All Related Articles

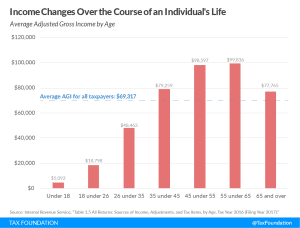

Average Income Tends to Rise with Age

Average income tends to rise dramatically as someone ages and gains education and experience. Viewing just one year of income tax data without digging any deeper misses some crucial context.

2 min read

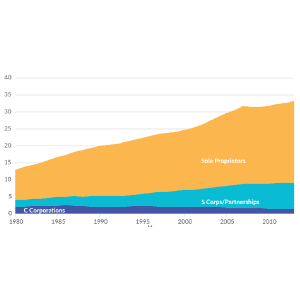

Increasing Individual Income Tax Rates Would Impact a Majority of US Businesses

Since most U.S. businesses are pass-through businesses, such as partnerships, S corporations, LLCs, and sole proprietorships, changes to the individual income tax, especially to top marginal rates, can affect a business’s incentives to invest, hire, and produce.

4 min read

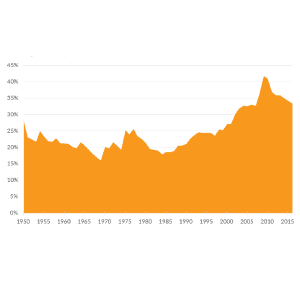

A Growing Percentage of Americans Have Zero Income Tax Liability

From 1986 to 2016, the top 1 percent’s share of income taxes rose from 25.8 percent to 37.3 percent, while the bottom 90 percent’s share fell from 45.3 percent to 30.5 percent.

4 min read

Who Benefits from Itemized Deductions?

While some tax preferences like the earned income tax credit (EITC) and child tax credit benefit lower- and middle-income households, others, like itemized deductions, benefit high-income households.

4 min read

The Top 1 Percent’s Tax Rates Over Time

In the 1950s, when the top marginal income tax rate reached 92 percent, the top 1 percent of taxpayers paid an effective rate of only 16.9 percent. As top marginal rates have fallen, the tax burden on the rich has risen.

5 min read

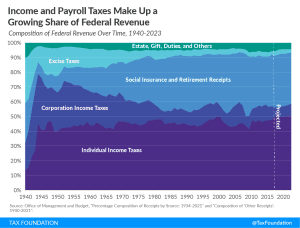

The Composition of Federal Revenue Has Changed Over Time

The federal income tax and federal payroll tax make up a growing share of federal revenue. Individual income taxes have become a central pillar of the federal revenue system, now comprising nearly half of all revenue.

2 min read

Income Taxes on the Top 0.1 Percent Weren’t Much Higher in the 1950s

Recent plans to increase the tax burden on wealthy Americans, such as higher marginal income tax rates and wealth taxes, are flawed in several ways, including in their lack of understanding of tax history.

4 min read

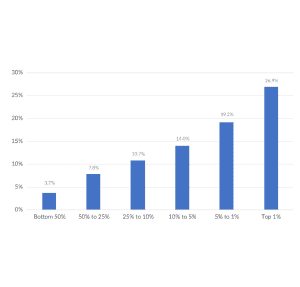

America Already Has a Progressive Tax System

Recent interest in raising the tax burden on high-income individuals glosses over the fact that the U.S. federal tax code is already progressive.

3 min read