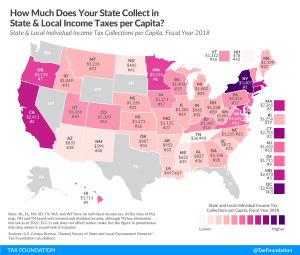

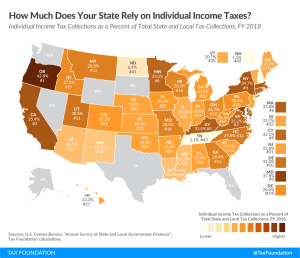

State and Local Individual Income Tax Collections Per Capita

The individual income tax is one of the most significant sources of revenue for state and local governments, generating approximately 24 percent of state and local tax collections in FY 2018.

2 min read