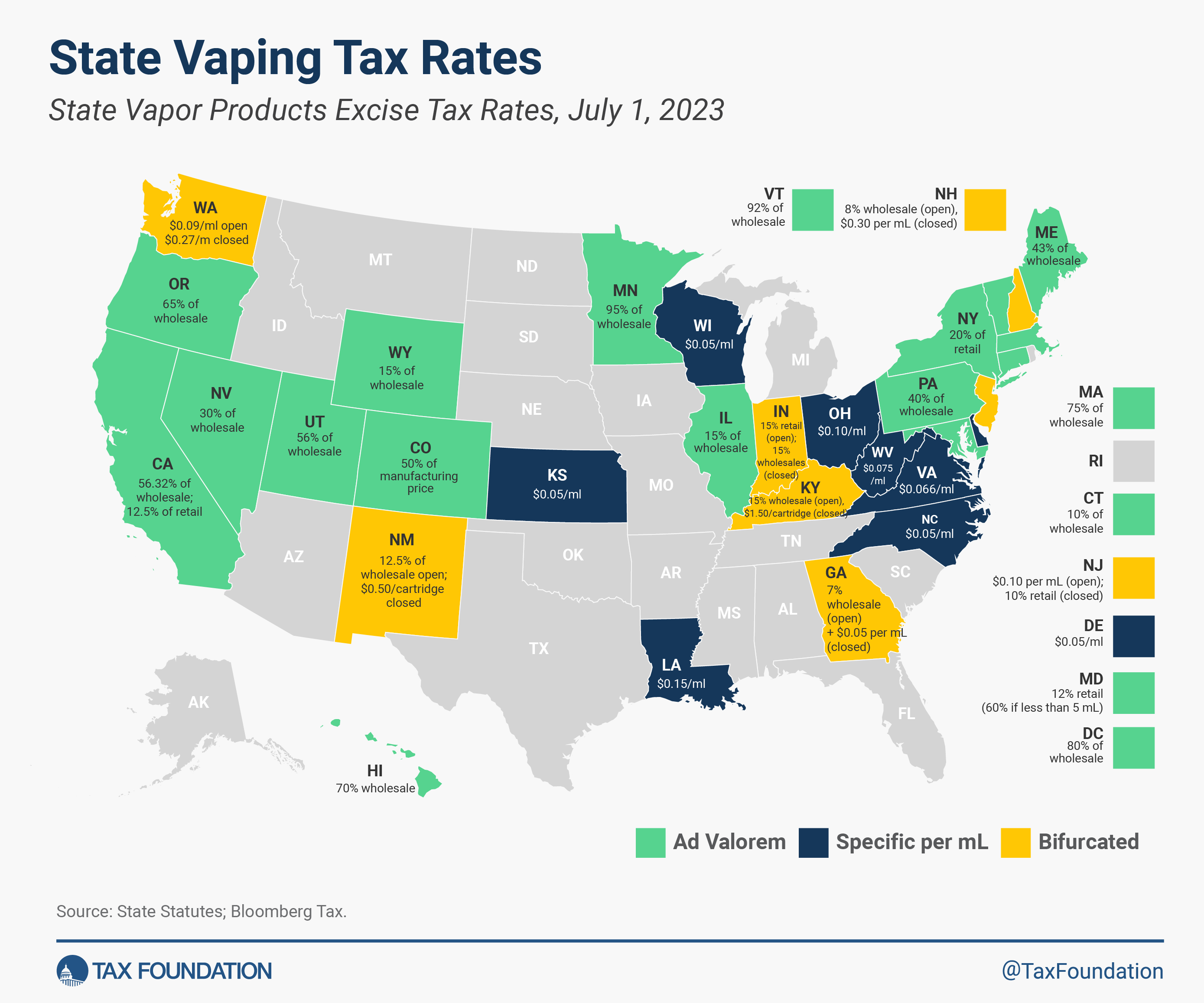

This week’s tax map illustrates the variety of vaping and electronic nicotine delivery systems (ENDS) taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. designs employed by U.S. states. Higher taxes on vaping and ENDS products discourage smokers from switching to vaping products.

Since vaping entered U.S. markets roughly two decades ago, it has grown into a well-established product category and a viable alternative to smoking. So far, 31 states and the District of Columbia have imposed an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on vaping products.

Vapor taxing methods vary. Authorities tax based on manufacturer, wholesale, or retail price (ad valorem), volume (specific), or with a bifurcated system that has different rates for open and closed tank systems.

Of those that tax wholesale values, Minnesota levies the heaviest tax at 95 percent, followed closely by Vermont at 92 percent. On the other end of the spectrum, Connecticut levies a 10 percent wholesale tax and Wyoming applies a 15 percent wholesale tax.

Delaware, Kansas, North Carolina, and Wisconsin all share the lowest rate per milliliter (mL) at $0.05 per mL. Louisiana has the highest rate per mL in the country after tripling its rate from $0.05 per mL to $0.15 per ml in 2023.

The following map shows where state vapor taxes stand as of July 1, 2023.

Vapor products can deliver nicotine, the addictive component of cigarettes, without the combustion and inhalation of tar that come with smoking cigarettes. While more research relating to the potential harm-reduction qualities of vapor products is needed, for now, the consensus is that vapor products are less harmful than traditional combustible tobacco products. Public Health England, an agency of the English Ministry for Health, concludes that vapor products are 95 percent less harmful than cigarettes.

Given this difference in harm levels, it is important to understand the concept of harm reduction and its relevance for vapor product taxes. Vapor products—even if unhealthy in their own right—are highly attractive as an alternative to smoking. After all, one main reason smokers have a hard time quitting is the addictive nature of nicotine. Harm reduction is the concept that it is more practical to reduce the harm associated with the use of certain products rather than attempting to eliminate it completely through ineffective bans or punitive levels of taxation.

Protecting access to harm-reducing vapor products is intertwined with tax policy because nicotine-containing products are economic substitutes. Low tax rates on vaping encourage consumers to switch from combustibles. High excise taxes on harm-reducing vapor products risk harming public health by pushing vapers back to smoking. A recent publication found that 32,400 smokers in Minnesota were deterred from quitting cigarettes after the state implemented a 95 percent excise tax on vapor products.

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design. For more discussion on the ideal design for vapor taxes and other alternative nicotine products, see our recent report.

Vaping Tax Rates by State, 2023

| State | Vape Tax Rates |

|---|---|

| Alabama | No Tax |

| Alaska | No Tax |

| Arizona | No Tax |

| Arkansas | No Tax |

| California | 56.32% of wholesale; 12.5% of retail |

| Colorado | 50% of manufacturing price |

| Connecticut | 10% of wholesale price |

| Delaware | 0.05 per mL |

| District of Columbia | 80% of wholesale |

| Florida | No Tax |

| Georgia | 7% wholesale (open) + $0.05 per mL (closed) |

| Hawaii | 70% wholesale |

| Idaho | No Tax |

| Illinois | 15% wholesale |

| Indiana | 15% retail (open); 15% wholesales (closed) |

| Iowa | No Tax |

| Kansas | $0.05 per mL |

| Kentucky | 15% wholesale (open), $1.50/cartridge (closed) |

| Louisiana | $0.15 per mL |

| Maine | 43% of wholesale |

| Maryland | 12% retail (60 % if less than 5mL) |

| Massachusetts | 75% of wholesale |

| Michigan | No tax |

| Minnesota | 95% of wholesale |

| Mississippi | No tax |

| Missouri | No Tax |

| Montana | No Tax |

| Nebraska | No Tax |

| Nevada | 30% of wholesale |

| New Hampshire | 8% wholesale (open), $0.30 per mL (closed) |

| New Jersey | $0.10 per mL (open); 10% retail (closed) |

| New Mexico | 12.5% wholesale; $0.50 per cartridge |

| New York | 20% retail |

| North Carolina | $0.05 per mL |

| North Dakota | No Tax |

| Ohio | $0.10 per mL |

| Oklahoma | No Tax |

| Oregon | 65% of wholesale |

| Pennsylvania | 40% wholesale |

| Rhode Island | No Tax |

| South Carolina | No Tax |

| South Dakota | No Tax |

| Tennessee | No Tax |

| Texas | No Tax |

| Utah | 56% of wholesale |

| Vermont | 92% of wholesale |

| Virginia | $0.066 per mL |

| Washington | $0.09 per mL open; $0.27 per mL closed |

| West Virginia | $0.075 per mL |

| Wisconsin | $0.05 per mL |

| Wyoming | 15% of wholesale |