Note: All data and methodological notes are accessible in our GitHub repository. New data on corporate tax rates for the years 2000-2020 was added on Jan. 22, 2021 to the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation database on corporate tax rates. This data will be included in the 2021 publication (but is not included in the 2020 publication).

Table of Contents

- Key Findings

- Introduction

- Notable Corporate Tax Rate Changes in 2020

- Scheduled Corporate Tax Rate Changes in the OECD

- The Highest and Lowest Corporate Tax Rates in the World

- Regional Variation in Corporate Tax Rates

- Distribution of Corporate Tax Rates

- The Decline of Corporate Tax Rates since 1980

- Conclusion

- Appendix

- List of all Corporate Tax Rates in 2020

Key Findings

- In 2020, 10 countries made changes to their statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates. One country—Micronesia—increased its top corporate tax rate, while nine countries—Armenia, Belgium, Colombia, France, French Polynesia, Greenland, Monaco, Togo, and Zimbabwe—reduced their corporate tax rates.

- Comoros (50 percent), Puerto Rico (37.5 percent), and Suriname (36 percent) are the countries with the highest corporate tax rates in the world, while Barbados (5.5 percent), Uzbekistan (7.5 percent), and Turkmenistan (8 percent) levy the lowest corporate rates. Fifteen jurisdictions do not impose corporate tax.

- The worldwide average statutory corporate income tax rate, measured across 177 jurisdictions, is 23.85 percent. When weighted by GDP, the average statutory rate is 25.85 percent.

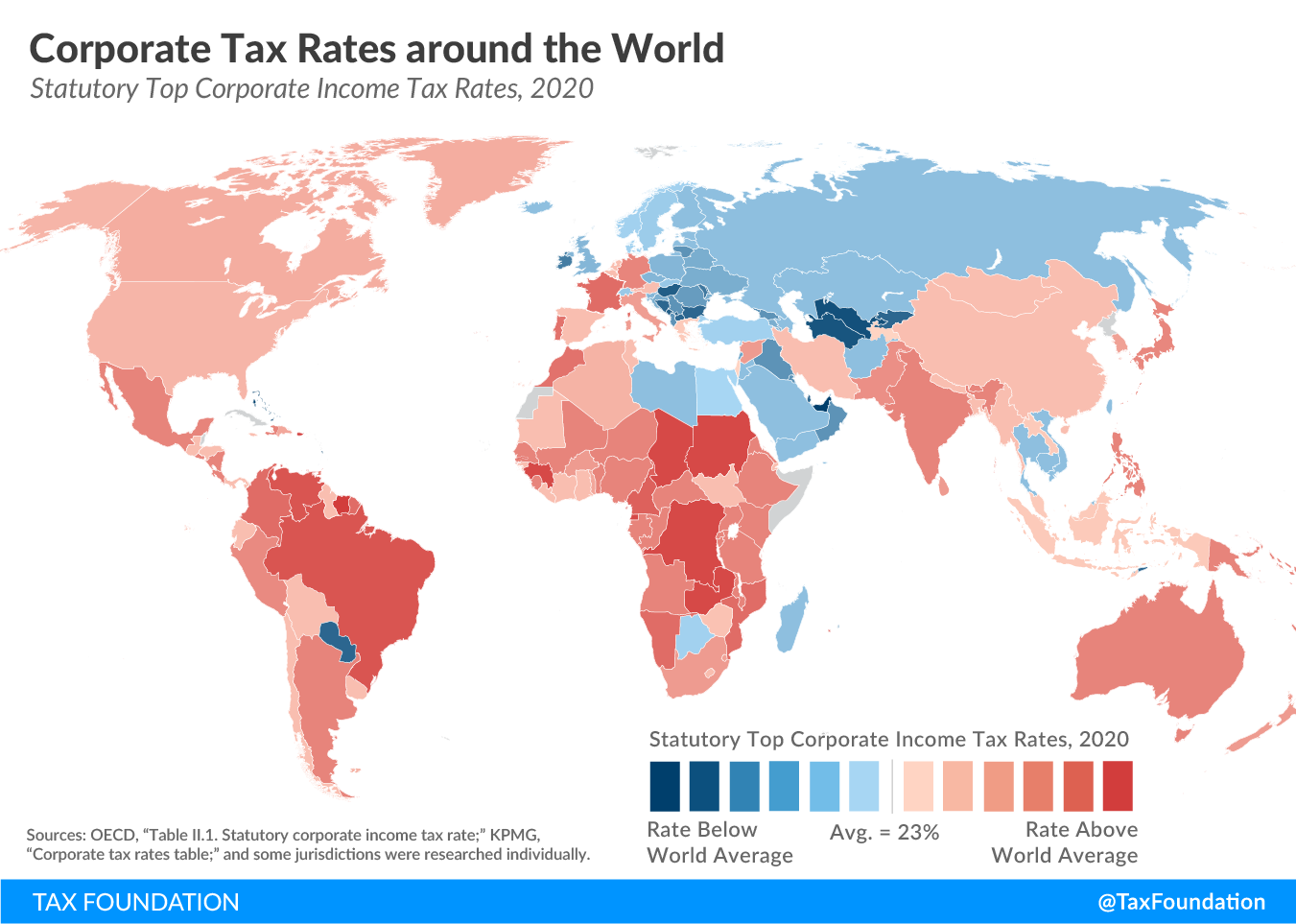

- Europe has the lowest regional average rate, at 19.99 percent (24.61 percent when weighted by GDP). Conversely, Africa has the highest regional average statutory rate, at 28.50 percent (28.16 percent weighted by GDP).

- The average top corporate rate among EU27 countries is 21.47 percent, 23.51 percent in OECD countries, and 24 percent in the G7.

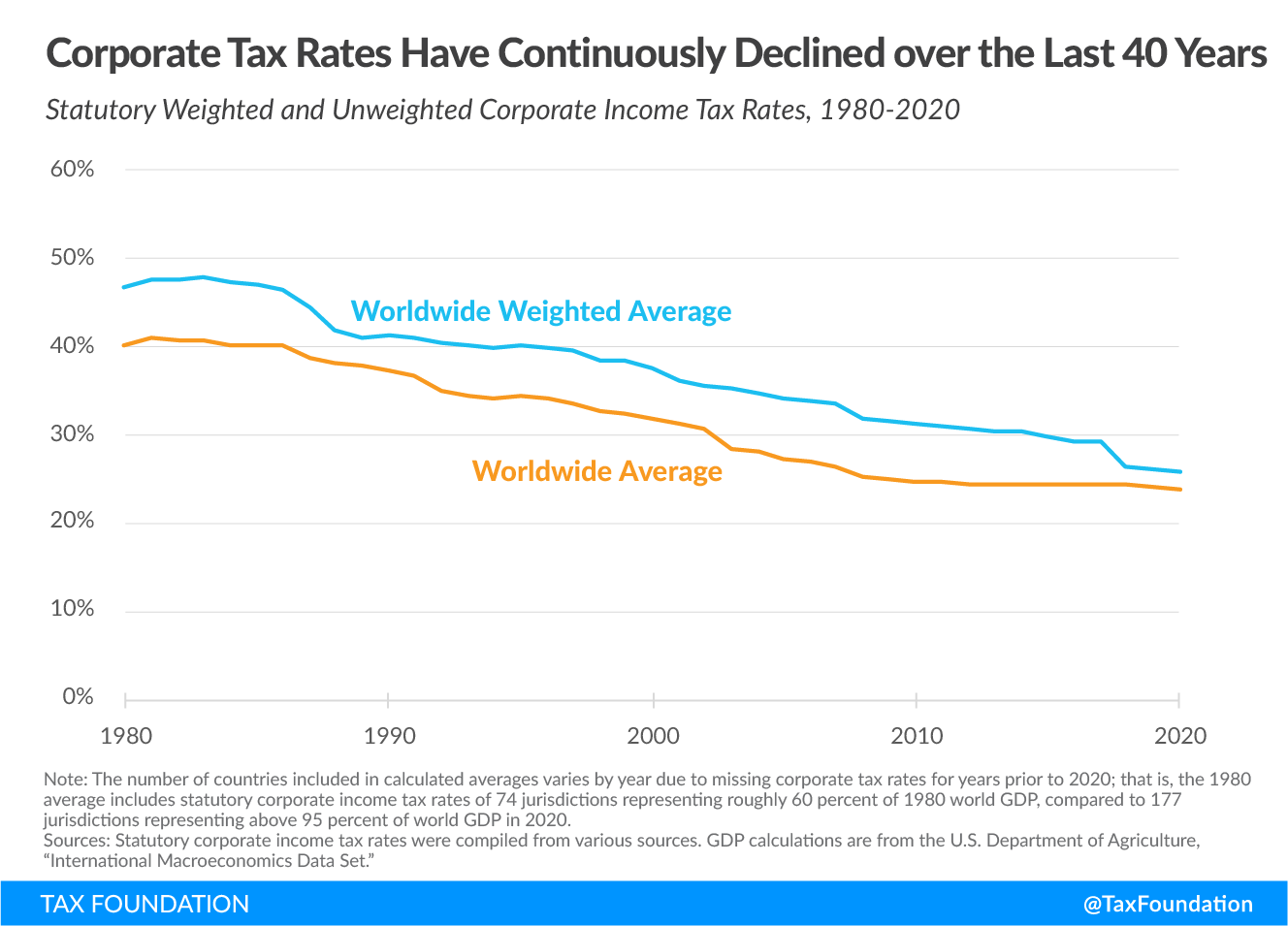

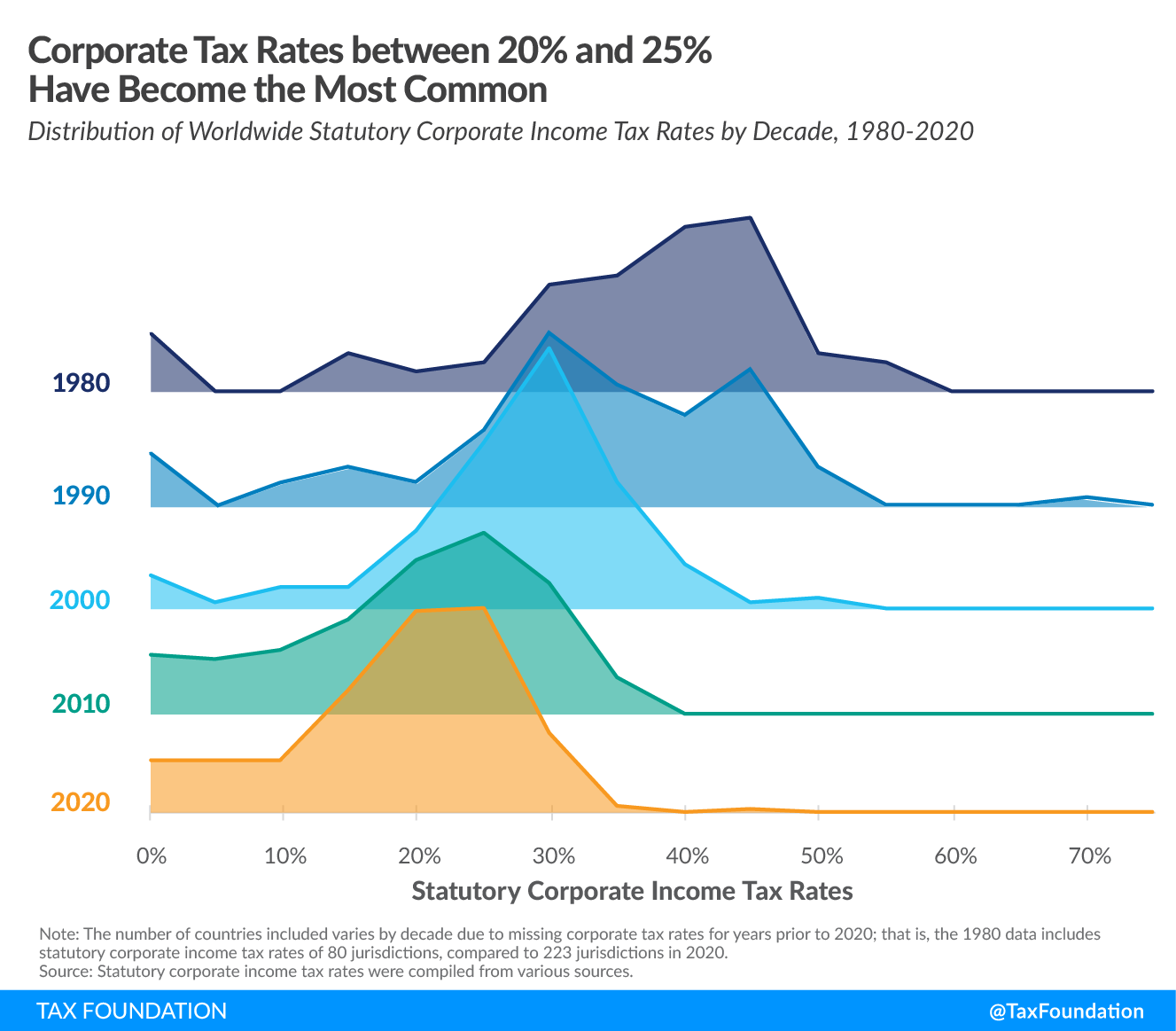

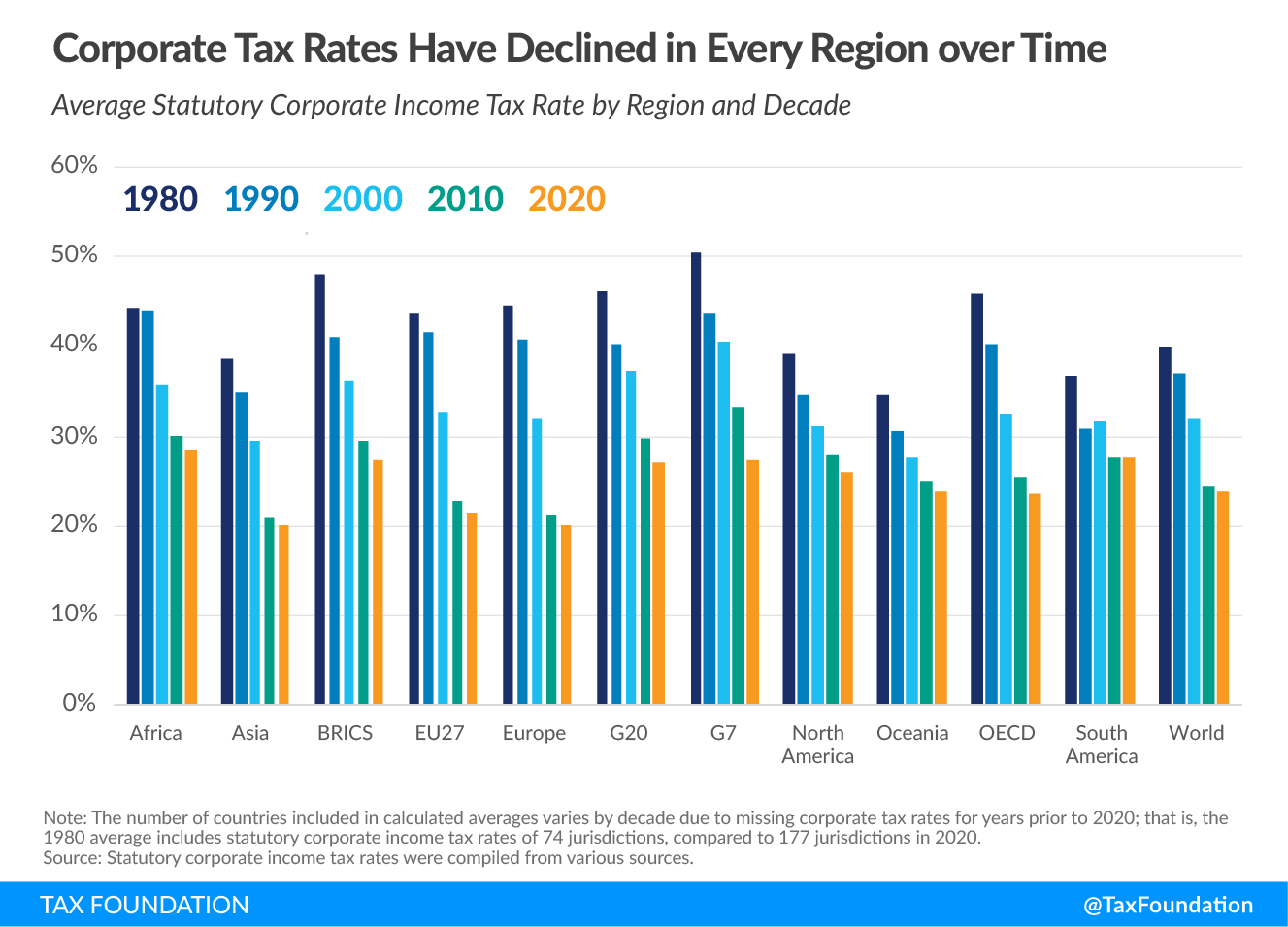

- The worldwide average statutory corporate tax rate has consistently decreased since 1980, with the largest decline occurring in the early 2000s.

- The average statutory corporate tax rate has declined in every region since 1980.

Introduction

In 1980, corporate tax rates around the world averaged 40.11 percent, and 46.52 percent when weighted by GDP.[1] Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2020, the average is now 23.85 percent, and 25.85 when weighted by GDP, for 177 separate tax jurisdictions.[2]

Declines have been seen in every major region of the world, including in the largest economies. The 2017 tax reform in the United States brought the statutory corporate income tax rate from among the highest in the world closer to the middle of the distribution. Whereas in 2017 the United States had the fourth highest corporate income tax rate in the world,[3] it now ranks towards the middle of the countries and tax jurisdictions surveyed.

European countries tend to have lower corporate income tax rates than countries in other regions, and many developing countries have corporate income tax rates that are above the worldwide average.

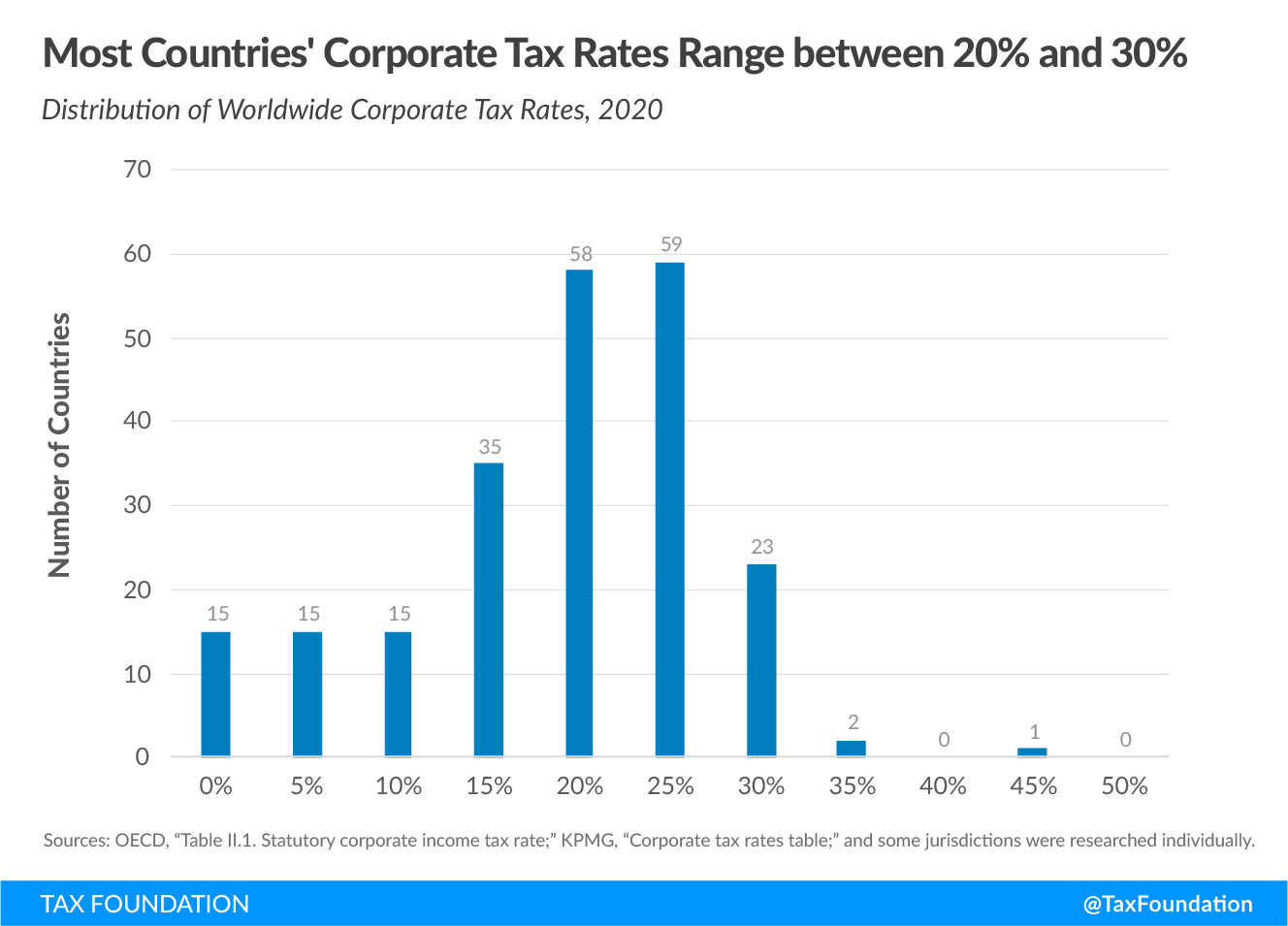

Today, most countries have corporate tax rates below 30 percent.

Notable Corporate Tax Rate Changes in 2020

Ten countries have made changes to their statutory corporate income tax rates in 2020. Micronesia was the only country to increase its top corporate tax rate, introducing a progressive corporate income tax system with a top rate of 30 percent, nine percentage points higher than the previous flat corporate tax of 21 percent.

Nine countries across five continents—Armenia, Belgium, Colombia, France, French Polynesia, Greenland, Monaco, Togo, and Zimbabwe—reduced their corporate tax rates in 2020. The tax rate reductions ranged from one percentage point in Colombia, French Polynesia, and Togo to 5.3 percentage points in Greenland.

| Country | 2019 Tax Rate | 2020 Tax Rate | Change from 2019 to 2020 |

|---|---|---|---|

| Africa | |||

| Togo | 28% | 27% | -1 ppt |

| Zimbabwe | 25.75% | 24.72% | -1.03 ppt |

| Asia | |||

| Armenia | 20% | 18% | -2 ppt |

| Europe | |||

| Belgium | 29.58% | 25.00% | -4.58 ppt |

| France (a) | 34.43% | 32.02% | -2.41 ppt |

| Monaco (b) | 31% | 28% | -3 ppt |

| North America | |||

| Greenland | 31.8% | 26.5% | -5.3 ppt |

| Oceania | |||

| French Polynesia | 26% | 25% | -1 ppt |

| Micronesia (Federated States of) (c) | 21% | 30% | +9 ppt |

| South America | |||

| Colombia (d) | 33% | 32% | -1 ppt |

|

Notes: (a) France has further corporate tax rate reductions scheduled, resulting in a rate of 25 percent (plus 3.3 percent social surcharge, equaling a combined rate of 25.83 percent) by 2022. (b) Monaco has further corporate tax rate reductions scheduled, resulting in a rate of 25 percent by 2022. (c) Micronesia implemented a progressive corporate income tax with a top rate of 30 percent. (d) Colombia’s 2018/2019 tax reform introduced measures to reduce the corporate income tax rate further, to 31 percent in 2021, and 30 percent from 2022 onwards. |

|||

Scheduled Corporate Tax Rate Changes in the OECD[4]

Among OECD countries, France, the Netherlands, and Sweden have announced they will implement changes to their statutory corporate income tax rate over the coming years.

- In France, the standard statutory corporate income tax rate was lowered to 32.02 percent (including the 3.3 percent social surcharge) in 2020. An already legislated corporate rate reduction is expected to progressively bring the corporate tax rate down to 25.83 percent by 2022.

- In the Netherlands, the originally planned reduction of the statutory corporate tax rate applying to income exceeding €200,000 was partly reversed: The corporate rate was not decreased to 22.55 percent in 2020 as originally planned. Instead, it remains at 25 percent in 2020 and will be lowered to 21.7 percent instead of 20.50 percent in 2021.

- In Sweden, the statutory corporate tax rate will be cut from 21.4 percent in 2020 to 20.6 percent in 2021.

The Highest and Lowest Corporate Tax Rates in the World[5]

One hundred of the 223 separate jurisdictions surveyed for the year 2020 have corporate tax rates below 25 percent and 117 have tax rates above 20 and at or below 30 percent. The average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. among the 223 jurisdictions is 22.57 percent.[6] The United States has the 85th highest corporate tax rate with a combined statutory rate of 25.77 percent.

The 20 countries with the highest statutory corporate income tax rates span almost every region, albeit unequally. While nine of the top 20 countries are in Africa, Europe appears only twice and Asia not at all. Of the remaining jurisdictions, two are in Oceania, and seven are in the Americas.

The only industrialized nation[7] in the top 20 is France (32.02 percent).

| Country | Continent | Tax Rate |

|---|---|---|

| Comoros* | Africa | 50% |

| Puerto Rico | North America | 37.5% |

| Suriname | South America | 36% |

| Chad | Africa | 35% |

| Democratic Republic of the Congo | Africa | 35% |

| Equatorial Guinea | Africa | 35% |

| Guinea | Africa | 35% |

| Kiribati | Oceania | 35% |

| Malta | Europe | 35% |

| Saint Martin (French Part) | North America | 35% |

| Sint Maarten (Dutch part) | North America | 35% |

| Sudan | Africa | 35% |

| Zambia | Africa | 35% |

| American Samoa | Oceania | 34% |

| Brazil | South America | 34% |

| Venezuela (Bolivarian Republic of) | South America | 34% |

| Cameroon | Africa | 33% |

| Saint Kitts and Nevis | North America | 33% |

| Seychelles | Africa | 33% |

| France | Europe | 32.02% |

|

Notes: *The normal corporate tax rate is 35 percent, which applies to both Comorian companies and foreign companies deriving Comorian-source income. However, public industrial and commercial enterprises or those where the state or certain public institutions are participants are subject to a corporate tax rate of 50 percent if their turnover exceeds 500 million Comorian francs; see Bloomberg Tax, “Country Guides: Comoros,” https://www.bloomberglaw.com/product/tax/document/25590833704. Sources: OECD, “Table II.1. Statutory corporate income tax rate,” updated April 2020, https://stats.oecd.org/index.aspx?DataSetCode=Table_II1; KPMG, “Corporate tax rates table,” https://home.kpmg/xx/en/home/services/tax/tax-tools-and-resources/tax-rates-online/corporate-tax-rates-table.html; and researched individually, see Tax Foundation, “worldwide-corporate-tax-rates,” GitHub, https://github.com/TaxFoundation/worldwide-corporate-tax-rates. |

||

On the other end of the spectrum, the 20 countries with the lowest non-zero statutory corporate tax rates all charge rates at or below 12.5 percent. Ten countries have statutory rates of 10 percent, six being small European nations (Andorra, Bosnia and Herzegovina, Bulgaria, Gibraltar, Kosovo, and Macedonia). The only two industrialized nations[8] represented among the bottom 20 countries are Ireland and Hungary. Ireland is known for its low 12.5 percent rate, which has been in place since 2003. Hungary reduced its corporate income tax rate from 19 to 9 percent in 2017.

| (Excluding Jurisdictions with a Corporate Income Tax Rate of Zero Percent) | ||

|---|---|---|

| Country | Continent | Tax Rate |

| Barbados | North America | 5.5% |

| Uzbekistan | Asia | 7.5% |

| Turkmenistan | Asia | 8% |

| Hungary | Europe | 9% |

| Montenegro | Europe | 9% |

| Andorra | Europe | 10% |

| Bosnia and Herzegovina | Europe | 10% |

| Bulgaria | Europe | 10% |

| Gibraltar | Europe | 10% |

| Kosovo, Republic of | Europe | 10% |

| Kyrgyzstan | Asia | 10% |

| Paraguay | South America | 10% |

| Qatar | Asia | 10% |

| The former Yugoslav Republic of Macedonia | Europe | 10% |

| Timor-Leste | Oceania | 10% |

| China, Macao Special Administrative Region | Asia | 12% |

| Republic of Moldova | Europe | 12% |

| Cyprus | Europe | 12.5% |

| Ireland | Europe | 12.5% |

| Liechtenstein | Europe | 12.5% |

| Sources: OECD, “Table II.1. Statutory corporate income tax rate;” KPMG, “Corporate tax rates table;” and researched individually, see Tax Foundation, “worldwide-corporate-tax-rates/.” | ||

Of the 223 jurisdictions surveyed, 15 currently do not impose a general corporate income tax. Except for the United Arab Emirates, all these jurisdictions are small, island nations. A handful, such as the Cayman Islands and Bermuda, are well-known for their lack of corporate taxes.

| Country | Continent |

|---|---|

| Anguilla | North America |

| Bahamas | North America |

| Bahrain* | Asia |

| Bermuda | North America |

| British Virgin Islands | North America |

| Cayman Islands | North America |

| Guernsey | Europe |

| Isle of Man | Europe |

| Jersey | Europe |

| Saint Barthelemy | North America |

| Tokelau | Oceania |

| Turks and Caicos Islands | North America |

| United Arab Emirates* | Asia |

| Vanuatu | Oceania |

| Wallis and Futuna Islands | Oceania |

|

Sources: OECD, “Table II.1. Statutory corporate income tax rate”; KPMG, “Corporate tax rates table”; and researched individually, see Tax Foundation, “worldwide-corporate-tax-rates.” Notes: *Bahrain has no general corporate income tax but has a targeted corporate income tax on oil companies, which can be as high as 46 percent. See Deloitte, “International Tax – Bahrain Highlights 2020,” last updated January 2020, https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-bahrainhighlights-2020.pdf?nc=1. The United Arab Emirates is a federation of seven separate emirates. Since 1960, each emirate has the discretion to levy up to a 55 percent corporate tax rate on any business. In practice, this tax is mostly levied on foreign banks and petroleum companies. For more information on the taxation system in the United Arab Emirates, see PwC, “Worldwide Tax Summaries – Corporate income tax (CIT) rates.” |

|

Regional Variation in Corporate Tax Rates

Corporate tax rates can vary significantly by region. Africa has the highest average statutory corporate tax rate among all regions, at 28.50 percent. Europe has the lowest average statutory corporate tax rate among all regions, at 19.99 percent.

When weighted by GDP, South America has the highest average statutory corporate tax rate at 31.83 percent. Europe has the lowest weighted average statutory corporate income tax, at 24.61 percent.

In general, larger and more industrialized nations tend to have higher corporate income tax rates than smaller nations. The G7, which is comprised of the seven wealthiest nations in the world, has an average statutory corporate income tax rate of 27.24 percent, and a weighted average rate of 26.95 percent. OECD member states have an average statutory corporate tax rate of 23.51 percent, and a rate of 26.30 percent when weighted by GDP. The BRICS[9] have an average statutory rate of 27.40 percent, and a weighted average statutory corporate income tax rate of 26.49 percent.

| Region | Average Rate | Average Rate Weighted by GDP | Number of Countries Covered |

|---|---|---|---|

| Africa | 28.50% | 28.16% | 50 |

| Asia | 20.06% | 25.37% | 46 |

| Europe | 19.99% | 24.61% | 39 |

| North America | 26.06% | 26.13% | 22 |

| Oceania | 23.75% | 29.74% | 8 |

| South America | 27.54% | 31.83% | 12 |

| G7 | 27.24% | 26.95% | 7 |

| OECD | 23.51% | 26.30% | 37 |

| BRICS | 27.40% | 26.49% | 5 |

| EU27 | 21.47% | 26.46% | 27 |

| G20 | 26.96% | 26.77% | 19 |

| World | 23.85% | 25.85% | 177 |

| Sources: Statutory corporate income tax rates are from OECD, “Table II.1. Statutory corporate income tax rate”; KPMG, “Corporate tax rates table”; and researched individually, see Tax Foundation, “worldwide-corporate-tax-rates.” GDP calculations are from the U.S. Department of Agriculture, “International Macroeconomics Data Set.” | |||

The following map illustrates the current state of corporate tax rates around the world. Countries in Africa and South America tend to have higher corporate tax rates than Asian and European jurisdictions. Oceania and North America’s corporate tax rates tend to be close to the world average.

Distribution of Corporate Tax Rates[10]

Very few tax jurisdictions impose a corporate income tax at statutory rates greater than 35 percent. The following chart shows a distribution of corporate income tax rates among 223 jurisdictions in 2020. A plurality of countries (117 total) impose a rate above 20 percent and at or below 30 percent. Twenty-three jurisdictions have a statutory corporate tax rate above 30 percent and at or below 35 percent. Eighty jurisdictions have a statutory corporate tax rate at or below 20 percent, and 197 jurisdictions have a corporate tax rate at or below 30 percent.

The Decline of Corporate Tax Rates since 1980

Over the past 40 years, corporate tax rates have consistently declined on a global basis. In 1980, the unweighted average worldwide statutory tax rate was 40.11 percent. Today, the average statutory rate stands at 23.85 percent, representing a 41 percent reduction over the 40 years surveyed.[11]

The weighted average statutory rate has remained higher than the simple average over this period. Prior to U.S. tax reform in 2017, the United States was largely responsible for keeping the weighted average so high, given its relatively high tax rate, as well as its significant contribution to global GDP. Figure 3 shows the significant impact the change in the U.S. corporate rate had on the worldwide weighted average. The weighted average statutory corporate income tax rate has declined from 46.52 percent in 1980 to 25.85 percent in 2020, representing a 44 percent reduction over the 40 years surveyed.

Over time, more countries have shifted to taxing corporations at rates of or lower than 30 percent, with the United States following this trend with its tax changes at the end of 2017. The largest shift occurred between 2000 and 2010, with 78 percent of countries imposing a statutory rate at or below 30 percent in 2010 and only 42 percent of countries imposing a statutory rate at or below 30 percent in 2000.[12]

All regions saw a net decline in average statutory rates between 1980 and 2020. The average declined the most in Europe, with the 1980 average of 44.6 percent dropping to 19.99 percent, representing a 55 percent rate reduction. South America has seen the smallest decline, with the average only decreasing by 25 percent, from 36.66 percent in 1980 to 27.54 percent in 2020.

South America saw a period (1990-2000) where the average statutory rate increased slightly at less than one percentage point, although the average rate decreased over the full 40-year period.

Conclusion

Worldwide and regional average top statutory corporate tax rates have declined over recent decades, with most countries following the trend. Of 223 jurisdictions around the world, only one has increased its top corporate income tax rate in 2020, while nine countries have decreased their corporate tax rate. The trend seems to be continuing, as several countries are planning to reduce their corporate tax rates in the coming years.

Appendix

The Dataset

Scope

The dataset compiled for this publication includes the 2020 statutory corporate income tax rates of 223 sovereign states and dependent territories around the world. Tax rates were researched only for jurisdictions that are among the around 250 sovereign states and dependent territories that have been assigned a country code by the International Organization for Standardization (ISO).[13] As a result, zones or territories that are independent taxing jurisdictions but do not have their own country code are generally not included in the dataset.

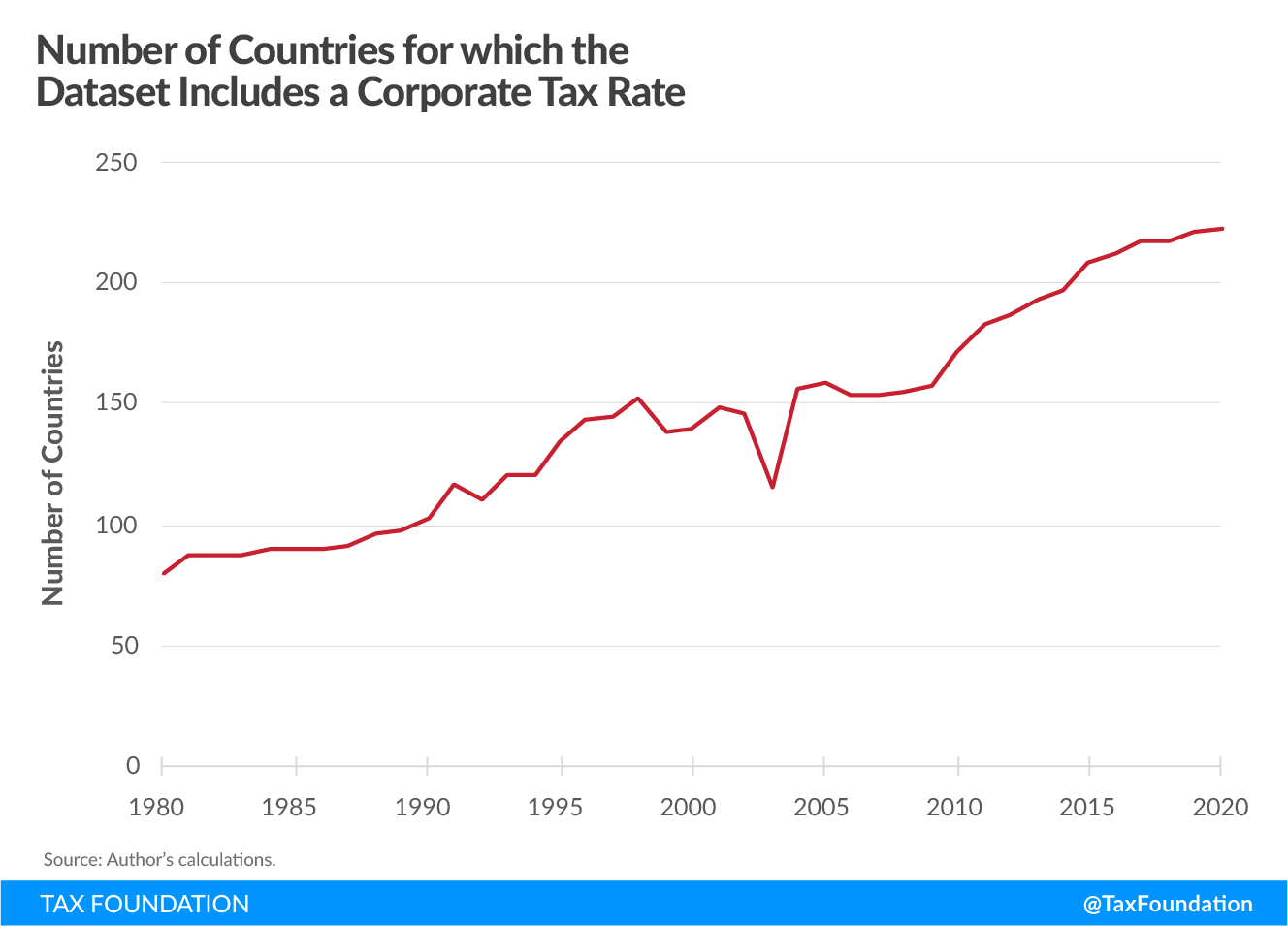

In addition, the dataset includes historic statutory corporate income tax rates for the time period 1980 to 2019. However, these years cover tax rates of fewer than 223 jurisdictions due to missing data points. Please let Tax Foundation know if you are aware of any sources for historic corporate tax rates that are not mentioned in this report, as we constantly strive to improve our datasets.

To be able to calculate average statutory corporate income tax rates weighted by GDP, the dataset includes GDP data for 177 jurisdictions. When used to calculate average statutory corporate income tax rates, either weighted by GDP or unweighted, only these 177 jurisdictions are included (to ensure the comparability of the unweighted and weighted averages).

Definition of Selected Corporate Income Tax Rate

The dataset captures standard top statutory corporate income tax rates levied on domestic businesses. This means:

- The dataset does not reflect special tax regimes, including but not limited to patent boxes, offshore regimes, or special rates for specific industries.

- A number of countries levy lower rates for businesses below a certain revenue threshold. The dataset does not capture these lower rates.

- A few countries levy gross revenue taxes on businesses instead of corporate income taxes. Since the tax rates of a corporate income tax and a gross revenue tax are not comparable, these countries are excluded from the dataset.

- Some countries have a separate tax rate for nonresident companies. This dataset does not consider nonresident tax rates that differ from the general corporate rate.

Sources

Tax Rates for the Year 2020

For OECD countries, the statutory corporate income tax rates used are the combined corporate income tax rates provided by the OECD; see OECD, “Table II.1. Statutory corporate income tax rate,” updated April 2020, https://stats.oecd.org/index.aspx?DataSetCode=Table_II1. The main source for non-OECD jurisdictions are the statutory rates provided by KPMG; see KPMG, “Corporate tax rates table,” 2020, https://home.kpmg/xx/en/home/services/tax/tax-tools-and-resources/tax-rates-online/corporate-tax-rates-table.html. Jurisdictions that are not part of either source were researched individually. The source for each of these jurisdictions is listed in a GitHub repository; see Tax Foundation, “worldwide-corporate-tax-rates,” GitHub, https://github.com/TaxFoundation/worldwide-corporate-tax-rates.

Tax Rates for the Years 1980-2019

Tax rates for the time frame between 1980 and 2019 are taken from a dataset compiled by the Tax Foundation over the last years. These historic rates come from multiple sources: PwC, “Worldwide Tax Summaries – Corporate Taxes,” 2010-2019; KPMG, “Corporate Tax Rate Survey,” 1998- 2003; KPMG, “Corporate tax rates table,” 2003-2019; EY, “Worldwide Corporate Tax Guide,” 2004-2019; OECD, “Historical Table II.1 – Statutory corporate income tax rate,” 1999, http://www.oecd.org/tax/tax-policy/tax-database.htm#C_CorporateCaptial; the University of Michigan – Ross School of Business, “World Tax Database,” https://www.bus.umich.edu/otpr/otpr/default.asp; and numerous government websites.

Gross Domestic Product (GDP) for the years 1980-2020

GDP calculations are from the U.S. Department of Agriculture, “International Macroeconomics Data Set,” Jan. 3, 2020, https://www.ers.usda.gov/data-products/international-macroeconomic-data-set/.

List of all Corporate Tax Rates in 2020

| ISO3 | Country | Continent | Corporate Tax Rate |

|---|---|---|---|

| AFG | Afghanistan | AS | 20.00% |

| ALA | Aland Islands | EU | 20.00% |

| ALB | Albania | EU | 15.00% |

| DZA | Algeria | AF | 26.00% |

| ASM | American Samoa | OC | 34.00% |

| AND | Andorra | EU | 10.00% |

| AGO | Angola | AF | 30.00% |

| AIA | Anguilla | NO | 0.00% |

| ATG | Antigua and Barbuda | NO | 25.00% |

| ARG | Argentina | SA | 30.00% |

| ARM | Armenia | AS | 18.00% |

| ABW | Aruba | NO | 25.00% |

| AUS | Australia | OC | 30.00% |

| AUT | Austria | EU | 25.00% |

| AZE | Azerbaijan | AS | 20.00% |

| BHS | Bahamas | NO | 0.00% |

| BHR | Bahrain | AS | 0.00% |

| BGD | Bangladesh | AS | 25.00% |

| BRB | Barbados | NO | 5.50% |

| BLR | Belarus | EU | 18.00% |

| BEL | Belgium | EU | 25.00% |

| BEN | Benin | AF | 30.00% |

| BMU | Bermuda | NO | 0.00% |

| BTN | Bhutan | AS | 30.00% |

| BOL | Bolivia (Plurinational State of) | SA | 25.00% |

| BES | Bonaire, Sint Eustatius and Saba | NO | 25.00% |

| BIH | Bosnia and Herzegovina | EU | 10.00% |

| BWA | Botswana | AF | 22.00% |

| BRA | Brazil | SA | 34.00% |

| VGB | British Virgin Islands | NO | 0.00% |

| BRN | Brunei Darussalam | AS | 18.50% |

| BGR | Bulgaria | EU | 10.00% |

| BFA | Burkina Faso | AF | 28.00% |

| BDI | Burundi | AF | 30.00% |

| CPV | Cabo Verde | AF | 22.00% |

| KHM | Cambodia | AS | 20.00% |

| CMR | Cameroon | AF | 33.00% |

| CAN | Canada | NO | 26.47% |

| CYM | Cayman Islands | NO | 0.00% |

| CAF | Central African Republic | AF | 30.00% |

| TCD | Chad | AF | 35.00% |

| CHL | Chile | SA | 25.00% |

| CHN | China | AS | 25.00% |

| HKG | China, Hong Kong Special Administrative Region | AS | 16.50% |

| MAC | China, Macao Special Administrative Region | AS | 12.00% |

| COL | Colombia | SA | 32.00% |

| COM | Comoros | AF | 50.00% |

| COG | Congo | AF | 30.00% |

| COK | Cook Islands | OC | 20.00% |

| CRI | Costa Rica | NO | 30.00% |

| CIV | Cote d’Ivoire | AF | 25.00% |

| HRV | Croatia | EU | 18.00% |

| CUW | Curacao | NO | 22.00% |

| CYP | Cyprus | EU | 12.50% |

| CZE | Czechia | EU | 19.00% |

| COD | Democratic Republic of the Congo | AF | 35.00% |

| DNK | Denmark | EU | 22.00% |

| DJI | Djibouti | AF | 25.00% |

| DMA | Dominica | NO | 25.00% |

| DOM | Dominican Republic | NO | 27.00% |

| ECU | Ecuador | SA | 25.00% |

| EGY | Egypt | AF | 22.50% |

| SLV | El Salvador | NO | 30.00% |

| GNQ | Equatorial Guinea | AF | 35.00% |

| ERI | Eritrea | AF | 30.00% |

| EST | Estonia | EU | 20.00% |

| ETH | Ethiopia | AF | 30.00% |

| FLK | Falkland Islands (Malvinas) | SA | 26.00% |

| FRO | Faroe Islands | EU | 18.00% |

| FJI | Fiji | OC | 20.00% |

| FIN | Finland | EU | 20.00% |

| FRA | France | EU | 32.02% |

| PYF | French Polynesia | OC | 25.00% |

| GAB | Gabon | AF | 30.00% |

| GMB | Gambia | AF | 31.00% |

| GEO | Georgia | AS | 15.00% |

| DEU | Germany | EU | 29.90% |

| GHA | Ghana | AF | 25.00% |

| GIB | Gibraltar | EU | 10.00% |

| GRC | Greece | EU | 24.00% |

| GRL | Greenland | NO | 26.50% |

| GRD | Grenada | NO | 28.00% |

| GUM | Guam | OC | 21.00% |

| GTM | Guatemala | NO | 25.00% |

| GGY | Guernsey | EU | 0.00% |

| GIN | Guinea | AF | 35.00% |

| GNB | Guinea-Bissau | AF | 25.00% |

| GUY | Guyana | SA | 25.00% |

| HTI | Haiti | NO | 30.00% |

| HND | Honduras | NO | 25.00% |

| HUN | Hungary | EU | 9.00% |

| ISL | Iceland | EU | 20.00% |

| IND | India | AS | 30.00% |

| IDN | Indonesia | AS | 25.00% |

| IRN | Iran (Islamic Republic of) | AS | 25.00% |

| IRQ | Iraq | AS | 15.00% |

| IRL | Ireland | EU | 12.50% |

| IMN | Isle of Man | EU | 0.00% |

| ISR | Israel | AS | 23.00% |

| ITA | Italy | EU | 27.81% |

| JAM | Jamaica | NO | 25.00% |

| JPN | Japan | AS | 29.74% |

| JEY | Jersey | EU | 0.00% |

| JOR | Jordan | AS | 20.00% |

| KAZ | Kazakhstan | AS | 20.00% |

| KEN | Kenya | AF | 30.00% |

| KIR | Kiribati | OC | 35.00% |

| XKX | Kosovo, Republic of | EU | 10.00% |

| KWT | Kuwait | AS | 15.00% |

| KGZ | Kyrgyzstan | AS | 10.00% |

| LAO | Lao People’s Democratic Republic | AS | 24.00% |

| LVA | Latvia | EU | 20.00% |

| LBN | Lebanon | AS | 17.00% |

| LSO | Lesotho | AF | 25.00% |

| LBR | Liberia | AF | 25.00% |

| LBY | Libya | AF | 20.00% |

| LIE | Liechtenstein | EU | 12.50% |

| LTU | Lithuania | EU | 15.00% |

| LUX | Luxembourg | EU | 24.94% |

| MDG | Madagascar | AF | 20.00% |

| MWI | Malawi | AF | 30.00% |

| MYS | Malaysia | AS | 24.00% |

| MDV | Maldives | AS | 15.00% |

| MLI | Mali | AF | 30.00% |

| MLT | Malta | EU | 35.00% |

| MRT | Mauritania | AF | 25.00% |

| MUS | Mauritius | AF | 15.00% |

| MEX | Mexico | NO | 30.00% |

| FSM | Micronesia (Federated States of) | OC | 30.00% |

| MCO | Monaco | EU | 28.00% |

| MNG | Mongolia | AS | 25.00% |

| MNE | Montenegro | EU | 9.00% |

| MSR | Montserrat | NO | 30.00% |

| MAR | Morocco | AF | 31.00% |

| MOZ | Mozambique | AF | 32.00% |

| MMR | Myanmar | AS | 25.00% |

| NAM | Namibia | AF | 32.00% |

| NRU | Nauru | OC | 25.00% |

| NPL | Nepal | AS | 25.00% |

| NLD | Netherlands | EU | 25.00% |

| NCL | New Caledonia | OC | 30.00% |

| NZL | New Zealand | OC | 28.00% |

| NIC | Nicaragua | NO | 30.00% |

| NER | Niger | AF | 30.00% |

| NGA | Nigeria | AF | 30.00% |

| NIU | Niue | OC | 30.00% |

| MNP | Northern Mariana Islands | OC | 21.00% |

| NOR | Norway | EU | 22.00% |

| OMN | Oman | AS | 15.00% |

| PAK | Pakistan | AS | 29.00% |

| PAN | Panama | NO | 25.00% |

| PNG | Papua New Guinea | OC | 30.00% |

| PRY | Paraguay | SA | 10.00% |

| PER | Peru | SA | 29.50% |

| PHL | Philippines | AS | 30.00% |

| POL | Poland | EU | 19.00% |

| PRT | Portugal | EU | 31.50% |

| PRI | Puerto Rico | NO | 37.50% |

| QAT | Qatar | AS | 10.00% |

| KOR | Republic of Korea | AS | 27.50% |

| MDA | Republic of Moldova | EU | 12.00% |

| ROU | Romania | EU | 16.00% |

| RUS | Russian Federation | EU | 20.00% |

| RWA | Rwanda | AF | 30.00% |

| BLM | Saint Barthelemy | NO | 0.00% |

| SHN | Saint Helena | AF | 25.00% |

| KNA | Saint Kitts and Nevis | NO | 33.00% |

| LCA | Saint Lucia | NO | 30.00% |

| MAF | Saint Martin (French Part) | NO | 35.00% |

| VCT | Saint Vincent and the Grenadines | NO | 30.00% |

| WSM | Samoa | OC | 27.00% |

| SMR | San Marino | EU | 17.00% |

| STP | Sao Tome and Principe | AF | 25.00% |

| SAU | Saudi Arabia | AS | 20.00% |

| SEN | Senegal | AF | 30.00% |

| SRB | Serbia | EU | 15.00% |

| SYC | Seychelles | AF | 33.00% |

| SLE | Sierra Leone | AF | 30.00% |

| SGP | Singapore | AS | 17.00% |

| SXM | Sint Maarten (Dutch part) | NO | 35.00% |

| SVK | Slovakia | EU | 21.00% |

| SVN | Slovenia | EU | 19.00% |

| SLB | Solomon Islands | OC | 30.00% |

| ZAF | South Africa | AF | 28.00% |

| SSD | South Sudan | AF | 25.00% |

| ESP | Spain | EU | 25.00% |

| LKA | Sri Lanka | AS | 28.00% |

| PSE | State of Palestine | AS | 15.00% |

| SDN | Sudan | AF | 35.00% |

| SUR | Suriname | SA | 36.00% |

| SWZ | Swaziland | AF | 27.50% |

| SWE | Sweden | EU | 21.40% |

| CHE | Switzerland | EU | 21.15% |

| SYR | Syrian Arab Republic | AS | 28.00% |

| TWN | Taiwan | AS | 20.00% |

| TJK | Tajikistan | AS | 23.00% |

| THA | Thailand | AS | 20.00% |

| MKD | The former Yugoslav Republic of Macedonia | EU | 10.00% |

| TLS | Timor-Leste | OC | 10.00% |

| TGO | Togo | AF | 27.00% |

| TKL | Tokelau | OC | 0.00% |

| TON | Tonga | OC | 25.00% |

| TTO | Trinidad and Tobago | NO | 30.00% |

| TUN | Tunisia | AF | 25.00% |

| TUR | Turkey | AS | 22.00% |

| TKM | Turkmenistan | AS | 8.00% |

| TCA | Turks and Caicos Islands | NO | 0.00% |

| UGA | Uganda | AF | 30.00% |

| UKR | Ukraine | EU | 18.00% |

| ARE | United Arab Emirates | AS | 0.00% |

| GBR | United Kingdom of Great Britain and Northern Ireland | EU | 19.00% |

| TZA | United Republic of Tanzania | AF | 30.00% |

| USA | United States of America | NO | 25.77% |

| VIR | United States Virgin Islands | NO | 23.10% |

| URY | Uruguay | SA | 25.00% |

| UZB | Uzbekistan | AS | 7.50% |

| VUT | Vanuatu | OC | 0.00% |

| VEN | Venezuela (Bolivarian Republic of) | SA | 34.00% |

| VNM | Viet Nam | AS | 20.00% |

| WLF | Wallis and Futuna Islands | OC | 0.00% |

| YEM | Yemen | AS | 20.00% |

| ZMB | Zambia | AF | 35.00% |

| ZWE | Zimbabwe | AF | 24.72% |

|

Notes: Continent abbreviations are as follows: “AF” is Africa, “AS” is Asia, “EU” is Europe, “OC” is Oceania, “NO” is North America, and “SA” is South America. Countries are assigned to continents based on ISO standards; see DataHub.io, “Comprehensive country codes: ISO 3166, ITU, ISO 4217 currency codes and many more,” https://datahub.io/core/country-codes#resource-country-codes_zip. Sources: Statutory corporate income tax rates are from OECD, “Table II.1. Statutory corporate income tax rate;” KPMG, “Corporate tax rates table;” and researched individually, see Tax Foundation, “worldwide-corporate-tax-rates.” |

|||

[1] Unless otherwise noted, calculated averages of statutory corporate income tax rates only include jurisdictions for which GDP data is available for all years between 1980 and 2020. For 2020, the dataset includes statutory corporate income tax rates of 223 jurisdictions, but GDP data is available for only 177 of these jurisdictions, reducing the number of jurisdictions included in calculated averages to 177. For years prior to 2020, the number of countries included in calculated averages varies by year due to missing corporate tax rates; that is, the 1980 average includes statutory corporate income tax rates of 74 jurisdictions, compared to 177 jurisdictions in 2020.

[2] Statutory corporate income tax rates are from OECD, “Table II.1. Statutory corporate income tax rate,” updated April 2020, https://stats.oecd.org/index.aspx?DataSetCode=Table_II1; KPMG, “Corporate tax rates table,” https://home.kpmg/xx/en/home/services/tax/tax-tools-and-resources/tax-rates-online/corporate-tax-rates-table.html; and researched individually, see Tax Foundation, “worldwide-corporate-tax-rates,” GitHub, https://github.com/TaxFoundation/worldwide-corporate-tax-rates. GDP calculations are from the U.S. Department of Agriculture, “International Macroeconomics Data Set,” Jan. 3, 2020, https://www.ers.usda.gov/data-products/international-macroeconomic-data-set/.

[3] Kari Jahnsen and Kyle Pomerleau, “Corporate Income Tax Rates around the World, 2017,” Tax Foundation, Sept. 7, 2017, https://taxfoundation.org/corporate-income-tax-rates-around-the-world-2017/.

[4] See OECD, “Tax Policy Reforms 2020,” Sept. 3, 2020, https://www.oecd.org/tax/tax-policy-reforms-26173433.htm. This section is limited to OECD countries as no comprehensive source for scheduled corporate rate changes was available for non-OECD countries.

[5] As no averages are presented in this section, it covers all 223 jurisdictions for which 2020 corporate income tax rates were found (thus including jurisdictions for which GDP data was not available).

[6] This average is lower than the average of the 177 jurisdictions because many of the jurisdictions for which no GDP data is available are small economies with low corporate income tax rates.

[7] Industrialized nations are those that are members of the OECD.

[8] Ibid.

[9] BRICS is a group of countries with major emerging economies. The members of this group are Brazil, Russia, India, China, and South Africa.

[10] As no averages are presented in this chapter, it covers all 223 jurisdictions for which 2020 corporate income tax rates were found (thus including jurisdictions for which GDP data was not available).

[11] Historical data comes from multiple sources: PwC, “Worldwide Tax Summaries – Corporate Taxes,” 2010-2019; KPMG, “Corporate Tax Rate Survey,” 1998- 2003; KPMG, “Corporate tax rates table,” 2003-2019; EY, “Worldwide Corporate Tax Guide,” 2004-2019; OECD, “Historical Table II.1 – Statutory corporate income tax rate,” 1999, http://www.oecd.org/tax/tax-policy/tax-database.htm#C_CorporateCaptial; the University of Michigan – Ross School of Business, “World Tax Database,” https://www.bus.umich.edu/otpr/otpr/default.asp; and numerous government websites.

[12] This section of the report covers all 223 jurisdictions for which 2020 corporate income tax rates were found (thus including jurisdictions for which GDP data was not available).

[13] The jurisdictions Netherland Antilles (which was split into different jurisdictions in 2010) and Kosovo (which has not yet officially been assigned a country code) were added to the dataset.

Share this article