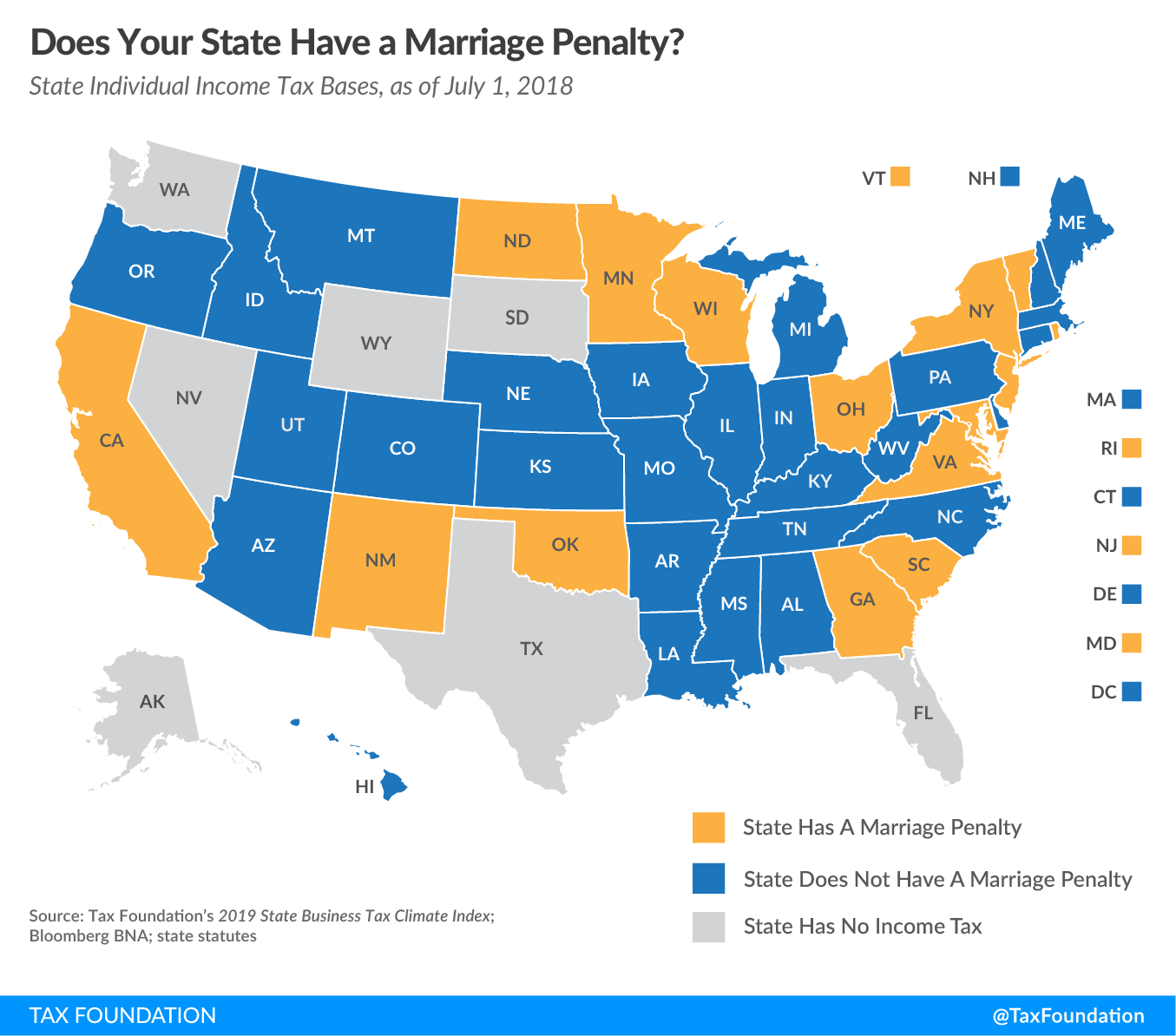

Today’s map examines states that have a “marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. ” in their individual income tax brackets.

Under a progressive, graduated-rate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system, as a taxpayer’s marginal income increases, tax rates also increase. A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers. Under this scenario, married couples face a higher effective tax rate filing jointly than they would if filing as two single individuals with the same amount of combined income.

This non-neutral tax treatment is particularly harmful to owners of pass-through businesses, who pay taxes on their business income under the individual income tax system. When a marriage penalty exists, married business owners are subject to higher effective tax rates on their business income than they would be otherwise.

Fifteen states (displayed in yellow on the map below) have a marriage penalty embedded in their bracket structure. Seven additional states (Arkansas, Delaware, Iowa, Mississippi, Missouri, Montana, and West Virginia), as well as the District of Columbia, offset the marriage penalty in their bracket structure by allowing married taxpayers to file separately on the same return to avoid losing credits and exemptions. While this tactic offsets the dollar cost of the marriage penalty, it comes at the cost of added complexity. States that have a graduated-rate income tax but double their brackets to avoid a marriage penalty are Alabama, Arizona, Connecticut, Hawaii, Idaho, Kansas, Louisiana, Maine, Nebraska, and Oregon.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe