Proposed “Junk Fee” Rule Would Create Inadvertent Tax Headaches

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min readJared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read

Virginia Governor Youngkin unveiled the contours of a tax reform plan incorporated into his forthcoming budget, which includes three major structural elements: a reduction in the individual income tax rate, a 0.9 percentage point increase in the sales tax rate, and the broadening of the sales tax base to include some “new economy” digital services.

6 min read

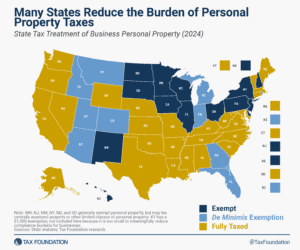

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost.

18 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

Whether tax savings motivated his move or not, the implications for Washington are very real, and serve to illustrate just how dangerous it can be to design tax systems that rely so overwhelmingly on a very small number of taxpayers choosing to stay put.

3 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

Responsible pro-growth reforms to Arkansas’s tax code can help ensure that the Natural State is indeed a Land of Opportunity.

9 min read

Given enough time, everything old is new again—including tax ideas best consigned to history. But worldwide combined reporting, which a few states flirted with in the 1980s, is rearing its head again.

6 min read

It’s the 5th anniversary of the groundbreaking Wayfair Supreme Court decision–a ruling that marked a new era of sales tax collection and changed how we think about taxation in the digital age.

As Minnesota lawmakers consider making theirs the first state to mandate worldwide combined reporting, they are relying on a revenue estimate that is—this may not be the technical term—completely bogus.

7 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

The Washington Supreme Court not only gave its blessing to a capital gains tax that runs afoul of the state constitution, but it also set out a welcome mat for legislators eager to implement a broader income tax.

7 min read

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

A growing number of cities, in red states like Arkansas and Texas, blue states like California and New Jersey, and purple states like Georgia and Nevada, have pursued streaming taxes in recent years.

7 min read

Most states avoid municipal income taxes for good reason. These taxes are more volatile and less economically competitive than other forms of taxation available to local governments, and add substantial complexity for governments and taxpayers alike.

23 min read

Despite robust revenues, some state lawmakers are champing at the bit to raise taxes on higher-income households, sometimes to extraordinary levels.

7 min read

If your state issued tax rebates last year, you might have to pay federal income tax on the rebate you received. Maybe. Who knows? Unfortunately, not the IRS—at least not yet.

5 min read