Portland Small Business Owners Facing Weirdly High New Taxes—and It Could Get Worse

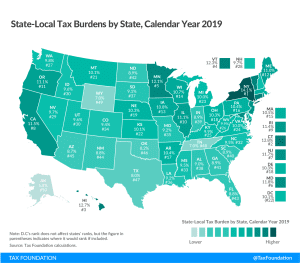

Newly implemented county and regional taxes yield state and local top marginal tax rates in excess of 26 percent for many Portland small businesses, and if all of President Biden’s tax proposals were adopted, those owners could face all-in marginal rates of more than 80 percent, far and away the highest in the country going back decades.

5 min read