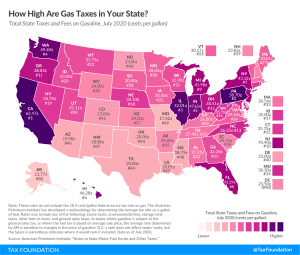

Gas Tax Rates by State, 2020

California pumps out the highest tax rate of 62.47 cents per gallon, followed by Pennsylvania (58.7 cpg), Illinois (52.01 cpg), and Washington (49.4 cpg).

2 min read

Janelle Fritts was a Policy Analyst with the Tax Foundation’s Center for State Tax Policy. She is the lead researcher on the annual State Business Tax Climate Index and was one of the lead authors of Pro-Growth Tax Reform for Oklahoma. Her work has been cited in The New York Times, the Associated Press, Bloomberg, and numerous state media outlets across the country.

Before joining the Tax Foundation team, Janelle interned at the Mackinac Center for Public Policy, the Reason Foundation, and the Illinois Policy Institute. She graduated from Dordt College (Sioux Center, Iowa) with a bachelor’s degree in English with a writing emphasis and a minor in Chemistry.

Janelle was born and raised in Midland, Michigan, which is near Lake Huron and about halfway up the “mitten.” In her free time, she enjoys rock climbing, hiking, swing dancing, and singing. You’ll also find her rocking out to metal in Roxanne, her bright yellow Celica.

California pumps out the highest tax rate of 62.47 cents per gallon, followed by Pennsylvania (58.7 cpg), Illinois (52.01 cpg), and Washington (49.4 cpg).

2 min read

Seeking new sources of funding, New York and New Jersey—two states at the heart of global financial markets—are considering financial transaction taxes.

5 min read

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read

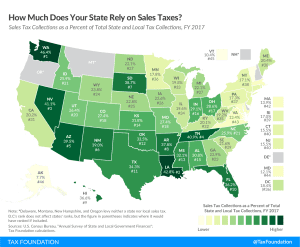

Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

12 min read

As New Jersey lawmakers grapple with reduced revenues due to the coronavirus pandemic, they have turned to an unusual solution: the issuance of bonds that would be repaid, if necessary, through temporarily higher sales and property taxes.

2 min read

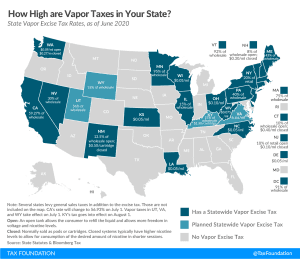

Many states may be looking toward vapor and other excise taxes to fill budget holes caused by the coronavirus crisis. While those areas may represent untapped revenue sources for many states, taxing those activities is unlikely to raise much revenue in the short term.

3 min read

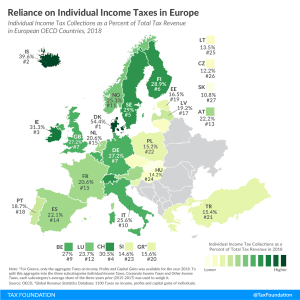

Consumption taxes, like sales taxes, are more economically neutral than taxes on capital and income because they target only current consumption.

3 min read

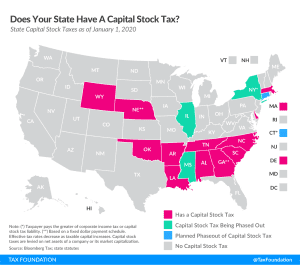

State recovery plans should lessen the burden on businesses by shifting from capital stock taxes and other taxes that are charged regardless of profitability. Louisiana does well to target its Corporation Franchise Tax, a burdensome tax that would target businesses that may already be struggling.

2 min read

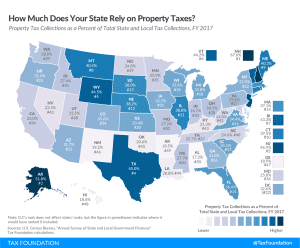

While the current crisis has caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn and income taxes tend to be more harmful to economic growth than consumption taxes and property taxes.

3 min read

Alabama and Missouri are considering excluding the CARES Act Economic Impact Payments from being taxed and exclude them from state income tax calculations.

2 min read

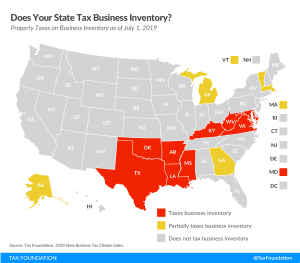

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat.

2 min read

As many businesses may need time to return to profitability after this crisis, states should prioritize reducing reliance on capital stock taxes, and shift toward more neutral forms of business taxation.

4 min read

As states look for a path out of these fiscally troubling times, Louisiana has several options for aspects of its tax code to promote economic recovery and growth. The Pelican State’s federal deductibility, Corporation Franchise Tax, and sales tax structure present opportunities for beneficial tax reform in the wake of the coronavirus crisis.

3 min read

While it’s unclear how soon state economies may be able to fully open again, it’s not too early for states to consider how they can remove barriers to businesses & consumers resuming activity.

3 min read

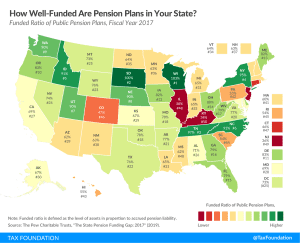

The current crisis highlights the cost of underfunding pensions in years of economic growth. Twenty states have pension plans that were less than two-thirds funded, and five states had pension plans that were less than 50 percent funded.

3 min read