Sen. Mitt Romney (R-UT) this week proposed the Family Security Act, which features a new, more generous child allowance for families with children while reforming other sources of aid for low-income individuals. Romney’s plan would replace the existing Child Tax Credit (CTC), which is subject to a minimum income requirement and other limitations, with a nearly universal child allowance that would be administered through the Social Security Administration (SSA) rather than the tax code. This new child allowance would be more generous than the CTC by increasing the payment amounts and providing the allowance on a monthly basis.

Romney’s proposal would also simplify the structure of the Earned Income Tax Credit, which is a wage subsidy for low-income workers. It also provides several ways to raise revenue to make the plan deficit neutral through 2025, according to the proposal’s advocates. The proposal furthers the debate over how to reform social support in the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code while recommending ways to simplify existing support in the tax code.

The Family Security Act repeals the Child Tax Credit (CTC), which is currently administered through the tax code. The current CTC is worth a maximum of $2,000 per child, subject to a $2,500 minimum income requirement, a phase-in rate, and a maximum refundability of $1,400 for workers with no tax liability to offset.

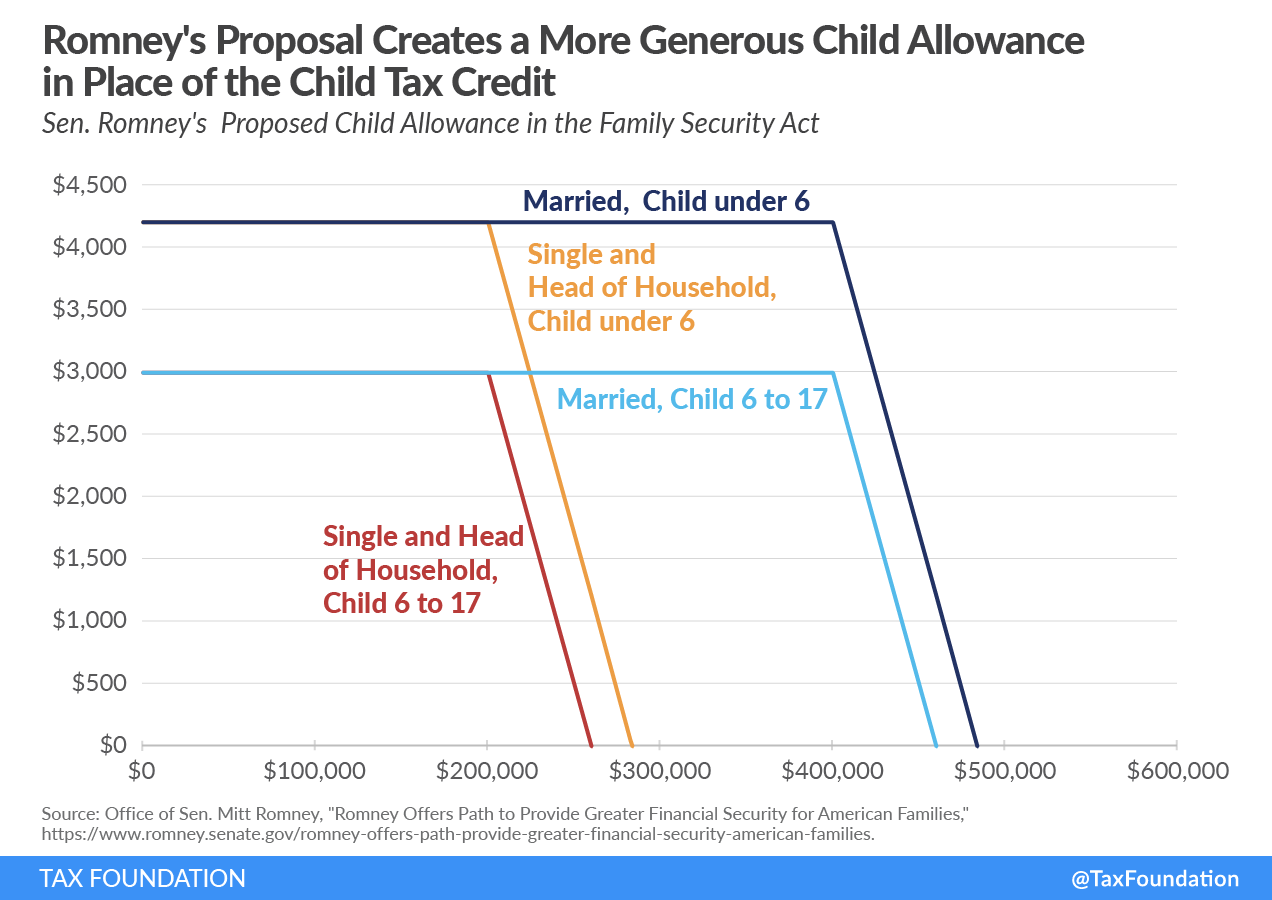

In its place, the proposal creates a child allowance of $4,200 per child under age 6 ($350 per month) and $3,000 per child ages 6 to 17 ($250 per month), administered through the Social Security Administration. Any child with a Social Security Number (SSN) would be eligible, and it is limited to a maximum allowance of $15,000 per year, or $1,250 per month.

The allowance would have no minimum income requirement or phase-in (see Figure 1). It would still phase out at $50 for every $1,000 in income above $200,000 for single filers and $400,000 for joint filers. The Internal Revenue Service (IRS) would reconcile any overpayments or underpayment on tax returns.

Romney estimates the expanded child benefit would cost $229.5 billion annually, $112.5 billion more than the current CTC, at least through 2025. Current tax law is scheduled to change after 2025 with the expiration of many individual provisions in the Tax Cuts and Jobs Act, which complicates the cost estimates beyond that horizon.

Advocates of the expanded child allowance argue that child poverty would be reduced upwards of 50 percent when combined with the other changes made in the proposal to America’s social safety net. The proposal will contribute to the ongoing debate across the political spectrum about how to reform the fiscalized social programs the U.S. has enacted to support families with children and low-income workers.

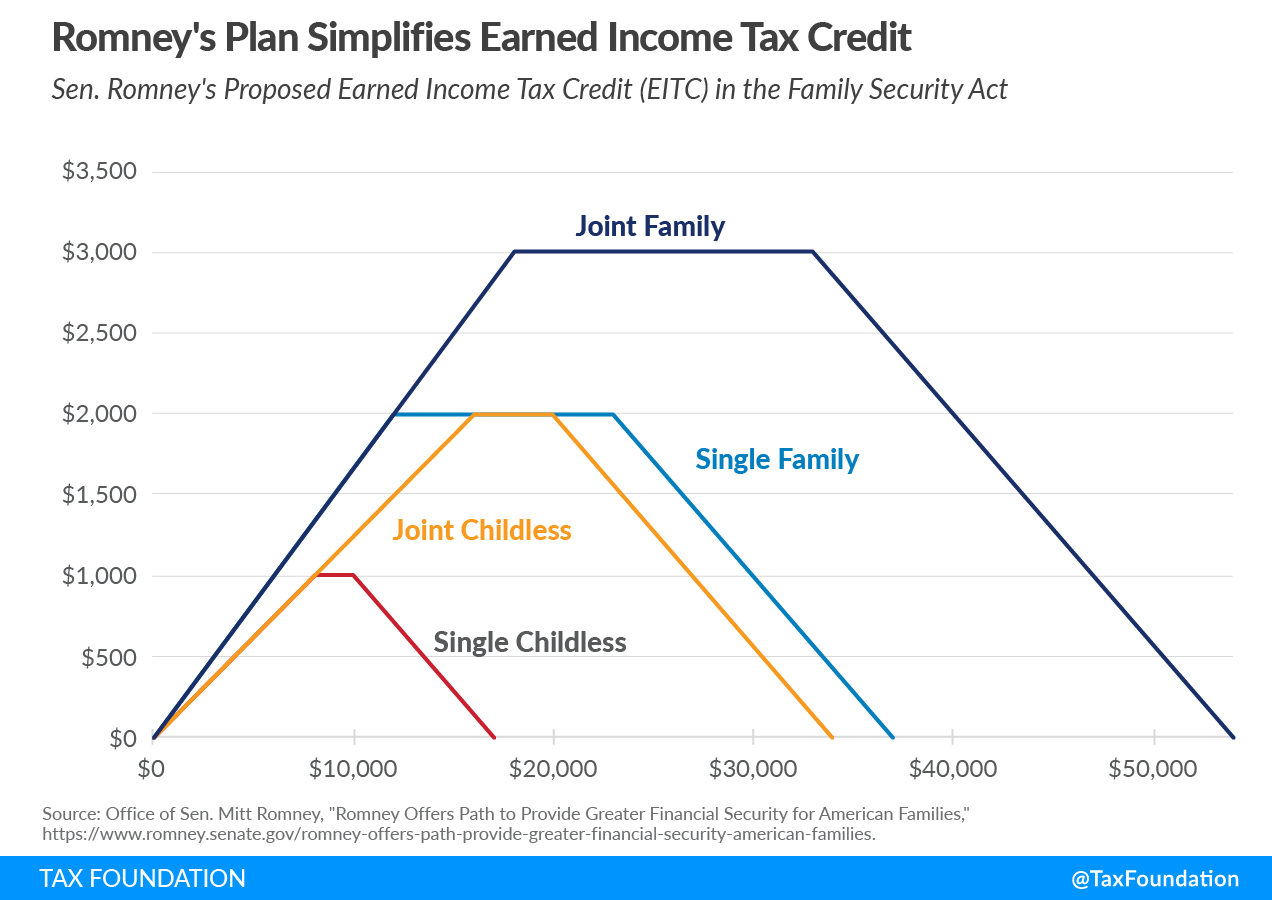

Romney’s plan would also reform the Earned Income Tax Credit (EITC) by turning the credit into an earnings credit with a maximum amount of $1,000 per adult. While the child-related benefits within the current EITC are repealed, the provision for adult dependents is maintained (see Figure 2). Romney estimates the reformed EITC would cost $24.5 billion annually, $46.5 billion less than the current EITC.

Romney’s plan would simplify the tax code by eliminating the complexity of the current CTC and EITC while expanding overall benefits for lower-income families. But there would still be some complications. The new child allowance would continue to rely on the IRS to reconcile payments for higher earners above the phaseout threshold. Combined with other changes in the plan, some households would see their marginal tax rates rise. It is challenging to consolidate social benefits without producing some net losers, and it will be important to identify who would lose and by how much if the plan moves forward.

To account for the cost of the expanded child benefit, the Romney plan would make $66 billion of offsets, including three tax changes and two spending changes.

The Romney plan would eliminate head of household filing status. Head of household status is available to single parents meeting certain qualifications: taxpayers who are unmarried, pay more than half the cost of keeping up a home, and have a qualifying child or dependent. It results in lower taxable income and lower marginal tax rates than if the taxpayer had to file as single. Romney estimates eliminating head of household filing status would result in $16.5 billion in annual savings through 2025.

The plan would also eliminate the Child and Dependent Care Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (CDCTC). The credit helps offset the cost of childcare for working parents. It is calculated by multiplying qualifying expenses by a credit rate. The credit rate varies from 20 percent to 35 percent depending on the taxpayer’s adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. , and qualifying expenses are limited to $3,000 for one qualifying individual or $6,000 for two or more qualifying individuals. It results in a maximum credit of $2,100, and the credit is not refundable. Romney estimates eliminating the credit would result in $4.7 billion in annual savings through 2025.

The third tax-related offset is eliminating the itemized deduction for state and local taxes paid (SALT deduction). Prior to the 2017 tax reform, taxpayers could deduct their income or sales tax liabilities, plus their property taxes paid. The 2017 tax reform introduced a temporary $10,000 limit on the itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. . The Romney proposal would take it further and eliminate deductions for any state and local taxes on taxpayers’ federal tax returns; it would primarily affect upper-income households. Romney estimates eliminating the SALT deduction would result in $25.2 billion in annual savings through 2025.

The plan would eliminate Temporary Assistance for Needy Families (TANF) and make some changes to SNAP eligibility (Supplemental Nutritional Assistance Program) for another $19.6 billion in annual offsets. This would consolidate disparate food assistance programs with a cash benefit. The proposal may have to address the possibility of some beneficiaries losing certain benefits automatically tied to TANF eligibility in certain states, such as the Low Income Home Energy Assistance Program (LIHEAP) and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).

Overall, advocates of the Romney plan argue it would result in a large reduction in child poverty, largely through increased transfers to families with children in deep poverty, and a major simplification of social benefits within the tax code. Some aspects of the plan need further review, such as its effects on marginal effective tax rates and whether it moves the tax code away from equally treating taxpayers earning similar incomes (known as horizontal equity in the tax code). However, it is an important contribution to the ongoing debate about reforming child and work-related tax benefits as well as the broader social safety net.

Share this article