Excise taxes are particular taxes levied on specific goods or activities, not general taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. bases like income or consumption. Some excise taxes are fairly well-known to the public, like cigarette or alcohol taxes, but others are more hidden, like taxes on admission for amusement businesses.

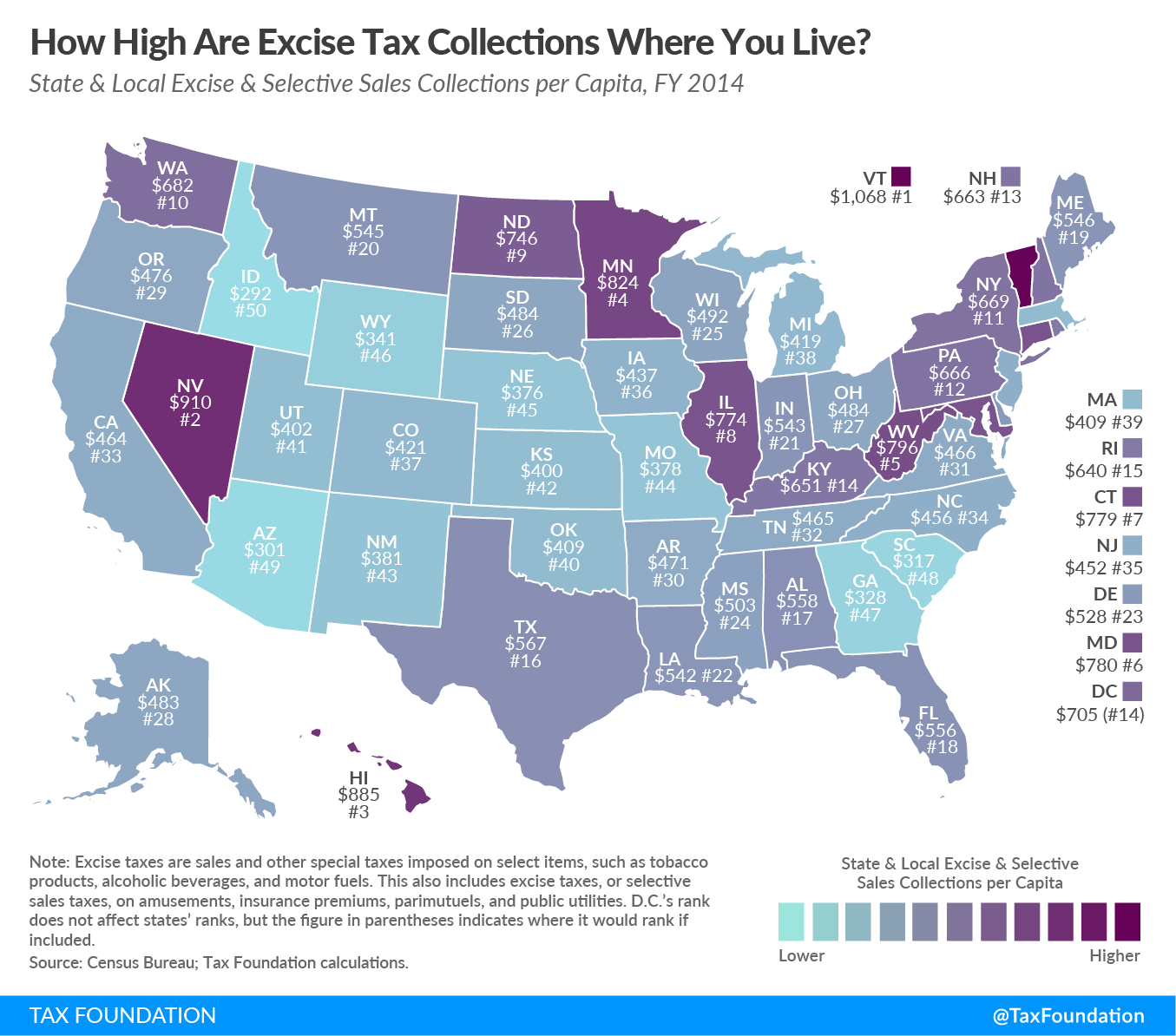

On average, these excise taxes make up a relatively small portion of state and local tax revenue – about 11 percent – but per capita collections vary widely among states. Vermont has the highest state and local collections at $1,068 per capita, followed by Nevada with $910, and Hawaii with $885 in collections per capita.

On the other hand, some states collect relatively little per capita in state and local excise taxes. South Carolina collects $317 per capita, Arizona collects $301, and Idaho collects the least in the country with only $292 per capita.

It’s important to note that this map uses Census data, which includes taxes on: alcoholic beverages, amusements, insurance, motor fuels, parimutuels (betting), public utilities, tobacco products, and other selective sales.

We’ve written extensively about the challenges associated with various excise taxes. Cigarette tax revenue is unstable. The soda taxA soda tax, often discussed under a broader policy category of a sugar-sweetened beverage tax, is an excise tax on sugary drinks. Most soda taxes apply a flat rate tax per ounce of a sugar-sweetened beverage, though some jurisdictions levy an ad valorem tax based on the beverage’s price. has serious unintended consequences, particularly as they pertain to health. Most of these excise taxes are regressive.

Excise taxes are typically either propped up as a way to either reduce consumption of a good or raise revenue, but these goals contradict each other. Reduced consumption naturally leads to a decline in revenue. Excise taxes are also often touted as a quick way to fill budget shortfalls. However, legislators should fund important policy priorities with broad-based, stable taxes, not narrow and nonneutral tax policy.

Share this article