Key Findings

- A typical American household with four wireless phones paying $100 per month for wireless voice service can expect to pay about $221 per year in wireless taxes, fees, and surcharges – down from $223 in 2016.

- Nationwide, taxes make up 18.5 percent of the average U.S. customer’s wireless bill. Washington has the highest wireless taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate in the country at 25.58 percent, followed closely by Nebraska at 25.10 percent, New York at 24.64 percent, Illinois at 24.59 percent, and Pennsylvania at 22.32 percent.

- Since 2008, average wireless monthly bills have dropped from just under $50 per month to $41.50 per month – a 17 percent reduction – while wireless taxes have increased from 15.1 percent to 18.5 percent – a 22 percent increase.

- Many states impose a much larger tax on wireless service than the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. imposed on the purchase of other goods and services. States with large disparities include Alaska (8.8 times) Nebraska (2.7 times), Pennsylvania (2.5 times), Maryland (2.2times), South Dakota (2.2 times), Florida (2.2 times), New York (2.2 times), Rhode Island (2.2 times), and Illinois (2.1times).

- Connecticut, Louisiana, Oklahoma, Utah, and West Virginia increased 911 fees in 2017. States are under pressure to fund upgrades to next-generation 911 (NG911) programs.

- In 2017, state Universal Service Fund (USF) rates increased in Alaska, Indiana, Kansas, New Mexico, Utah, and Wisconsin.South Carolina expanded the scope of its USF surcharge to include wireless service. California and Wyoming lowered the rates of their state USF surcharges.

- At the end of 2016, over 66 percent of all poor adults had only wireless service, and 51 percent of all adults were wireless only. Excessive taxes and fees, especially the regressive per-line taxes like those imposed in Chicago and Baltimore, impose a disproportionate burden on low-income consumers. Chicago’s per-line tax increases to $5 per month per line as of January 1, 2018.

Executive Summary

Wireless consumers will pay an estimated $17.1 billion in taxes, fees, and government surcharges to federal, state, and local governments in 2017, down about $100 million from 2016. These taxes, fees, and surcharges break down as follows:

- $6.7 billion in sales taxes and other nondiscriminatory consumption taxes.

- $5.1 billion in federal Universal Service Fund (USF) surcharges.

- $2.6 billion in 911 fees, a category that includes hundreds of millions of dollars that are not actually used for 911 purposes.

- $2.7 billion in other industry-specific state and local taxes and fees.

A typical American household with four wireless phones paying $100 per month for wireless voice service can expect to pay about $221 per year in wireless taxes, fees, and surcharges – down from $223 in 2016.

Consumers in Washington, Nebraska, New York, Illinois, and Pennsylvania pay the highest wireless taxes in the country, while wireless users in Oregon, Nevada, and Idaho pay the lowest wireless taxes. While Washington consumers currently pay the highest wireless taxes in the country, Illinois wireless taxes will likely become the highest in the country in January 2018, when a sizable increase in the Chicago and Illinois 911 fees will take effect.

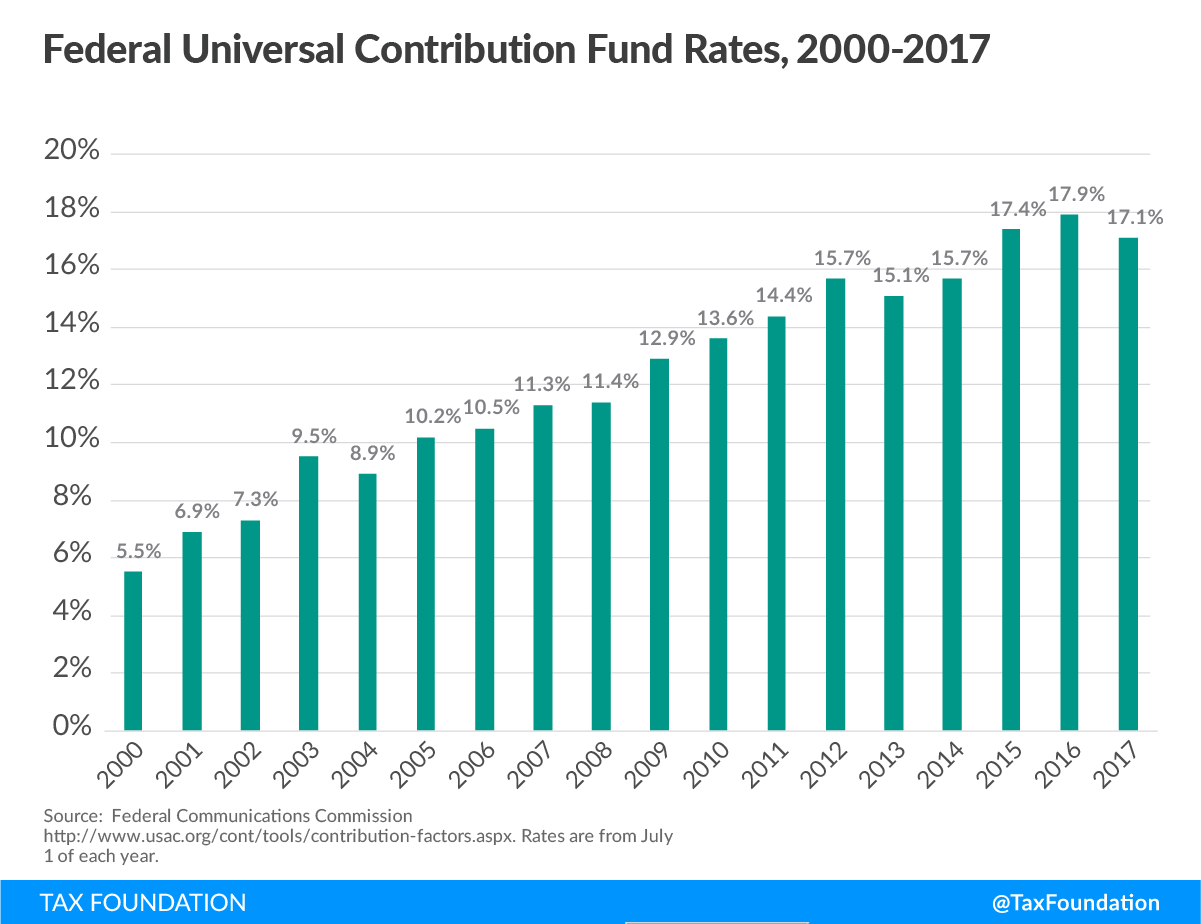

Nationwide, taxes and fees on wireless consumers were essentially flat between 2016 and 2017, falling from 18.6 percent to 18.5 percent of the average U.S. customer’s monthly bill. This was the first reduction in wireless tax burdens since 2014.State and local wireless taxes increased from 11.9 percent to 12.1 percent, the fourth consecutive increase. This increase was offset by a 0.3 percent decrease in the federal Universal Service Fund (FUSF) surcharge. This was the first reduction in the FUSF surcharge since 2003.

Fortunately for wireless consumers, intense price competition produced a large reduction in the average monthly cost of wireless service. Average revenue per subscriber fell dramatically, from $44.65 per month to $41.50 per month. Unfortunately, consumers were not able to fully enjoy this price reduction because taxes, fees, and surcharges continue to remain stubbornly high.

Wireless service is increasingly the sole means of communications and connectivity for many Americans, particularly young people and those with lower incomes. At the end of 2016, about 66 percent of all low income adults had only wireless service and 51 percent of all adults of all incomes were wireless only.[1] These excessive taxes and fees – especially those that impose high per-line taxes and fees – impose a disproportionate tax burden on those least able to afford them.

Wireless Taxes And Fees Remain High In 2017

This is the eighth in a series of reports that examine trends in taxes, fees, and government surcharges imposed on wireless service by federal, state, and local governments since 2003. The methodology for the report, which was originally developed by the Committee on State Taxation in a 1999 report, is detailed in Appendix A.

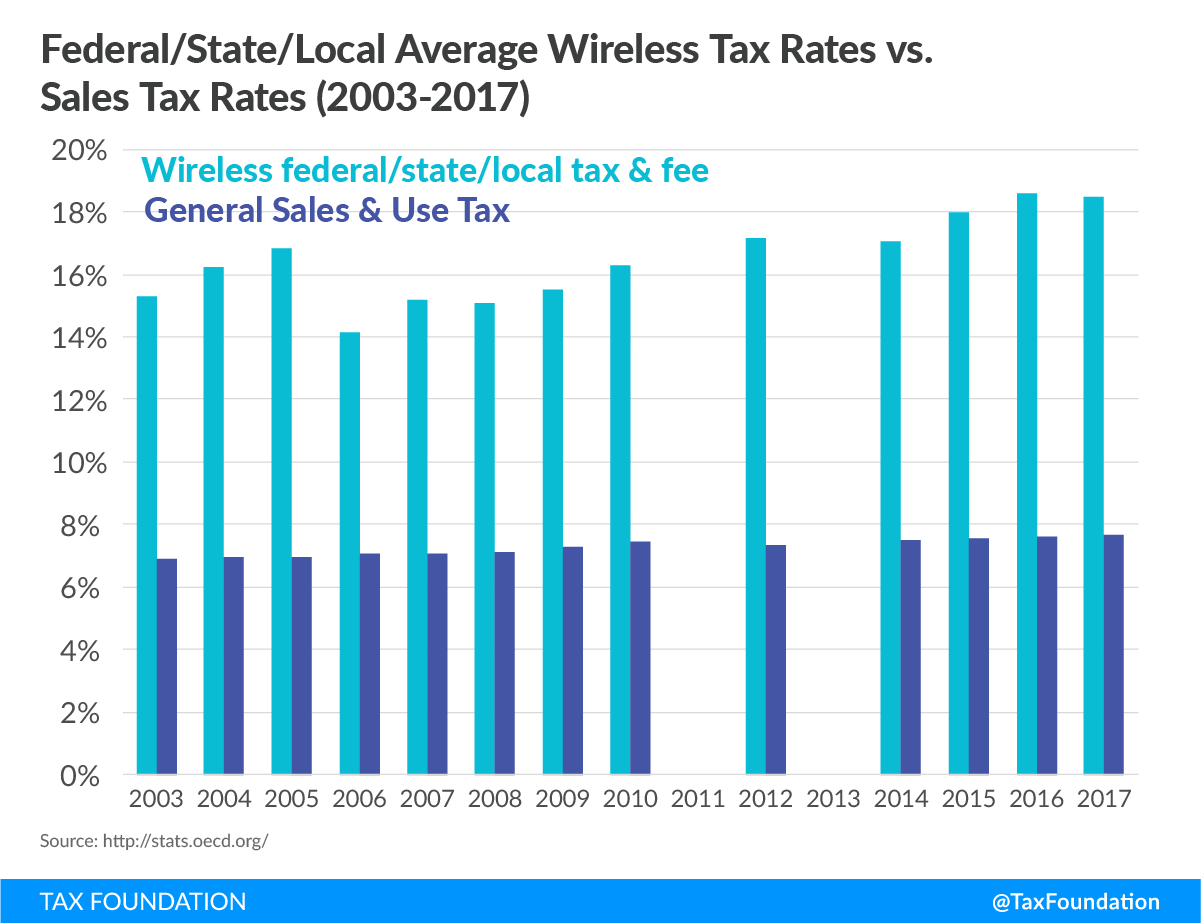

Table 1 shows national trends in tax rates imposed by all levels of government on taxable wireless service between 2003 and 2017. Between 2005 and 2006, wireless taxes dropped after the federal courts forced the IRS to end the imposition of the 3 percent federal excise tax on wireless service. After that court decision, wireless tax rates dropped to a low of 14.1 percent. Since then, however, wireless tax rates have climbed steadily to their current rate of 18.5 percent.

| Note: Federal includes 3% federal excise tax (until 5/2006) and federal universal service fund charge, which is set by the FCC and varies quarterly: Federal USF 7/1/2017 — 37.1% Interstate safe harbor x 17.1% contribution factor = 6.34% effective tax rate http://www.usac.org/cont/tools/contribution-factors.aspx Source: Methodology derived from Committee on State Taxation, “50-State Study and Report on Telecommunications Taxation,” May 2005. Updated July 2016 from state statutes, FCC data, and local ordinances by Scott Mackey, Leonine Public Affairs LLP, Montpelier, VT. | |||||

| Weighted Average | |||||

|---|---|---|---|---|---|

| Wireless: State & Local tax & fee | Wireless: Federal tax & fee | Wireless: Federal/State/Local tax & fee | General Sales/Use Tax | Disparity — Wireless Tax Over General Sales Tax | |

| 1/1/2003 | 10.20% | 5.07% | 15.27% | 6.87% | 3.33% |

| 4/1/2004 | 10.74% | 5.48% | 16.22% | 6.93% | 3.81% |

| 7/1/2005 | 10.94% | 5.91% | 16.85% | 6.94% | 4.00% |

| 7/1/2006 | 11.14% | 2.99% | 14.13% | 7.04% | 4.10% |

| 7/1/2007 | 11.00% | 4.19% | 15.19% | 7.07% | 3.93% |

| 7/1/2008 | 10.86% | 4.23% | 15.09% | 7.11% | 3.75% |

| 7/1/2009 | 10.74% | 4.79% | 15.53% | 7.26% | 3.48% |

| 7/1/2010 | 11.21% | 5.05% | 16.26% | 7.42% | 3.79% |

| 7/1/2012 | 11.36% | 5.82% | 17.18% | 7.33% | 4.03% |

| 7/1/2014 | 11.23% | 5.82% | 17.05% | 7.51% | 3.72% |

| 7/1/2015 | 11.50% | 6.46% | 17.96% | 7.57% | 3.93% |

| 7/1/2016 | 11.93% | 6.64% | 18.57% | 7.61% | 4.32% |

| 7/1/2017 | 12.11% | 6.34% | 18.46% | 7.65% | 4.46% |

Table 1 also separates the impact of federal taxes and surcharges from state and local government taxes, fees, and surcharges.Throughout the period, state and local taxes have been trending upward steadily, from 10.2 percent in 2003 to their current level of 12.1 percent in 2017. The FUSF surcharge has also increased throughout the period, although the FUSF declined in2017 for the first time since this report began tracking wireless taxes in 2003. For a detailed explanation of the FUSF and how it is imposed, see Appendix B.

Table 1 also shows the general trends in average tax rates of the sales and use tax, which is the primary broad-based consumption tax imposed by 45 states, the District of Columbia, and Puerto Rico. Since 2003, the average state-local sales tax rate has increased by about 0.8 percentage points – from 6.87 percent to 7.65 percent. During that same period, wireless taxes increased by 1.9 percentage points – from 10.2 percent to 12.11 percent. Wireless tax rates have increased roughly two-and-a-halftimes faster than sales tax rates.

Wireless industry competition has led to significant reductions in average monthly bills since 2008, a trend that accelerated dramatically in 2017, when average bills dropped from $44.65 per month in 2016 to $41.50 per month this year. In fact, Federal Reserve Chair Janet Yellen specifically identified wireless price reductions as a key factor in keeping U.S. inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. low.[2] Since 2008, average wireless monthly bills have dropped from just under $50 per month to $41.50 per month – a 17 percent reduction – while wireless taxes have increased from 15.1 percent to 18.5 percent – a 22 percent increase. Unfortunately, consumers have not enjoyed the full benefits of wireless price competition because tax increases have offset some of the price reductions.

Figure 1.

Table 2 shows wireless tax, fee, and government surcharge rates as of July 2017. Column 1 shows the average combined state-local tax rate in the largest city and the capital city in each state, while column 2 shows the effective rate of the FUSF surcharge.Once again, Washington has the highest wireless tax rates in the country at 25.58 percent, followed closely by Nebraska at 25.10 percent, New York at 24.64 percent, Illinois at 24.59 percent, and Pennsylvania at 22.32 percent.

| Source: Methodology from COST, “50-State Study and Report on Telecommunications Taxation,” May 2005. Updated July 2017 using state statutes, FCC data, and local ordinances. | ||||

| 2017 Wireless State-Local Rate |

2017 Federal USF Rate |

2017 Combined Federal/State/Local Rate |

||

|---|---|---|---|---|

| 1 | Washington | 19.24% | 6.34% | 25.58% |

| 2 | Nebraska | 18.75% | 6.34% | 25.10% |

| 3 | New York | 18.30% | 6.34% | 24.64% |

| 4 | Illinois | 18.25% | 6.34% | 24.59% |

| 5 | Pennsylvania | 15.98% | 6.34% | 22.32% |

| 6 | Alaska | 15.53% | 6.34% | 21.87% |

| 7 | Rhode Island | 15.04% | 6.34% | 21.38% |

| 8 | Arkansas | 14.81% | 6.34% | 21.16% |

| 9 | Missouri | 14.79% | 6.34% | 21.13% |

| 10 | Florida | 14.76% | 6.34% | 21.11% |

| 11 | Kansas | 14.33% | 6.34% | 20.68% |

| 12 | South Dakota | 13.97% | 6.34% | 20.31% |

| 13 | Utah | 13.75% | 6.34% | 20.09% |

| 14 | Puerto Rico | 13.58% | 6.34% | 19.92% |

| 15 | Maryland | 13.35% | 6.34% | 19.69% |

| 16 | California | 12.82% | 6.34% | 19.16% |

| 17 | North Dakota | 12.61% | 6.34% | 18.95% |

| 18 | Arizona | 12.53% | 6.34% | 18.88% |

| 19 | New Mexico | 12.51% | 6.34% | 18.85% |

| 20 | South Carolina | 12.30% | 6.34% | 18.65% |

| 21 | Tennessee | 12.30% | 6.34% | 18.64% |

| 22 | Colorado | 12.06% | 6.34% | 18.40% |

| 23 | District of Columbia | 11.83% | 6.34% | 18.18% |

| 24 | Texas | 11.68% | 6.34% | 18.02% |

| 25 | Oklahoma | 11.61% | 6.34% | 17.96% |

| 26 | Indiana | 11.46% | 6.34% | 17.80% |

| 27 | Kentucky | 10.92% | 6.34% | 17.26% |

| 28 | Georgia | 10.74% | 6.34% | 17.09% |

| 29 | Alabama | 10.22% | 6.34% | 16.56% |

| 30 | Minnesota | 10.11% | 6.34% | 16.45% |

| 31 | Louisiana | 9.64% | 6.34% | 15.98% |

| 32 | Mississippi | 9.41% | 6.34% | 15.75% |

| 33 | Wisconsin | 9.21% | 6.34% | 15.55% |

| 34 | New Jersey | 9.04% | 6.34% | 15.39% |

| 35 | Iowa | 8.98% | 6.34% | 15.33% |

| 36 | Maine | 8.85% | 6.34% | 15.19% |

| 37 | New Hampshire | 8.81% | 6.34% | 15.15% |

| 38 | North Carolina | 8.69% | 6.34% | 15.03% |

| 39 | Massachusetts | 8.66% | 6.34% | 15.00% |

| 40 | Vermont | 8.50% | 6.34% | 14.84% |

| 41 | Ohio | 8.48% | 6.34% | 14.83% |

| 42 | Michigan | 8.09% | 6.34% | 14.43% |

| 43 | West Virginia | 8.05% | 6.34% | 14.39% |

| 44 | Wyoming | 7.90% | 6.34% | 14.25% |

| 45 | Connecticut | 7.75% | 6.34% | 14.09% |

| 46 | Hawaii | 7.63% | 6.34% | 13.98% |

| 47 | Virginia | 6.81% | 6.34% | 13.15% |

| 48 | Delaware | 6.45% | 6.34% | 12.79% |

| 49 | Montana | 6.40% | 6.34% | 12.74% |

| 50 | Idaho | 2.41% | 6.34% | 8.75% |

| 51 | Nevada | 2.35% | 6.34% | 8.69% |

| 52 | Oregon | 1.98% | 6.34% | 8.32% |

| Weighted Avg. | 12.11% | 6.34% | 18.46% | |

| Simple Avg. | 11.04% | 6.34% | 17.39% | |

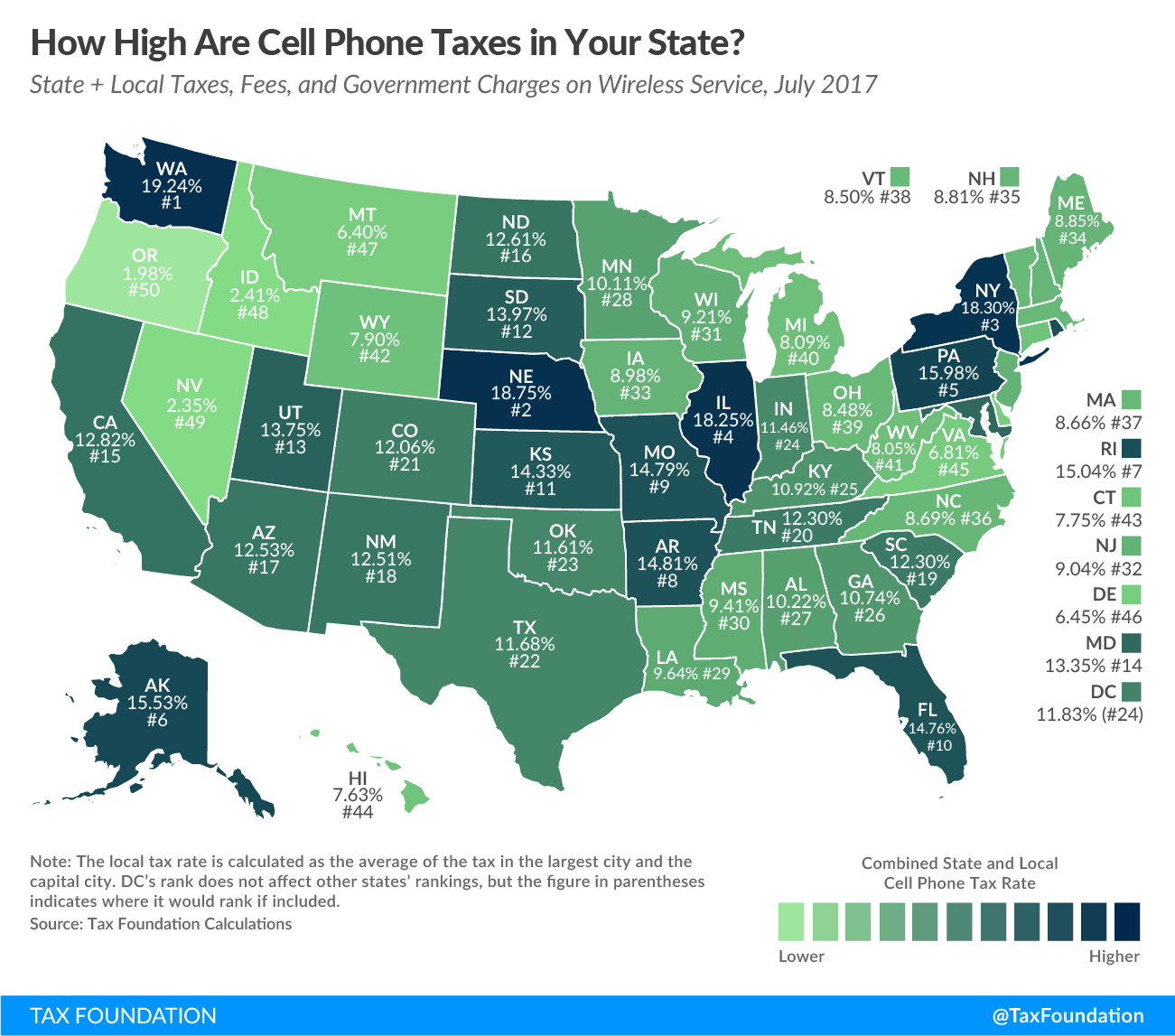

Figure 2 maps the states by average state-local wireless tax rates, without including the FUSF imposition. Other than the cluster of low tax states in the western United States, there do not appear to be any strong regional patterns to the distribution of high-tax and low-tax states. The New England states tend to have lower wireless tax rates, while the high-tax states are scattered throughout the country.

Figure 2.

There is disparity in tax burdens on wireless as compared to broad-based consumption taxes on other goods and taxable services subject to sales and use taxes. Wireless and other telecommunications are one of the few services that are consistently subject to sales and use taxes by states with both narrow and broad sales tax bases. Table 3 ranks the states by comparing the disparity between the tax rates imposed on wireless service to the combined state and local sales tax rate in each state.Alaska leads all states in this regard, imposing wireless taxes that are nearly nine times higher than average sales tax rates – 15.5 percent versus 1.26 percent. Other states with large disparities include Nebraska (2.7 times), Pennsylvania (2.5 times), Maryland (2.2 times), South Dakota (2.2 times), Florida (2.2 times), New York (2.2 times), Rhode Island (2.2 times), and Illinois (2.1 times).Three states impose lower taxes on wireless service than on other goods and services subject to the sales tax: Nevada, Idaho, and Louisiana.

| Source: Methodology from COST, “50-State Study and Report on Telecommunications Taxation,”May 2005. Updated July 2017 using state statutes, Tax Foundation and FCC data, and local ordinances. | ||||

| State Plus Average Local Sales Tax | State-Local Wireless Tax | Wireless Over / Under Sales Tax | Disparity Multiple | |

|---|---|---|---|---|

| Alaska | 1.76% | 15.53% | 13.77% | 8.82 |

| Nebraska | 6.90% | 18.75% | 11.85% | 2.72 |

| Pennsylvania | 6.34% | 15.98% | 9.64% | 2.52 |

| Maryland | 6.00% | 13.35% | 7.35% | 2.22 |

| South Dakota | 6.40% | 13.97% | 7.57% | 2.18 |

| Florida | 6.80% | 14.76% | 7.96% | 2.17 |

| New York | 8.49% | 18.30% | 9.81% | 2.16 |

| Rhode Island | 7.00% | 15.04% | 8.04% | 2.15 |

| Illinois | 8.69% | 18.25% | 9.56% | 2.10 |

| Washington | 9.20% | 19.24% | 10.04% | 2.09 |

| District of Columbia | 5.75% | 11.83% | 6.08% | 2.06 |

| Utah | 6.77% | 13.75% | 6.98% | 2.03 |

| North Dakota | 6.79% | 12.61% | 5.82% | 1.86 |

| Missouri | 7.97% | 14.79% | 6.82% | 1.86 |

| Kentucky | 6.00% | 10.92% | 4.92% | 1.82 |

| Hawaii | 4.35% | 7.63% | 3.28% | 1.75 |

| Wisconsin | 5.42% | 9.21% | 3.79% | 1.70 |

| South Carolina | 7.37% | 12.30% | 4.93% | 1.67 |

| Kansas | 8.68% | 14.33% | 5.65% | 1.65 |

| New Mexico | 7.63% | 12.51% | 4.88% | 1.64 |

| Indiana | 7.00% | 11.46% | 4.46% | 1.64 |

| Maine | 5.50% | 8.85% | 3.35% | 1.61 |

| Colorado | 7.50% | 12.06% | 4.56% | 1.61 |

| Arkansas | 9.34% | 14.81% | 5.47% | 1.59 |

| US Weighted Average | 7.65% | 12.11% | 4.46% | 1.58 |

| California | 8.48% | 12.82% | 4.34% | 1.51 |

| Arizona | 8.32% | 12.53% | 4.21% | 1.51 |

| Wyoming | 5.26% | 7.90% | 2.64% | 1.50 |

| Georgia | 7.15% | 10.74% | 3.59% | 1.50 |

| Texas | 8.17% | 11.68% | 3.51% | 1.43 |

| Minnesota | 7.29% | 10.11% | 2.82% | 1.39 |

| Massachusetts | 6.25% | 8.66% | 2.41% | 1.39 |

| Vermont | 6.18% | 8.50% | 2.32% | 1.38 |

| Michigan | 6.00% | 8.09% | 2.09% | 1.35 |

| Mississippi | 7.07% | 9.41% | 2.34% | 1.33 |

| Iowa | 6.80% | 8.98% | 2.18% | 1.32 |

| New Jersey | 6.85% | 9.04% | 2.19% | 1.32 |

| Oklahoma | 8.86% | 11.61% | 2.75% | 1.31 |

| Tennessee | 9.45% | 12.30% | 2.85% | 1.30 |

| West Virginia | 6.29% | 8.05% | 1.76% | 1.28 |

| North Carolina | 6.95% | 8.69% | 1.74% | 1.25 |

| Connecticut | 6.35% | 7.75% | 1.40% | 1.22 |

| Virginia | 5.63% | 6.81% | 1.18% | 1.21 |

| Ohio | 7.14% | 8.48% | 1.34% | 1.19 |

| Puerto Rico | 11.50% | 13.58% | 2.08% | 1.18 |

| Alabama | 9.03% | 10.22% | 1.19% | 1.13 |

| Louisiana | 10.02% | 9.64% | -0.38% | 0.96 |

| Idaho | 6.03% | 2.41% | -3.62% | 0.40 |

| Nevada | 8.14% | 2.35% | -5.79% | 0.29 |

| Delaware | 0.00% | 6.45% | 6.45% | NA |

| Montana | 0.00% | 6.40% | 6.40% | NA |

| New Hampshire | 0.00% | 8.81% | 8.81% | NA |

| Oregon | 0.00% | 1.98% | 1.98% | NA |

Total Taxes Paid

In addition to the $5.3 billion in taxes discussed above, wireless consumers also pay an estimated $5.1 billion in FUSF surcharges and $6.7 billion in nondiscriminatory broad-based sales taxes on wireless service.[3] In total, wireless consumers contribute about $17.1 billion in revenues to federal, state, and local governments.

Wireless consumers pay about $5.3 billion in taxes and fees that are specifically levied on telecommunications services but not on other taxable goods and services, consisting of approximately $2.6 billion in 911 taxes and fees and another $2.7 billion in other discriminatory state and local taxes, fees, and government surcharges. According to the FCC, some states and localities routinely divert 911 taxes and fees for other purposes.[4] For example, in July the Illinois Legislature granted the City of Chicago the authority to increase its 911 tax from $3.90 per line to $5.00 per line, effective January 1 ,2018.[5] Media reports suggest that 911 tax increases were intended to cover a shortfall in city pension obligations.[6]

Appendix C provides a detailed breakdown of the specific taxes, fees, and government surcharges imposed in each state, including the respective rates of each. To facilitate interstate comparisons, local rates imposed in the most populated city and the capital city in each state are averaged into a single rate. In the case of taxes and fees that are imposed on a flat per-line basis – for example, $1 per month per line – the tax is converted from a flat amount to a percentage by dividing the flat amount by the industry average revenue per line of $41.50 per month. For a detailed description of the methodology, please see Appendix A.

Trends In Wireless Taxes And Fees

911 Fees

Most states impose 911 fees to fund capital expenses associated with the 911 system, and in some states fees fund operations as well. Wireless 911 fees vary greatly by state, from a low of zero in Missouri to a high of $3.34 per line in West Virginia.Most wireless 911 fees are levied at uniform rates statewide, although there are a few exceptions. In Illinois, fees are uniform statewide at $0.87 per line per month except in the City of Chicago, where the fee is over four times higher at$3.90. In July 2017, the legislature overrode the governor’s veto and enacted legislation to increase the state fee to $1.50 per line per month and to allow Chicago to raise the fee to $5.00 per line per month. This is by far the highest wireless 911 fee in the country.

Connecticut, Louisiana, Oklahoma, Utah, and West Virginia also increased 911 fees in 2017. States are under additional pressure to fund upgrades to next generation 911 (NG 911) programs. Therefore, it is likely that additional 911 tax increases will be debated in state legislatures in the coming years.

State Universal Service Funds

Some states have their own Universal Service Funds (USF) that provide subsidies for many of the same purposes as the FUSF. State USF surcharges are imposed on intrastate revenues, while the FUSF is imposed on interstate revenues. In states like Alaska, Kansas, and Nebraska, high state USF surcharge rates add significantly to the overall burden on wireless consumers.For example, the USF rate in Alaska is 14.2 percent of all intrastate charges. In just two years, significant increases in the state USF rate propelled Alaska upward in the overall wireless tax rankings from 14th highest in 2015 to sixth highest in 2017.

In 2017, state USF rates increased in Alaska, Indiana, Kansas, New Mexico, Utah, and Wisconsin. South Carolina expanded the scope of its USF surcharge to include wireless service. California and Wyoming lowered the rates of their state USF surcharges.

State Level Wireless Taxes

In addition to 911 fees and state USF charges, 14 states impose taxes on wireless service that are either in addition to state sales taxes or in lieu of sales taxes but at a higher rate than the state sales tax. Table 4 below lists these states.No states increased or decreased discriminatory state wireless taxes in 2017.

| State Gross Receipts Tax in Addition to Sales Tax |

Higher State Tax Rate in Lieu of Sales Tax |

Wireless Tax but No State Sales Tax |

|---|---|---|

| Indiana | District of Columbia | Delaware |

| Kentucky | Florida | Montana |

| New York | Illinois | New Hampshire |

| North Dakota | Maine | |

| Pennsylvania | ||

| Rhode Island | ||

| South Dakota |

Local Wireless Taxes

Many local governments also impose discriminatory taxes on wireless consumers. Many of these are legacy taxes that were established during the regulated telephone monopoly era that existed prior to the late 1980s. Local governments in some states have longstanding authority to impose “right-of-way” fees on telephone companies for placing poles, wires, and other landline infrastructure on public property. In other states, localities exercised the authority to impose franchise fees on telephone companies in exchange for granting one company the exclusive franchise agreement to provide service within the municipality.

In the late 1990s and early 2000s, when wireless service began to displace landline service, localities became concerned about losing revenues and sought to extend these legacy fees to wireless providers even though wireless providers did not receive the same benefits for which the fees were established. For example, a wireless provider does not receive the ability to access the public right of way to place equipment. Instead, wireless providers negotiate a rental agreement for the use of public property similar to agreements negotiated with private property owners. In addition, wireless providers must pay billions to purchase spectrum from the federal government through auctions held by the Federal Communications Commission(FCC).

Local governments in 12 states currently impose some type of tax or fee on wireless service over and above any broad-based local sales tax. In most of these states, the local wireless tax is in addition to state taxes. California is the exception; wireless service is not subject to sales taxes but is subject to local Utility User Taxes at rates as high as 11 percent.Table 5 provides a breakdown of the types of local wireless taxes.

| Privilege, License or User Taxes | State-Authorized Telecom Taxes | School District and Other Special District Taxes |

|---|---|---|

| Note: Excludes local general sales taxes. | ||

| Arizona | Florida | Kentucky |

| California | Illinois | New York |

| Maryland | Maryland | |

| Missouri | New York | |

| Nebraska | Utah | |

| Nevada | ||

| South Carolina | ||

| Washington | ||

Local government taxes have a significant impact on the overall tax burden on wireless consumers in many of the states that have high wireless taxes and fees. In all five states shown on Table 2 with the highest wireless tax rank, local taxes play a prominent role. Washington allows municipal governments to impose “utility franchise taxes” with rates as high as 9 percent.Nebraska allows local business license taxes with rates as high as 6.25 percent. New York allows New York City, other selected cities, school districts, and certain transit districts to levy various wireless taxes in addition to county 911 fees. Finally, Florida and Illinois have special state communications taxes with a local add-on that result in rates typically two times higher than the sales tax.

Tucson, Arizona, was the only locality covered by this study that increased a discriminatory wireless tax in 2016, from 6.5 percent to 7 percent. In addition, local sales taxes paid by wireless consumers were increased in Atlanta, Georgia; Albuquerque, New Mexico; Charleston, South Carolina; and Seattle, Washington.

Excessive per-line taxes impose a disproportionate burden on low-income individuals and families in particular. Most wireless providers have structured multi-line or “family share” plans that charge as little as $5 or $10 for additional lines added to the primary consumer’s account. In Chicago and Baltimore, for example, the tax on the additional line could be nearly as expensive as the line itself.

Table 6 illustrates the impact of taxes and fees on consumers in selected large cities around the country. Wireless service is increasingly becoming the sole means of communication and connectivity for many Americans, particularly those struggling to overcome poverty. At the end of 2016, over 66 percent of all poor adults had only wireless service, and 51 percent of all adults were wireless only.[7] Excessive taxes and fees, especially the regressive per-line taxes like those imposed in Chicago and Baltimore, impose a disproportionate burden on low-income consumers.

| *Chicago — 911 increased to $5.00 per line on 1/1/2018 | ||

| City | Tax on 4-line voice plan @$100 per month |

Effective Tax Rate |

|---|---|---|

| Chicago, IL (1/1/2018)* | $40.34 | 40.34% |

| Chicago, IL (7/1/2017) | $35.94 | 35.94% |

| Baltimore, MD | $29.54 | 29.54% |

| New York, NY | $26.81 | 26.81% |

| Seattle, WA | $26.24 | 26.24% |

| Philadelphia, PA | $25.94 | 25.94% |

| Omaha, NE | $25.84 | 25.84% |

| Providence, RI | $23.38 | 23.38% |

| Tallahassee, FL | $22.28 | 22.28% |

| Kansas City, MO | $21.19 | 21.19% |

| Los Angeles, CA | $20.16 | 20.16% |

The Impact of Excessive Wireless Taxes

The popularity of wireless service, and the explosive growth in the number of wireless subscribers, has led some to question whether high wireless taxes matter to wireless consumers and the wireless industry. However, there are two compelling reasons why policymakers should be cautious about expanding wireless taxes, fees, and surcharges. First, wireless taxes and fees are regressive and have a disproportionate impact on poorer citizens. Excessive taxes and fees may reduce low-income consumer access to wireless service at a time when such access is critical to economic success. Second, discriminatory taxes may slow investment in wireless infrastructure. Ample evidence exists that investments in wireless networks provide economic benefits to the broader economy because so many sectors – transportation, health care, energy, education, even government– use wireless networks to boost productivity and efficiency.

Wireless infrastructure investment can enable an entire entrepreneurial culture to focus on creating applications and devices to make businesses more productive and to improve the lives of consumers. These tools in turn make businesses more productive and profitable so that they can create new jobs that generate economic activity and tax revenues for governments. While most infrastructure investments create these types of multiplier effects, the multiplier effects for telecommunications infrastructure are higher than other industries because communications and information technology are so deeply embedded in business processes. These infrastructure investments also benefit the government and nonprofit sectors in ways that do not necessarily show up directly in economic statistics but nonetheless make these sectors more efficient and enable them to lower the cost of providing government services.

As noted in a report by the International Chamber of Commerce[8], “Remedying the discriminatory tax treatment of telecom goods and services may reduce tax receipts in the short-term,but the longer-term increase in the use of advanced capability devices, service demand, and network deployment resulting from these tax reductions is likely to counteract this loss of revenue over time.”[9] Policymakers need to weigh the trade-offs between the short-term revenue benefits of excessive wireless taxes versus the long-term economic impact on the state from reduced infrastructure investment.

Conclusion

Wireless consumers continue to be burdened with excessive taxes, fees, and surcharges in many states and localities across the United States. With state and local governments continuing to face revenue challenges, the wireless industry and its customers continue to be an attractive target for raising new revenues. Excessive taxes on wireless consumers disproportionately impacts low income families and may have ramifications for long-term state economic development and growth. Higher taxes on wireless service, coupled with increased taxes on wireless investments, may lead to slower deployment of wireless network infrastructure, including fourth and fifth generation (“4G” and “5G”) wireless broadband technologies – a key element to the future success of smart cities.

States should study their existing communications tax structure and consider policies that transition their tax systems away from narrowly-based wireless taxes and toward broad-based tax sources that do not distort consumer purchasing decisions and do not slow investment in critical infrastructure like wireless broadband. Florida took a step in the right direction by reducing the Communications Services Tax in 2015, but wireless tax rates there are still well above the sales tax. Reform of communications taxes in states with excessive tax rates would position those states to attract additional wireless infrastructure investments that generate economic growth through the new jobs and revenue growth they produce while helping provide relief to low-income wireless users.

Appendix A: Methodology

The methodology used in this report to calculate wireless taxes compares the applicable federal, state, and local tax rates on wireless voice service in the capital city and the most populous city in each state. This methodology was first developed by the Committee on State Taxation (COST) in its landmark “50-State Study and Report on Telecommunications Taxation,”first published in 2000.

The use of a consistent methodology allows for accurate time-series comparisons across states and over time.However, changes in consumer demand for wireless services pose challenges when measuring the impact of wireless taxes on consumer bills. In particular, two trends in the industry are significantly impacting the amount of taxes that wireless consumers pay on their monthly bills.

First, a growing share of wireless consumer purchases is for internet access. Recent data from U.S. Census Bureau surveys suggest that over 31 percent of the typical wireless consumer’s bill is internet access. Under federal law, all but a handful of states are currently precluded from imposing taxes on internet access and all states will be prohibited from taxing internet access after 2019. This suggests that of the “typical” consumer’s monthly expenditure of $41.50 per month, approximately $13 is for nontaxable internet access and $28.50 is for taxable wireless service. A consumer applying the effective tax rates in this report to their total bill will find that the effective tax rate overstates their actual tax paid.

Second, the report’s methodology understates the tax rate impact of flat rate taxes and fees – those that are imposed a set dollar amount per line. Under the report’s methodology, a $1 per month per line tax is converted to a percentage amount by dividing $1 by the $41.50 average monthly bill, resulting in a tax rate of 2.4 percent in this example. However,these flat rate taxes and fees are only permitted to be imposed on the portion of the wireless bill that is not internet access. In this same example, if the $1 per month were divided by the taxable portion of the bill ($28.50), the tax rate would be 3.5 percent.

Notwithstanding these methodological challenges, the authors have determined that the benefits of retaining the current methodology – consistent measurement of trends in tax rates over time – outweigh the benefits of changing the methodology to adjust to recent trends. This is particularly true since the Census Bureau has only been tracking the percentage of wireless expenditures on internet access since 2012, so it would not be possible to go back and retroactively adjust data prior to then.

Appendix B: What is The Federal Universal Service Fund?

The Federal USF is administered by the Federal Communications Commission (FCC) under open-ended authority from Congress.The program subsidizes telecommunications services for schools, libraries, hospitals, low-income people, and rural telephone companies operating in high-cost areas. The FCC has authority to set spending for these programs outside of the normal congressional appropriations process. After deciding what to spend on the various programs, the FCC sets the quarterly “contribution factor” or surcharge rate that telecommunications providers must remit to the USF to generate sufficient revenues to fund the expenditure commitments. Providers are permitted to surcharge these “contributions” on the phone bills.

FUSF surcharges apply only to interstate telecommunications services. They currently do not apply to internet access service, information services, and intrastate telecommunications services.

Wireless carriers generally sell plans that include either unlimited voice minutes or a fixed number of voice minutes fora set amount. Since these plans include both interstate calls (subject to the FUSF) and intrastate calls (not subject to FUSF), the FCC allows providers to allocate the fixed monthly plans to interstate and intrastate calls by one of two methods.Carriers may use traffic studies to show the actual split between interstate and interstate calls for all its subscribers and apply the FUSF to the aggregated interstate portion of subscriber calls.

Alternatively, carriers may use a single uniform national “safe harbor” percentage to its fixed monthly plans. The FCC currently sets this safe harbor at 37.1 percent of the fixed monthly charge. For example, when determining the FUSF, a customer with a $50 monthly plan is deemed to include $18.55 in interstate calls and $31.45 in intrastate calls. If a carrier elects to use the safe harbor, the FUSF rate would be applied to $18.55 of the bill each month.

The FUSF rate (euphemistically called the “contribution factor”) is set by the FCC each quarter. For the period beginning July 1, 2017, the contribution factor is 17.1 percent. Thus, the FUSF rate is 6.34 percent (17.1 percent times 37.1 percent).[10] The figure below highlights the significant growth in the FCC contribution rate since 2003.

Despite the growing burden on wireless consumers, Congress has shown little interest in restricting or otherwise limiting the growth of the programs funded through the FSUF.

States also have the authority to supplement the programs funded through the FUSF with their own programs funded through state universal services funds. The state programs are funded to surcharges applied to the intrastate portion of telephone charges. Like the FUSF, state universal service fund charges do not apply to internet access. State USF charges are a key factor in the high wireless tax burden in states like California, Kansas, and Nebraska. As shown in Appendix C, 20 states impose their own USF charges.

Appendix C

| State | Type of Tax | Rate | Comments |

|---|---|---|---|

| Sources: Methodology: Committee on State Taxation, 50-State Study and Report on Telecommunications Taxation, May 2005. Updated July 2017 by Scott Mackey, Leonine Public Affairs LLP, using state statutes and regulations. Average Revenue Per Unit (ARPU): $41.50 per Cellular Telephone and Internet Association, July 2017. | |||

| Alabama | |||

| AL Cell Service Tax | 6.00% | Access, interstate and intrastate | |

| E911 | 4.22% | $1.75 per month | |

| TOTAL TRANSACTION TAX | 10.22% | ||

| Alaska | |||

| Local Sales Tax | 2.50% | Avg. of Juneau (5%) & Anchorage (0%) | |

| Local E911 | 4.10% | Anchorage – $1.50; Juneau – $1.90 | |

| State USF | 8.93% | 14.2% times FCC safe harbor | |

| TOTAL TRANSACTION TAX | 15.53% | ||

| Arizona | |||

| State sales (transaction priv.) | 5.60% | intrastate telecommunications service | |

| County sales (transaction priv.) | 0.60% | Phoenix (Maricopa) = 0.7%; Tucson (Pima) = 0.5% | |

| City telecommunications | 5.85% | Avg. Phoenix (4.7%) & Tucson (7.0%) | |

| 911 | 0.48% | $.20 per month | |

| TOTAL TRANSACTION TAX | 12.53% | ||

| Arkansas | |||

| State sales tax | 6.50% | ||

| Local sales taxes | 2.88% | Avg. Little Rock (2.5%) & Fayetteville (3.25%) | |

| State High Cost Fund | 3.77% | 6.0% times FCC safe harbor | |

| Wireless 911 | 1.57% | $.65 / month statewide. | |

| TRS service & TRS equipment | 0.10% | $.04 per line per month | |

| TOTAL TRANSACTION TAX | 14.81% | ||

| California | |||

| Local Utility User Tax | 8.00% | Avg. of LA (9%) and Sacramento (7%) | |

| State 911 | 0.47% | 0.75% times FCC safe harbor | |

| PUC fee | 0.14% | 0.23% times FCC safe harbor | |

| ULTS (lifeline) | 2.99% | 4.75% times FCC safe harbor | |

| Deaf/CRS | 0.31% | 0.5% times FCC safe harbor | |

| High Cost Funds A & B | 0.22% | 0.35% times FCC safe harbor | |

| Teleconnect Fund | 0.68% | 1.08% times FCC safe harbor | |

| CASF – advanced services fund | 0.00% | ||

| TOTAL TRANSACTION TAX | 12.82% | ||

| Colorado | |||

| State Sales Tax | 2.90% | access and intrastate | |

| Local Sales Tax — City/County | 5.05% | Avg. of Denver (4.75%) & Colorado Springs (5.35%) | |

| 911 | 2.47% | Denver ($.70) / Colorado Springs ($1.35) | |

| USF | 1.64% | 2.6% times FCC safe harbor | |

| TOTAL TRANSACTION TAX | 12.06% | ||

| Connecticut | |||

| State sales tax | 6.35% | Access, interstate and intrastate | |

| 911 | 1.40% | $.58 per line | |

| TOTAL TRANSACTION TAX | 7.75% | ||

| Delaware | |||

| Public Utility Gross Receipts Tax | 5.00% | Access and intrastate | |

| Local 911 tax | 1.45% | $.60 / month | |

| TOTAL TRANSACTION TAX | 6.45% | ||

| District of Columbia | |||

| Telecommunication Privilege Tax | 10.00% | Monthly gross charge; | |

| 911 | 1.83% | $0.76 per month | |

| TOTAL TRANSACTION TAX | 11.83% | ||

| Florida | |||

| State Communications services | 7.44% | Access, interstate and intrastate | |

| Local Communications services | 6.36% | Jacksonville 5.82%; Tallahassee 6.9% | |

| 911 | 0.96% | $.40/month statewide | |

| TOTAL TRANSACTION TAX | 14.76% | ||

| Georgia | |||

| State sales tax | 3.37% | 4% of “access charge” — assume $35 | |

| Local sales tax | 3.75% | Avg. rate Atlanta (4.9%) & Augusta (4%) | |

| Local 911 | 3.61% | Altanta — $1.50/line; Augusta — $1.50/line | |

| TOTAL TRANSACTION TAX | 10.74% | ||

| Hawaii | |||

| Public service company tax | 4.00% | ||

| Additional county tax | 1.89% | ||

| PUC Fee | 0.16% | 0.25% of intrastate charges | |

| Wireless 911 fee | 1.59% | $.66 per month | |

| TOTAL TRANSACTION TAX | 7.63% | ||

| Idaho | |||

| Telephone service assistance program | 0.00% | Set annually by PUC — currently zero | |

| Statewide wireless 911 | 2.41% | Boise = $1.00 per month | |

| TOTAL TRANSACTION TAX | 2.41% | ||

| Illinois | |||

| State telecom excise tax | 7.00% | Access, interstate and intrastate | |

| Simplified municipal tax | 5.50% | Avg. of Chicago (7%) & Springfield (4%) | |

| Wireless 911 | 5.75% | Chicago $3.90/mo.; others $.87/mo ($5.00 Chicago / $1.50 state on 1/1/2018) | |

| TOTAL TRANSACTION TAX | 18.25% | ||

| Indiana | |||

| State sales tax | 7.00% | Access and intrastate | |

| Utility receipts tax | 1.40% | Same base as sales tax | |

| Wireless 911 | 2.41% | $1.00 per month | |

| State USF | 0.52% | .82% x FCC safe harbor | |

| PUC fee | 0.13% | Statutory max 0.15% | |

| TOTAL TRANSACTION TAX | 11.46% | ||

| Iowa | |||

| State sales tax | 6.00% | ||

| Local option sales taxes | 0.50% | Avg. of Cedar Rapids (1%) & Des Moines (0%) | |

| Wireless 911 | 2.41% | $1.00 per month | |

| Dual Party Relay Service fee | 0.07% | $0.03 per month | |

| TOTAL TRANSACTION TAX | 8.98% | ||

| Kansas | |||

| State sales tax | 6.50% | intrastate & interstate | |

| Local option sales taxes | 1.83% | Avg. of Wichita (1.0%) & Topeka (2.65%) | |

| USF | 4.56% | 7.25% x FCC safe harbor | |

| Wireless 911 | 1.45% | $.60 per month per line | |

| TOTAL TRANSACTION TAX | 14.33% | ||

| Kentucky | |||

| State sales tax | 6.00% | Access, interstate and intrastate | |

| School utility gross receipts | 1.50% | Avg Frankfort (3%) and Lousiville (0%) | |

| Kentucky USF | 0.34% | $.14 per month | |

| Kentucky TAP & TRS | 0.10% | $.04 per month | |

| Wireless 911 | 1.69% | $.70 / month | |

| Communications gross receipts tax | 1.30% | Access, interstate and intrastate | |

| TOTAL TRANSACTION TAX | 10.92% | ||

| Louisiana | |||

| State sales tax | 4.00% | Intrastate rate | |

| Wireless 911 | 2.53% | New Orleans $1.25/mo.; Baton Rouge $.85/mo. | |

| State USF | 3.11% | May vary by carrier | |

| TOTAL TRANSACTION TAX | 9.64% | ||

| Maine | |||

| State service provider tax | 6.00% | intrastate | |

| 911 fee | 1.08% | $.45 per month | |

| Maine USF | 1.32% | 2.1% times FCC safe harbor | |

| MTEAF | 0.44% | 0.7% times FCC safe harbor | |

| TOTAL TRANSACTION TAX | 8.85% | ||

| Maryland | |||

| State sales tax | 6.00% | ||

| Local telecom excise | 4.82% | $4.00 per month in Baltimore; no tax in Annapolis | |

| State 911 | 0.60% | $.25 per month | |

| County 911 | 1.81% | $.75 per month in all counties | |

| State USF | 0.12% | $0.05 per month | |

| TOTAL TRANSACTION TAX | 13.35% | ||

| Massachusetts | |||

| State sales tax | 6.25% | interstate and intrastate | |

| Wireless 911 | 2.41% | $1.00 per month | |

| TOTAL TRANSACTION TAX | 8.66% | ||

| Michigan | |||

| State sales tax | 6.00% | interstate and intrastate | |

| State wireless 911 | 0.46% | $.19 per month | |

| County wireless 911 | 1.01% | Detroit $.42; Lansing $.42 | |

| Intrastate toll assessment | 0.62% | .98% of intrastate charges | |

| TOTAL TRANSACTION TAX | 8.09% | ||

| Minnesota | |||

| State sales tax | 6.88% | Interstate and intrastate | |

| Local sales tax | 0.83% | Minneapolis (0.9%) and St. Paul (0.75%) | |

| 911 | 2.29% | $.95 per month | |

| Telecom access MN fund | 0.12% | $0.05 per line per month | |

| TOTAL TRANSACTION TAX | 10.11% | ||

| Mississippi | |||

| State sales tax | 7.00% | Access, interstate and intrastate | |

| Wireless 911 | 2.41% | $1.00 per month per line | |

| TOTAL TRANSACTION TAX | 9.41% | ||

| Missouri | |||

| State sales tax | 4.23% | Access and intrastate | |

| Local sales taxes | 4.06% | Avg. Jefferson City (3.5%) & Kansas City (4.625%) | |

| Local business license tax | 6.50% | Jefferson City (7%); Kansas City (6% residential) | |

| TOTAL TRANSACTION TAX | 14.79% | ||

| Montana | |||

| Telecom excise tax | 3.75% | Access, interstate and intrastate | |

| 911 & E911 tax | 2.41% | $1.00 per number per month | |

| TDD tax | 0.24% | $.10 per number per month | |

| TOTAL TRANSACTION TAX | 6.40% | ||

| Nebraska | |||

| State sales tax | 5.50% | Access & intrastate | |

| Local sales tax | 1.63% | Lincoln (1.75%) and Omaha (1.5%) | |

| City business and occupation tax | 6.13% | Avg. of Omaha (6.25%) & Lincoln (6.0%) | |

| State USF | 4.37% | 6.95% times FCC safe harbor | |

| Wireless 911 | 1.08% | $.45 per month | |

| TRS | 0.05% | $.02 per month | |

| TOTAL TRANSACTION TAX | 18.75% | ||

| Nevada | |||

| Local franchise / gross receipts | 1.81% | 5% of first $15 intrastate revenues | |

| Local 911 tax | 0.30% | Washoe County = $.25 / month; Clark County no tax | |

| State deaf relay charge | 0.17% | $.07 per month | |

| Nevada USF | 0.07% | 0.11% times FCC safe harbor | |

| TOTAL TRANSACTION TAX | 2.35% | ||

| New Hampshire | |||

| Communication services tax | 7.00% | Access, interstate and intrastate | |

| 911 tax | 1.81% | $.75 per month | |

| TOTAL TRANSACTION TAX | 8.81% | ||

| New Jersey | |||

| State sales tax | 6.88% | ||

| Wireless 911 | 2.17% | $.90 per month | |

| TOTAL TRANSACTION TAX | 9.04% | ||

| New Mexico | |||

| State gross receipts (sales) tax | 5.13% | 5.125% intrastate; 4.25% interstate | |

| City and county gross receipts tax | 2.78% | Avg. Santa Fe (3.19%) & Albuquerque (2.38%) | |

| Wireless 911 | 1.23% | $.51 per month | |

| TRS surcharge | 0.21% | 0.33% times FCC safe harbor | |

| State USF | 3.16% | 5.03% times FCC safe harbor | |

| TOTAL TRANSACTION TAX | 12.51% | ||

| New York | |||

| State sales tax | 4.00% | Intrastate and monthly access | |

| Local sales taxes | 4.25% | NYC 4.5%; Albany 4% | |

| MCTD sales tax | 0.19% | NYC 0.375%; Albany 0% | |

| State excise tax (186e) | 2.90% | mobile telecom service — includes interstate | |

| MCTD excise/surcharge (186c) | 0.36% | NYC & surrounding counties – .72%; Albany 0% | |

| Local utility gross receipts tax | 1.49% | NYC — 84% of 2.35%; Albany 1% | |

| State wireless 911 | 2.89% | $1.20 per month | |

| Local wireless 911 | 0.72% | $.30 per month — NYC & most counties | |

| School district utility sales tax | 1.50% | Albany 3%; NYC no tax | |

| TOTAL TRANSACTION TAX | 18.30% | ||

| North Carolina | |||

| State sales tax | 7.00% | Access, interstate and intrastate | |

| Wireless 911 | 1.45% | $.60 per month | |

| TRS Charge | 0.24% | $.10 per month | |

| TOTAL TRANSACTION TAX | 8.69% | ||

| North Dakota | |||

| State sales tax | 5.00% | Access and intrastate | |

| Local sales taxes | 2.00% | Avg Fargo (2.5%) & Bismarck (1.5%) | |

| State gross receipts tax | 2.50% | interstate and intrastate | |

| Local 911 tax | 3.01% | $1.00 Bismarck; $1.50 Fargo | |

| TRS | 0.10% | Up to $.11/mo — currently $.04 | |

| TOTAL TRANSACTION TAX | 12.61% | ||

| Ohio | |||

| State sales tax | 5.75% | Access, interstate and intrastate | |

| Local sales taxes | 2.00% | Columbus (1.75%) and Cleveland (2.25%) | |

| Regulatory fee | 0.13% | Intrastate Gross Revenues | |

| State/local wireless 911 | 0.60% | $.25 per month | |

| TOTAL TRANSACTION TAX | 8.48% | ||

| Oklahoma | |||

| State sales tax | 4.50% | Access, interstate and intrastate | |

| Local sales taxes | 3.95% | Avg. of OK City (3.88%) & Tulsa (4.02%) | |

| Local 911 | 1.81% | $.50 per month in OK City and Tulsa | |

| USF | 1.36% | 2.16% times FCC safe harbor | |

| TOTAL TRANSACTION TAX | 11.61% | ||

| Oregon | |||

| Local utililty tax | 0.00% | No tax on wireless in Portland or Salem | |

| 911 tax | 1.81% | $.75 per month | |

| RSPF Surcharge | 0.17% | $0.07 per month | |

| TOTAL TRANSACTION TAX | 1.98% | ||

| Pennsylvania | |||

| State sales tax | 6.00% | Access, interstate and intrastate | |

| State gross receipts tax | 5.00% | Access, interstate and intrastate | |

| Local sales tax | 1.00% | Philadephia 2%; Harrisburg 0% | |

| Statewide wireless 911 | 3.98% | $1.65 per month | |

| TOTAL TRANSACTION TAX | 15.98% | ||

| Puerto Rico | IVU (Sales Tax) | 11.50% | |

| 911 fee | 1.20% | $.50 per line | |

| USF | 0.87% | 1.39% times FCC safe harbor | |

| TOTAL TRANSACTION TAX | 13.58% | ||

| Rhode Island | |||

| State sales tax | 7.00% | Access, interstate and intrastate | |

| Gross receipts tax | 5.00% | Access, interstate and intrastate | |

| 911 fee | 2.41% | $1.00 per month | |

| Additional wireless 911 fee | 0.63% | $.26 per month | |

| TOTAL TRANSACTION TAX | 15.04% | ||

| South Carolina | |||

| State sales tax | 6.00% | Access, interstate and intrastate | |

| Local sales tax | 2.50% | Avg. of Charleston (3%) and Columbia (2%) | |

| Municipal license tax | 1.00% | Charleston (1.0%) and Columbia (1.0%) | |

| Dual party relay charge | 0.14% | $.06 per line per month | |

| State USF | 1.16% | 1.85% of intrastate charges | |

| 911 tax | 1.49% | $.62 / month | |

| TOTAL TRANSACTION TAX | 12.30% | ||

| South Dakota | |||

| State sales tax | 4.50% | access, interstate and intrastate | |

| State gross receipts tax | 4.00% | ||

| local option sales tax | 2.00% | Avg. of Pierre (2.0%) and Sioux Falls (2.0%) | |

| 911 excise | 3.01% | $1.25 per month | |

| TRS fee | 0.36% | $.15 per month by statute | |

| PUC fee | 0.09% | .15% of intrastate receipts | |

| TOTAL TRANSACTION TAX | 13.97% | ||

| Tennessee | |||

| State sales tax | 7.00% | Access, interstate and intrastate | |

| Local sales tax | 2.50% | Statewide local rate for intrastate | |

| 911 tax | 2.80% | $1.16 per month | |

| TOTAL TRANSACTION TAX | 12.30% | ||

| Texas | |||

| State sales tax | 6.25% | Access, interstate and intrastate | |

| Local sales tax | 2.00% | Austin (2.0%) & Houston (2.0%) | |

| Wireless 911 tax | 1.20% | $.50 per month per line | |

| Texas USF | 2.08% | 3.3% times FCC safe harbor | |

| 911 Equalization surcharge | 0.14% | $.06 per line | |

| TOTAL TRANSACTION TAX | 11.68% | ||

| Utah | |||

| State sales tax | 4.70% | Access and intrastate | |

| Local sales taxes | 2.15% | Avg. of Salt Lake City (2.15%) and Provo (2.15%) | |

| Local utility wireless | 3.50% | Levied at 3.5% max. in SLC and Provo | |

| State 911 service charges | 1.93% | $.80 per month | |

| State Radio Network charge | 0.43% | $.18 per month; increases to $.52 on 1/1/18 | |

| State USF | 1.04% | 1.65% rate times FCC safe harbor | |

| State TRS | 0.00% | Repealed 7/1/2017; was $.02 per line | |

| TOTAL TRANSACTION TAX | 13.75% | ||

| Vermont | |||

| State sales tax | 6.00% | Access, interstate and intrastate | |

| Local sales tax | 0.50% | Avg. of Montpelier (0%) and Burlington (1%) | |

| State USF | 2.00% | funds 911 and other programs | |

| TOTAL TRANSACTION TAX | 8.50% | ||

| Virginia | |||

| State communications sales tax | 5.00% | CST | |

| Wireless 911 | 1.81% | $.75 per month | |

| TOTAL TRANSACTION TAX | 6.81% | ||

| Washington | |||

| State sales tax | 6.50% | Access, interstate and intrastate | |

| Local sales taxes | 2.95% | Olympia (2.3%) & Seattle (3.6%) average | |

| B&O / Utility Franchise — local | 7.50% | Olympia (9%) & Seattle (6%) average | |

| 911 — state | 0.60% | $.25 per month | |

| 911 — local | 1.69% | $.70 per month | |

| TOTAL TRANSACTION TAX | 19.24% | ||

| West Virginia | |||

| State sales tax | 0.00% | No sales tax on wireless | |

| Wireless 911 | 8.05% | $3.34 per month | |

| TOTAL TRANSACTION TAX | 8.05% | ||

| Wisconsin | |||

| State sales tax | 5.00% | Access, intrastate and interstate | |

| Local sales tax | 0.55% | Avg. of Milwaukee (0.6%) & Madison (0.5%) | |

| Police and Fire Protection Fee | 1.81% | $.75 per month | |

| State USF | 1.85% | 2.94% times FCC safe harbor | |

| TOTAL TRANSACTION TAX | 9.21% | ||

| Wyoming | |||

| State sales tax | 4.00% | access and intrastate | |

| Local sales tax | 1.00% | Avg. of Cheyenne (1%) and Casper (1%) | |

| TRS | 0.22% | Up to $.25/month — $.09 currently | |

| USF | 0.88% | 1.4% times FCC safe harbor | |

| 911 tax | 1.81% | $.75 per month in Cheyenne and Casper | |

| TOTAL TRANSACTION TAX | 7.90% | ||

| ARPU= $ 41.50 | |||

| FCC Safe Harbor = 62.9% | |||

[1] Stephen J. Blumberg and Julian V. Luke, “Wireless Substitution: Early Release of Estimates from the National Health Interview Survey, July-December 2016,” National Center for Health Statistics, released May 2017, 1-3. https://www.cdc.gov/nchs/data/nhis/earlyrelease/wireless201705.pdf.

[2] Neil Irwin, “Janet Yellen and the Case of the Missing Inflation,” The New York Times, June 14, 2017. Accessed Aug. 24, 2017, at https://www.nytimes.com/2017/06/14/upshot/janet-yellen-and-the-case-of-the-missing-inflation.html?mcubz=3.

[3] This report uses an average monthly bill of $41.50 to estimate the amount of taxes paid if the average state and local sales tax rate in this report is applied to wireless service across the state. For the FUSF, the calculation uses the FCCinterstate safe harbor percentage (37.1 percent) to determine the intrastate portion of the average monthly bill subjectto the surcharge.

[4] Federal Communications Commission, “Eighth Annual Report to Congress on State Collection and Distribution of 911 Feesand Charges for the Period January 1, 2015 to December 31, 2015,” Federal Communications Commission. https://transition.fcc.gov/pshs/911/Net%20911/Net911_Act_8thReport_to_Congress_123016.pdf.

[5] This increase is not reflected in this report, which measures taxes effective on July 1, 2017.

[6] Bill Ruthhart and Hal Dardick, “Emanuel’s latest possible tax hike: 911 phone fees,” Chicago Tribune, June 1, 2017. http://www.chicagotribune.com/news/local/politics/ct-rahm-emanuel-phone-fee-increase-met-0602-20170601-story.html

[7] Stephen J. Blumberg, Ph.D., and Julian V. Luke, “Wireless Substitution: Early Release of Estimates from the NationalHealth Interview Survey, July-December 2015,” National Center for Health Statistics, released May 2016, 2. http://www.cdc.gov/nchs/data/nhis/earlyrelease/wireless201605.pdf

[8] International Chamber of Commerce, “ICC discussion paper on the adverse effects of discriminatory taxes on telecommunicationsservice,” Oct. 26, 2010. https://cdn.iccwbo.org/content/uploads/sites/3/2010/10/ICC-discussion-paper-on-the-adverse-effects-of-discriminatory-taxes-on-telecommunications-services.pdf.

[9] ICC discussion paper, 2.

[10] For the purposes of this report, the FCC safe harbor percentage is used. This allows for consistent multiyear comparisons of taxes, fees, and surcharges.

Share this article