Key Findings

- The United States has the fourth highest statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate in the world, levying a 38.91 percent taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on corporate earnings. The only jurisdictions with a higher statutory rate are the United Arab Emirates, Comoros, and Puerto Rico.

- The worldwide average statutory corporate income tax rate, measured across 202 tax jurisdictions, is 22.96 percent. When weighted by GDP, the average statutory rate is 29.41 percent.

- Europe has the lowest regional average rate, at 18.35 percent (25.58 percent when weighted by GDP). Conversely, Africa and South America tie for the highest regional average statutory rate, at 28.73 percent (28.2 percent weighted by GDP for Africa, 32.98 percent weighted by GDP for South America).

- In general, large industrialized nations tend to have higher statutory corporate income tax rates than developing countries.

- The worldwide average statutory corporate tax rate has consistently decreased since 1980, with the largest decline occurring in the early 2000s.

- The average statutory corporate tax rate has declined in every region since 1980.

Introduction

It is commonly known that the United States has the highest statutory corporate income tax rate in the industrialized world.[1] However, less is known about how the United States measures up against the rest of the world. By expanding the sample of tax jurisdictions from the 35 OECD member states to 202 countries and tax jurisdictions around the world, we find the United States corporate tax rate of 38.91 percent is the fourth highest rate in the world. The United States statutory corporate income tax rate is 15.92 percentage points higher than the worldwide average, and 9.5 percentage points higher than the worldwide average weighted by gross domestic product (GDP). The worldwide corporate tax rate has declined significantly since 1980 from an average of 38 percent to 22.96 percent. Today, most countries have corporate tax rates below 30 percent.

The United States Corporate Income Tax Rate in Context

The United States has the fourth highest statutory corporate income tax rate among the 202 jurisdictions surveyed. The U.S. rate of 38.91 percent (comprised of the federal statutory rate of 35 percent plus an average of the corporate income taxes levied by individual states) ranks only behind the United Arab Emirates (55 percent),[2] Comoros (50 percent), and Puerto Rico (39 percent). Comparatively, the average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. of the 202 jurisdictions surveyed is 22.96 percent,[3] or 29.41 percent weighted by GDP.[4]

The twenty countries with the highest statutory corporate income tax rates span every region, albeit unequally. While seven of the top twenty countries are located in Africa, Europe and Asia appear in the top twenty only twice each. Of the remaining jurisdictions, three are located in Oceania, and six are located in the Americas.

Several jurisdictions on the list are United States territories. Puerto Rico, Guam, the Northern Mariana Islands, and the U.S. Virgin Islands rank second, tenth, fourteenth, and sixteenth respectively. Taken together, the United States indirectly accounts for a quarter of the twenty jurisdictions with the highest statutory corporate tax rates.

The only other countries with large economies in the top twenty are India (34.61 percent) and France (34.43 percent), which rank near the bottom of the category. India holds the eighteenth spot, while France holds the twentieth.

| Country | Rate | Region |

|---|---|---|

| Source: Tax Foundation. Data compiled from numerous sources including: PwC, KPMG, Deloitte, and the U.S. Department of Agriculture. | ||

| United Arab Emirates | 55% | Asia |

| Comoros | 50% | Africa |

| Puerto Rico | 39% | North America |

| United States | 38.91% | North America |

| Suriname | 36% | South America |

| Argentina | 35% | South America |

| Chad | 35% | Africa |

| Congo, Democratic Republic of the | 35% | Africa |

| Equatorial Guinea | 35% | Africa |

| Guam | 35% | Oceania |

| Guinea | 35% | Africa |

| Kiribati | 35% | Oceania |

| Malta | 35% | Europe |

| Northern Mariana Islands | 35% | Oceania |

| Sudan | 35% | Africa |

| Virgin Islands, U.S. | 35% | North America |

| Zambia | 35% | Africa |

| India | 34.61% | Asia |

| Saint Maarten | 34.5% | North America |

| France | 34.43% | Europe |

| Worldwide average | 22.96% | N/A |

| Worldwide weighted average (by GDP) | 29.41% | N/A |

On the other end of the spectrum, the twenty countries with the lowest non-zero statutory corporate tax rates all charge rates lower than 15 percent. Ten countries have statutory rates of 10 percent, six being small European nations (Andorra, Bosnia and Herzegovina, Bulgaria, Gibraltar, Kosovo, and Macedonia). The only two major industrialized nations[5] represented among the bottom twenty countries are Ireland and Hungary. Ireland is known for its low 12.5 percent rate, which has been in place since 2003. Hungary dropped into the bottom twenty for the first time in 2017 after reducing its corporate income tax rate from 19 percent to 9 percent.

| Country | Rate | Region |

|---|---|---|

| Source: Tax Foundation. Data compiled from numerous sources including: PwC, KPMG, Deloitte, and the U.S. Department of Agriculture. | ||

| Uzbekistan | 7.5% | Asia |

| Turkmenistan | 8% | Asia |

| Hungary | 9% | Europe |

| Montenegro | 9% | Europe |

| Andorra | 10% | Europe |

| Bosnia and Herzegovina | 10% | Europe |

| Bulgaria | 10% | Europe |

| Gibraltar | 10% | Europe |

| Kosovo, Republic of | 10% | Europe |

| Kyrgyzstan | 10% | Asia |

| Macedonia, Former Yugoslav Republic of | 10% | Europe |

| Paraguay | 10% | South America |

| Qatar | 10% | Asia |

| Timor-Leste | 10% | Asia |

| Macao | 12% | Asia |

| Moldova, Republic Of | 12% | Europe |

| Oman | 12% | Asia |

| Cyprus | 12.5% | Europe |

| Ireland | 12.5% | Europe |

| Liechtenstein | 12.5% | Europe |

| Worldwide average | 22.96% | N/A |

| Worldwide weighted average (by GDP) | 29.41% | N/A |

Of the 202 jurisdictions surveyed, fourteen currently do not impose a general corporate income tax. Most of these countries are small, island nations. A handful, such as the Cayman Islands and Bermuda, are well-known for their lack of corporate taxes. Bahrain has no general corporate income tax, but has a targeted corporate income tax on oil companies.[6]

| Country | Region |

|---|---|

| Source: Tax Foundation. Data compiled from numerous sources including: PwC, KPMG, Deloitte, and the U.S. Department of Agriculture. | |

| Anguilla | North America |

| Bahamas | North America |

| Bahrain | Asia |

| Bermuda | North America |

| Cayman Islands | North America |

| Guernsey | Europe |

| Isle of Man | Europe |

| Jersey | Europe |

| Maldives | Asia |

| Nauru | Oceania |

| Palau | Oceania |

| Turks and Caicos Islands | North America |

| Vanuatu | Oceania |

| Virgin Islands, British | North America |

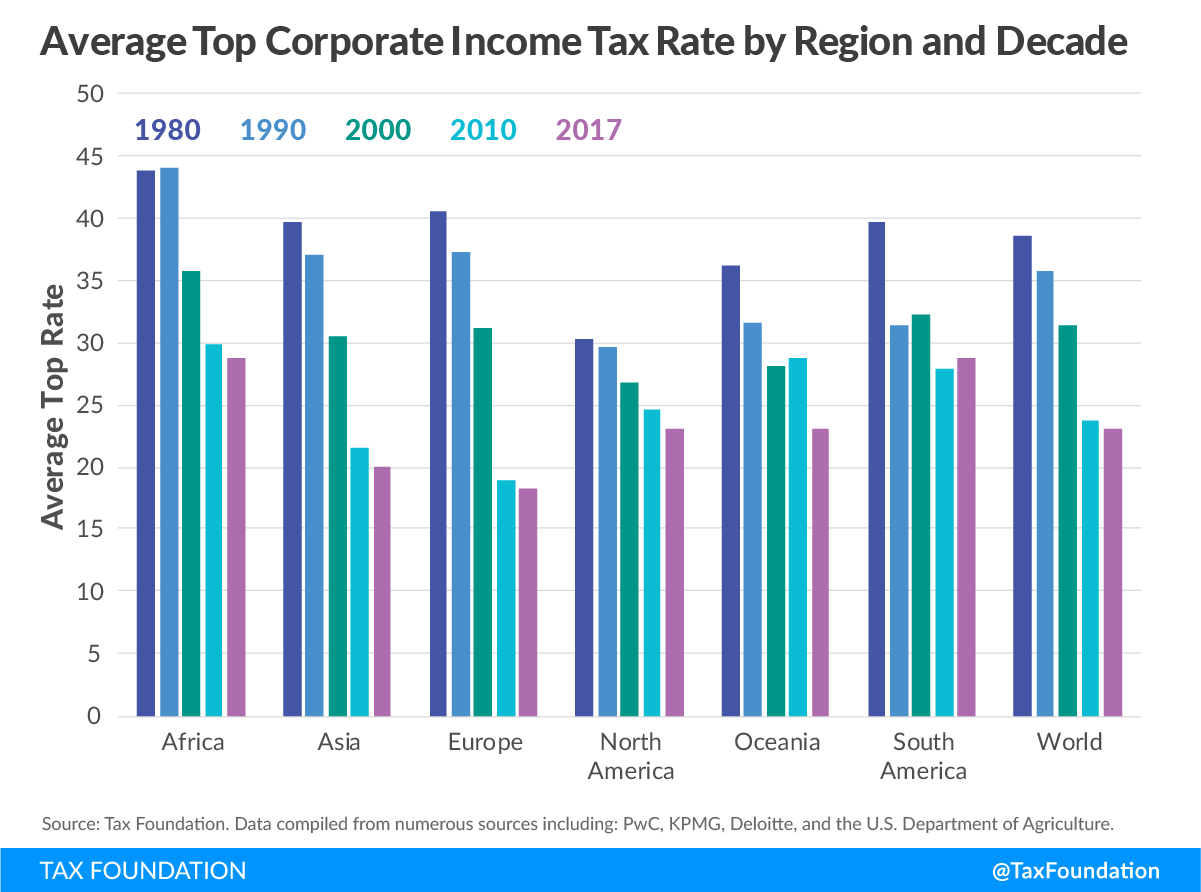

Regional Variation in Corporate Tax Rates

Corporate tax rates can vary significantly by region. Africa has the highest average statutory tax rate among all regions, at 28.73 percent. Europe has the lowest average statutory corporate tax rate among all regions, at 18.35 percent.

When weighted by GDP, North America has the highest average statutory corporate tax rate at 37.01 percent. Although many low tax jurisdictions are located in this region, the United States accounts for more than 82 percent of regional GDP so its comparatively high rate has a significant impact on the regional average. Europe has the lowest weighted average statutory corporate income tax, with a rate of 25.58 percent.

In general, larger and more industrialized nations tend to have higher corporate income tax rates than smaller or less developed nations. These rates are usually above the worldwide average. The G7, which is comprised of the seven wealthiest nations in the world, has an average statutory corporate income tax rate of 29.57 percent, and a weighted average rate of 33.48 percent. OECD member states have an average statutory corporate tax rate of 24.18 percent and a rate of 31.12 when weighted by GDP. The BRICS[7] have an average statutory rate of 28.32 percent and a weighted average statutory corporate income tax rate of 27.34 percent.

| Region or Group | Average Rate | Weighted Average Rate | Number of Countries |

|---|---|---|---|

| Source: Tax Foundation. Data compiled from numerous sources including: PwC, KPMG, Deloitte, and the U.S. Department of Agriculture. | |||

| Africa | 28.73% | 28.20% | 48 |

| Asia | 20.05% | 26.26% | 45 |

| Europe | 18.35% | 25.58% | 49 |

| North America | 23.08% | 37.01% | 30 |

| Oceania | 23.67% | 27.10% | 18 |

| South America | 28.73% | 32.98% | 13 |

| BRICS | 28.32% | 27.34% | 5 |

| EU | 21.82% | 26.25% | 28 |

| G20 | 28.04% | 30.90% | 19 |

| G7 | 29.57% | 33.48% | 7 |

| OECD | 24.18% | 31.12% | 35 |

| World | 22.96% | 29.41% | 202 |

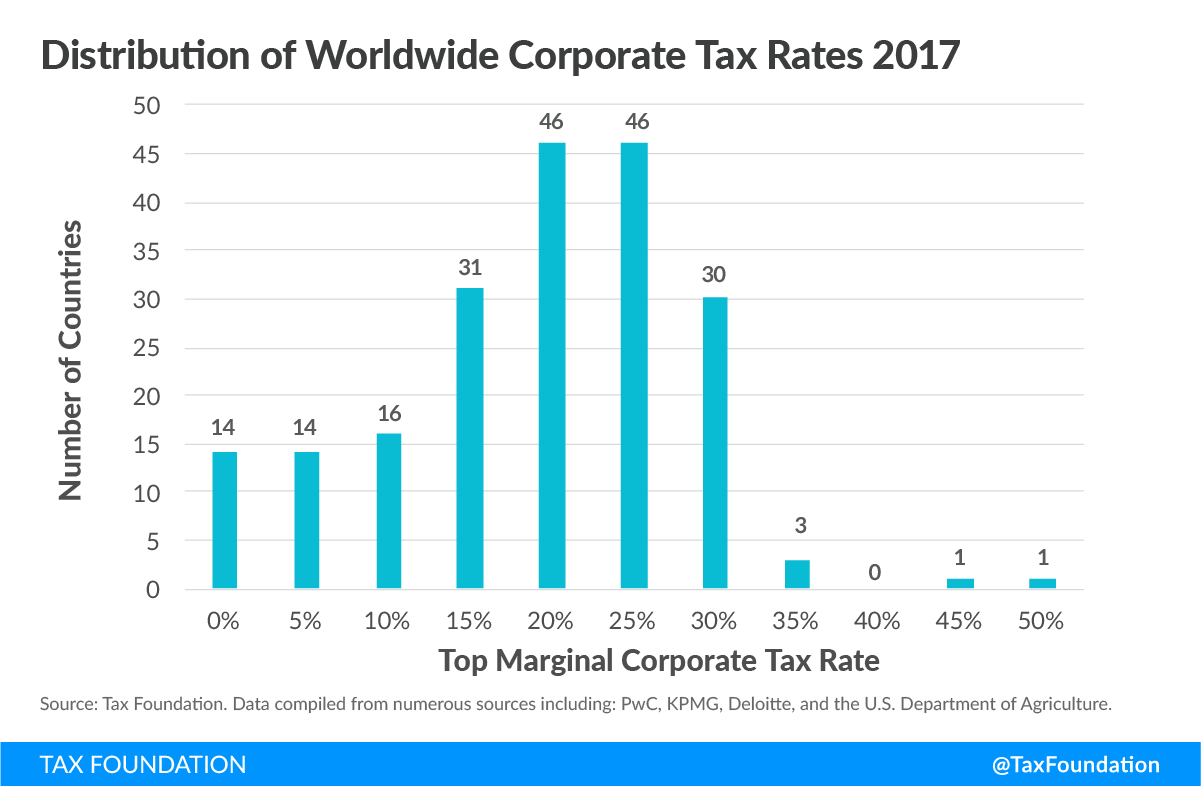

Distribution of Corporate Tax Rates

Very few tax jurisdictions impose a corporate income tax at statutory rates greater than 35 percent. The following chart shows a distribution of corporate income tax rates among 202 jurisdictions in 2017. A plurality of countries (92 total) impose a rate between 20 and 30 percent. Thirty countries have a statutory corporate tax rate between 30 and 35 percent. The United States is among only five countries to have a statutory corporate income tax rate exceeding 35 percent. Seventy-five countries have a statutory corporate tax rate lower than 20 percent and 167 countries have a corporate tax below 30 percent.

The Decline of Worldwide Corporate Tax Rates Since 1980

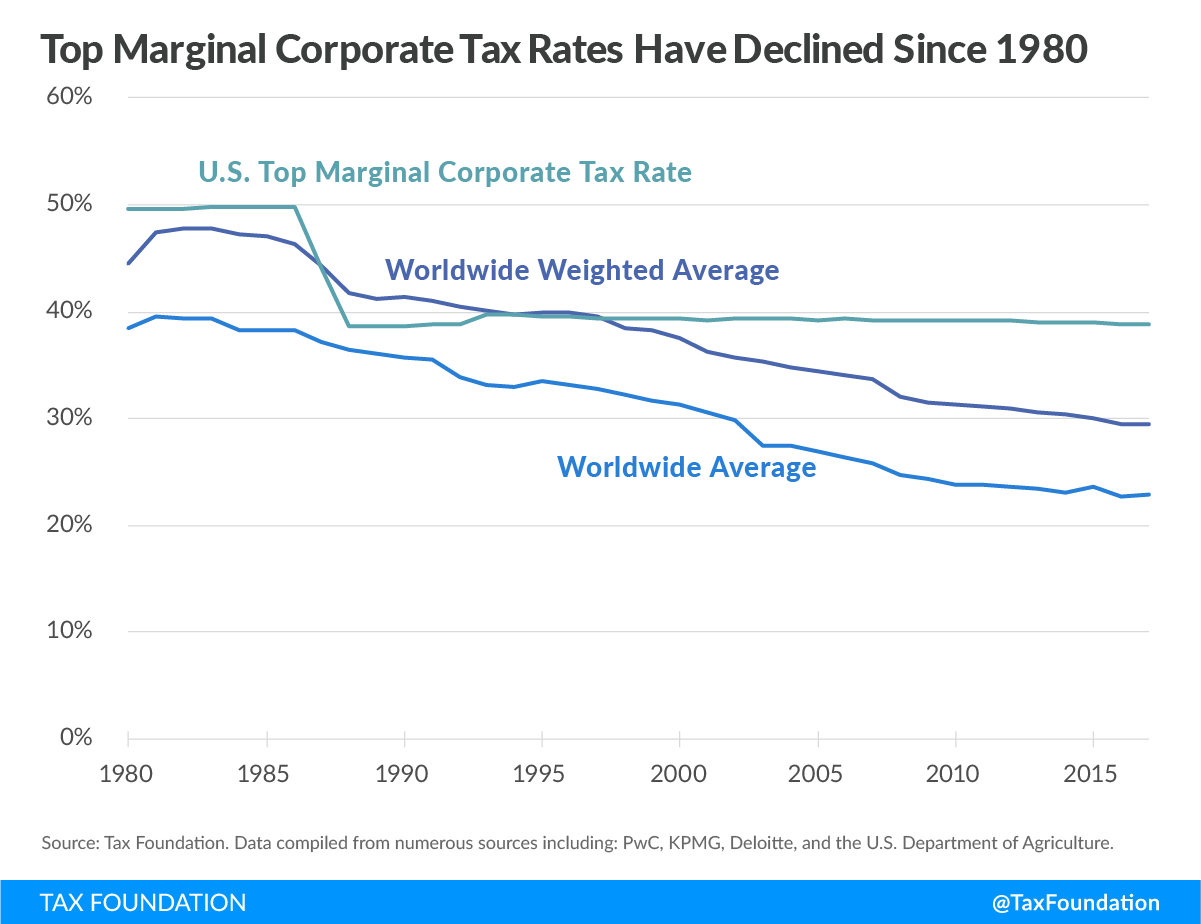

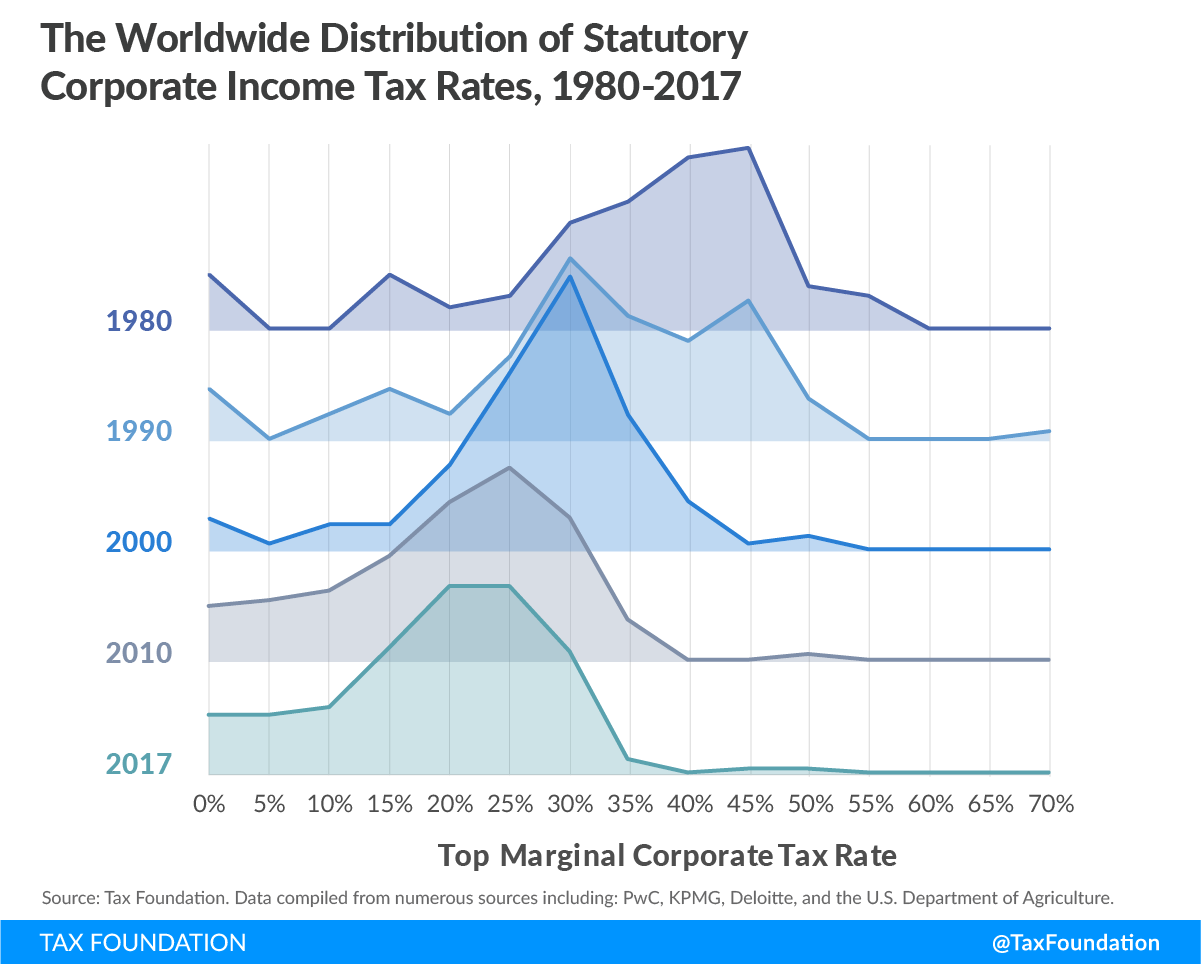

Over the past 37 years, the corporate tax rate has consistently declined on a global basis.[8] In 1980, the unweighted average worldwide statutory tax rate was 38.68 percent. Today, the average statutory rate stands at 22.96 percent, representing a 41 percent reduction over the 37 years surveyed.

The weighted average statutory rate has remained higher than the simple average over this period. The United States is largely responsible for keeping the weighted average so high, given its relatively high tax rate across all years, as well as its significant contribution to global GDP. Regardless, the weighted average statutory corporate income tax rate has declined from 46.64 percent in 1980 to 29.41 percent in 2017, representing a 37 percent reduction over the 37 years surveyed.

Unlike the rest of the world, the United States has maintained a relatively stable corporate rate for the last several decades. The only major rate change occurred as part of the 1986 tax reforms. The reforms reduced the federal statutory rate from 46 percent in 1986 to 40 percent in 1987, before further reducing the rate to 34 percent in 1988. The rate would later be raised to 35 percent in 1993, where it remains today.

Over time, more countries have shifted to taxing corporations at rates lower than 30 percent. This changing distribution of corporate tax rates has been far from consistent. The largest shift occurred between 2000 and 2010, with 77 percent of countries imposing a statutory rate below 30 percent in 2010 and only 42 percent of countries imposing a statutory rate below 30 percent in 2000.

All regions saw a net decline in average statutory rates between 1980 and 2017. The average declined the most in Europe, with the 1980 average of 40.5 percent dropping to 18.35 percent, representing almost a 55 percent rate reduction. South America has seen the smallest decline, with the average only decreasing by 28 percent from 39.66 percent in 1980 to 28.73 percent in 2017.

Africa, Oceania, and South America all saw periods where the average statutory rate increased, although the average rates decreased in all regions over the full period. In each instance of an average rate increase, the change was relatively small, with the absolute change being less than 1 percentage-point between decades.

Conclusion

The last time the United States reduced its federal corporate income tax rate was in 1986. Since then, countries throughout the world have significantly reduced their statutory tax rates. Today, the United States statutory corporate tax rate is one of the highest in the world and stands well above the worldwide average. Reducing the statutory corporate tax rate to around the worldwide average as part of tax reform could discourage profit shifting and encourage companies to locate investment in the United States.

[1] OECD Tax Database, “Table II.1 – Statutory corporate income tax rate,” April 2017, https://stats.oecd.org/index.aspx?DataSetCode=Table_II1.

[2] The United Arab Emirates is a federation of seven separate emirates. Since 1960, each emirate has the discretion to levy up to a 55 percent corporate tax rate on any business. In practice, this tax is mostly levied on foreign banks and petroleum companies. For more information on the taxation system in the United Arab Emirates see PwC, “Worldwide Tax Summaries – Corporate Taxes 2016/2017,” https://www.pwc.com/gx/en/tax/corporate-tax/worldwide-tax-summaries/assets/worldwide-tax-summaries-corporate-taxes-2016-17.pdf and Galadari & Associates, “Taxation in the United Arab Emirates,” http://www.galadarilaw.com/uploads/brochures/172113_Tax.pdf.

[3] Data on statutory corporate tax rates are from multiple sources: Deloitte, “Tax guides and highlights,” 2017, https://dits.deloitte.com/#TaxGuides; PwC, “Worldwide Tax Summaries – Corporate Taxes 2016/2017,” https://www.pwc.com/gx/en/tax/corporate-tax/worldwide-tax-summaries/assets/worldwide-tax-summaries-corporate-taxes-2016-17.pdf; KPMG, “Corporate tax rates table,” https://home.kpmg.com/xx/en/home/services/tax/tax-tools-and-resources/tax-rates-online/corporate-tax-rates-table.html; the OECD Tax Database, “Table II.1 – Statutory corporate income tax rates,” April 2017, https://stats.oecd.org/index.aspx?DataSetCode=Table_II1; EY, “Worldwide Corporate Tax Guide 2017”, http://www.ey.com/Publication/vwLUAssets/Worldwide_Corporate_Tax_Guide_2017/$FILE/Worldwide%20Corporate%20Tax%20Guide%202017.pdf; and various government publications.

[4] GDP calculations are from the U.S. Department of Agriculture, “International Macroeconomics Data Set,” December 2016, https://www.ers.usda.gov/data-products/international-macroeconomic-data-set/; World Bank, “World Development Indicators – GDP (current US$),” August 2017, http://data.worldbank.org/indicator/NY.GDP.MKTP.CD; United Nations Department of Economic and Social Affairs -Statistics Division, World Statistics Pocketbook 2016 edition (New York: United Nations, 2016), https://unstats.un.org/unsd/publications/pocketbook/files/world-stats-pocketbook-2016.pdf; European Commission, “Gross domestic product (GDP) at current market prices by NUTS 2 regions,” March 20, 2017, http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=nama_10r_2gdp&lang=en; and official government publications.

[5] Here, “major industrialized nations” refers to members of the Organisation of Economic Co-operation and Development (OECD).

[6] This tax rate can be as high as 46%. See Deloitte, Tax guides and highlights.

[7] BRICS is a group of countries with major emerging economies. The members of this group are Brazil, Russia, India, China, and South Africa.

[8] Historical data comes from multiple sources: PwC, “Worldwide Tax Summaries – Corporate Taxes,” 2010-2017; KPMG, “Corporate Tax Rate Survey,” 1998-2003; KPMG, “Corporate tax rates table,” 2003-2017; EY, “Worldwide Corporate Tax Guide,” 2004-2017; OECD, “Historical Table II.1 – Statutory corporate income tax rate,” 1999, http://www.oecd.org/tax/tax-policy/tax-database.htm#C_CorporateCaptial; and the University of Michigan – Ross School of Business, “World Tax Database,” https://www.bus.umich.edu/otpr/otpr/default.asp.

Share this article