West Virginia Lawmakers Reach Deal on Tax Relief

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min readJared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

A growing number of cities, in red states like Arkansas and Texas, blue states like California and New Jersey, and purple states like Georgia and Nevada, have pursued streaming taxes in recent years.

7 min read

Most states avoid municipal income taxes for good reason. These taxes are more volatile and less economically competitive than other forms of taxation available to local governments, and add substantial complexity for governments and taxpayers alike.

23 min read

Despite robust revenues, some state lawmakers are champing at the bit to raise taxes on higher-income households, sometimes to extraordinary levels.

7 min read

If your state issued tax rebates last year, you might have to pay federal income tax on the rebate you received. Maybe. Who knows? Unfortunately, not the IRS—at least not yet.

5 min read

Forty-three states adopted tax relief in 2021 or 2022—often in both years—and of those, 21 cut state income tax rates. It’s been a remarkable trend, driven by robust state revenues and an increasingly competitive tax environment.

4 min read

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read

West Virginia is one of only seven states that hasn’t offered any significant tax relief since 2021—and five of the other six forgo an individual income tax.

6 min read

On the heels of adopting one of the most comprehensive state tax reform packages in years, Iowa lawmakers are back in Des Moines with property tax relief in their sights. But while the issue is worthy of their attention, House File 1 (HF 1) as currently drafted misses the mark.

4 min read

In a coordinated effort, lawmakers in seven states that collectively house about 60 percent of the nation’s wealth—California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington—are introducing wealth tax legislation on Thursday.

7 min read

The logic that has prevailed for local sales taxes should apply equally to other taxes that localities impose on multijurisdictional businesses, including local tourism taxes. The evidence is clear that central administration of local taxes reduces compliance costs without sacrificing local revenue.

15 min read

In times of high inflation, states should consider adopting permanent full expensing because it boosts long-run productivity, economic output, and wages.

7 min read

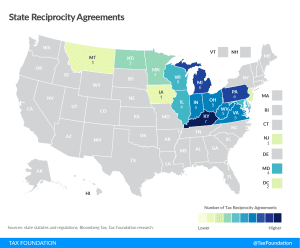

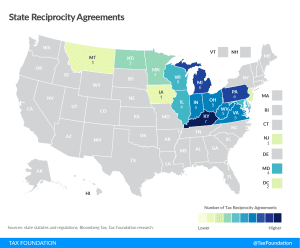

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live.

15 min read

The first-in-the-nation digital advertising tax was recently struck down by a Maryland circuit court on three separate grounds. Other states might want to avoid getting themselves into this situation in the first place.

5 min read

While there are many ways to show how much is collected in taxes by state governments, our Index is designed to show how well states structure their tax systems by focusing on the how more than the how much in recognition of the fact that there are better and worse ways to raise revenue.

129 min read

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

1 min read

California is no stranger to high taxes, and the state has enough going for it that its economy can withstand higher tax burdens than would be viable in other parts of the country. But there’s always a tipping point.

5 min read

West Virginia Amendment 2 would not directly reduce tangible personal property taxes—on cars, inventory, or machinery and equipment. It would, however, empower the legislature to consider such reforms.

4 min read

When NFL star wide receiver Tyreek Hill weighed offers from the New York Jets and the Miami Dolphins, no doubt there was a lot on his mind. But one consideration towered over the rest, at least according to Hill himself: signing with the Jets “was very close to happening,” but “those state taxes man. I had to make a grown-up decision.”

7 min read

Alaska policymakers are understandably concerned about the long-term viability of the state’s overwhelming reliance on the oil and gas industry for revenue, but the state’s unique economy and geography, and low population density make some of the “traditional” taxes less efficient than they might be elsewhere.

55 min read