Pass-through businesses are the dominant business structure in America. Pass throughs file more taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. returns and report more business income than C corporations. Pass-through businesses are not subject to the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , but instead report their income on the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. returns of owners. This blog will address some frequently asked questions about pass-through structure and taxation as part of our series on Business in America.

Question: How are pass-throughs taxed?

Answer: When a pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. earns profits, it does not directly send a portion of the profits to the Internal Revenue Service (IRS). Instead, the profit is “passed through” the business and onto the tax returns of the business owners. The owners are then responsible for paying the tax to the IRS. That means that pass-through businesses pay individual income taxes, not corporate income taxes.

Q: How many times are pass-throughs taxed?

A: In contrast to C corporations, which face two layers of taxes (one at the corporate level and another at the shareholder level), pass-through businesses face only one layer of taxation, paid by the business owner. Thus, pass-through taxation represents the ideal tax treatment of business income.

Q: What other types of taxes do pass-throughs pay?

A: Pass throughs pay income taxes at individual income tax rates on their owners’ tax returns. The top federal income tax rate is 37 percent. Pass-through businesses also pay self-employment taxes and state and local taxes.

Q: Are there different types of pass-throughs?

A: The types of pass-through entities include sole proprietorships, partnerships, such as LLCs, and S Corporations.

| Category | Description |

|---|---|

|

Sole Proprietorship |

An unincorporated business owned by a single individual. Individuals report sole proprietorship income on Schedule C of the 1040 tax form. |

|

Partnership |

An unincorporated business with multiple owners, either individuals or other businesses. |

|

S Corporation |

A domestic corporation that can only be owned by U.S. citizens (not other corporations or partnerships) and can only have up to 100 shareholders. |

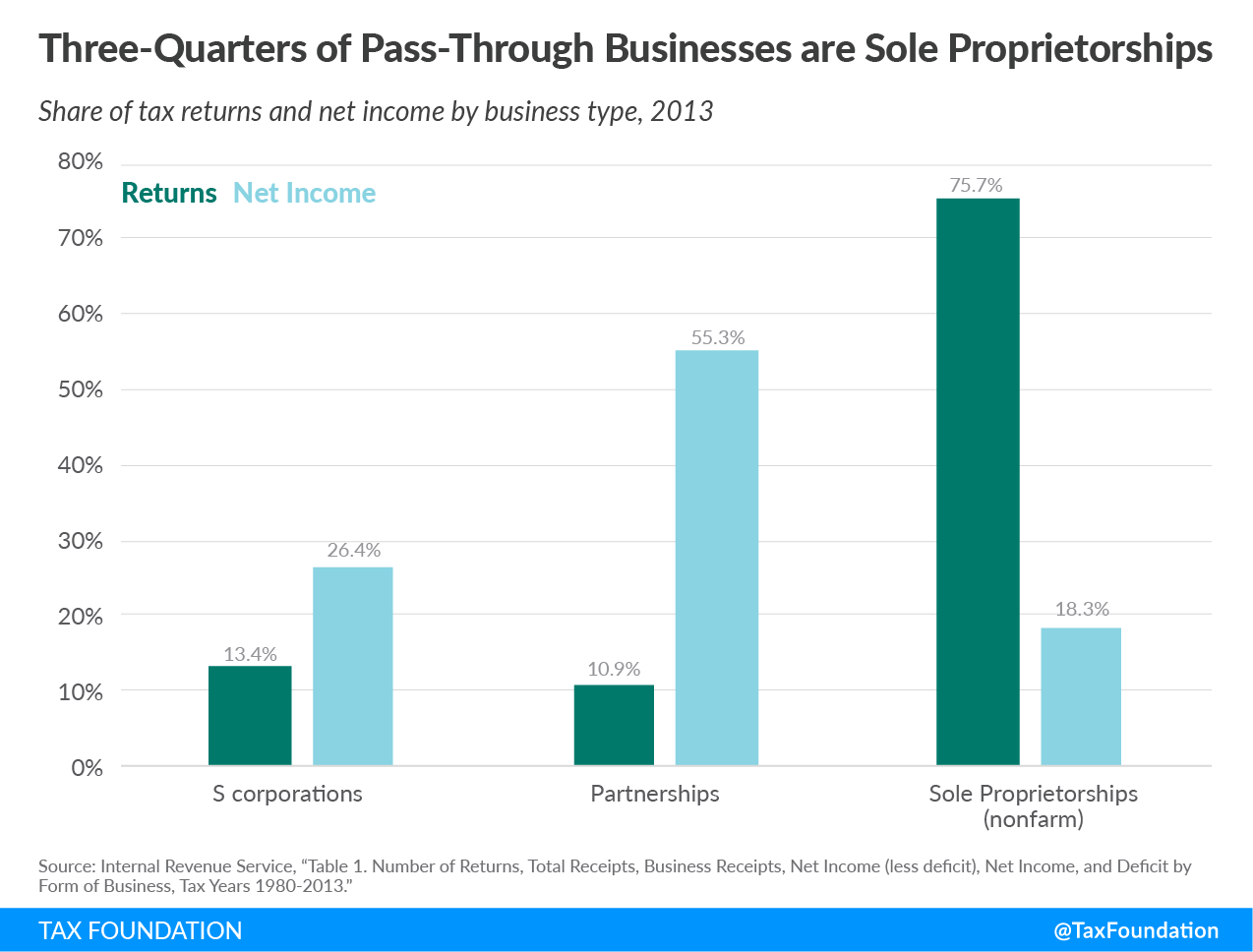

More than three-quarters of all pass-through businesses are sole proprietorships. However, sole proprietorships earned less than one-fifth of pass-through business net income in 2013. Partnerships account for 10.9 percent of pass-through businesses but earned more than half of pass-through business net income in 2013. S corporations comprise the remaining 13 percent of pass-through businesses and account for just over a quarter of net income.

Q: Are pass-throughs and small businesses the same?

A: Many small businesses tend to organize as pass throughs, but not all pass-through businesses are small. In some cases, pass-through businesses are very large, with thousands of employees and billions of dollars in revenue.

Q: Who earns pass-through business income?

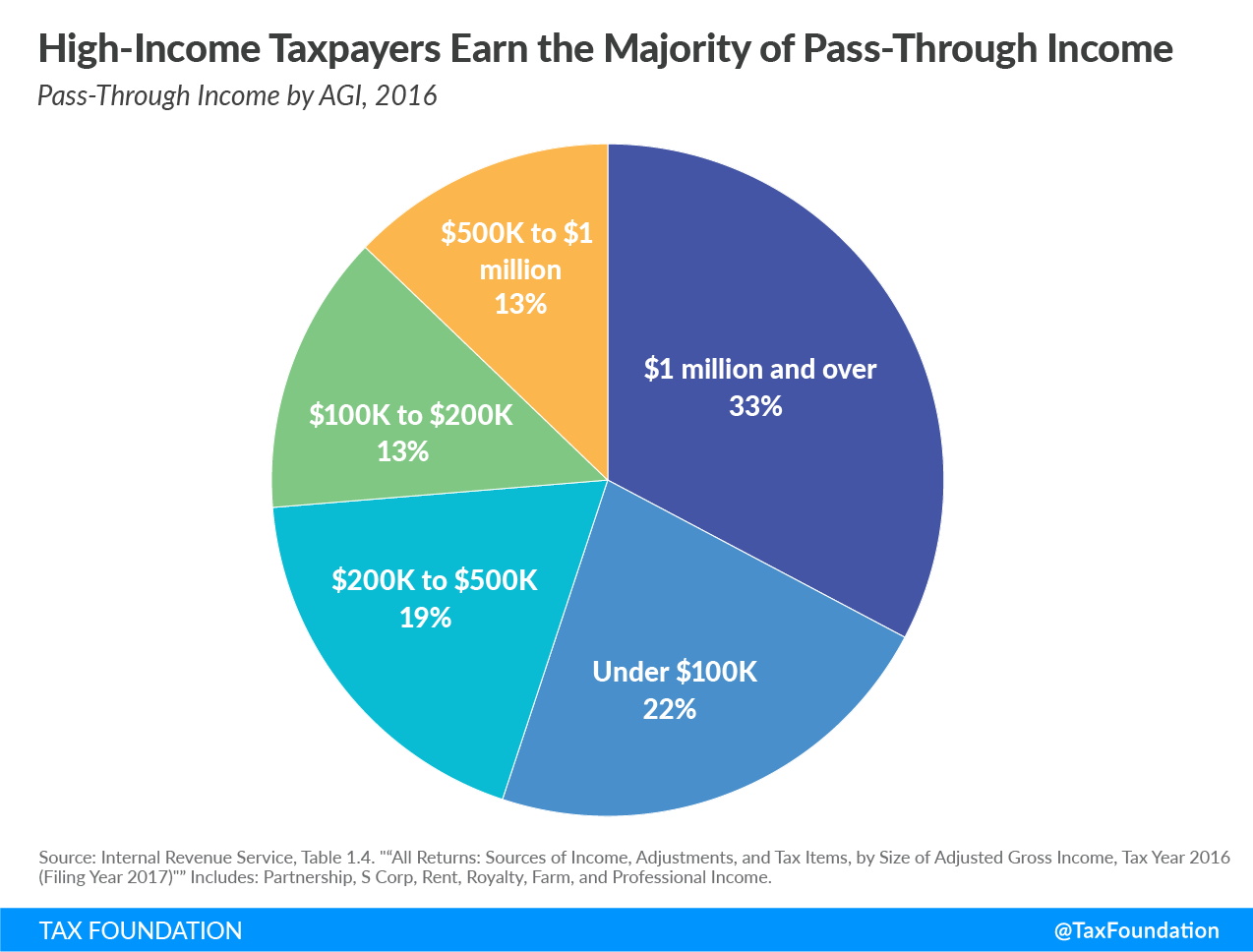

A: Pass-through business income is concentrated among high-income taxpayers. In tax year 2016, more than 45 percent of pass-through income was earned by taxpayers with adjusted gross incomes of more than $500,000. Taxpayers with AGIs of $100,000 or below accounted for 22 percent of pass-through business income in 2016.

Q: What is the pass-through deduction (Section 199A)?

A: The Tax Cuts and Jobs Act of 2017 created a deduction for households with income from pass-through businesses, which allows taxpayers to exclude up to 20 percent of their pass-through business income from federal income tax. The design of the pass-through deduction leaves room for improvement as it is complex, challenging to administer, and favors only certain economic activities, so as not to be as economically efficient.

For more on the characteristics of pass-through businesses, as well as corporations, see our blog series “Business in America.”

Note: This is part of our “Business in America” blog series

- The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

- Corporate and Pass-through Business Income and Returns Since 1980

- Firm Variation by Employment and Taxes

- 2017 GDP and Employment by Industry

- State Corporate Income Taxes Increase Tax Burden on Corporate Profits

- Marginal Tax Rates for Pass-through Businesses Vary by State

- Taxes on Capital Income Are More Than Just the Corporate Income Tax

- Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

- Not All Tax Expenditures Are Equal