Janelle Fritts

Janelle Fritts was a Policy Analyst with the Tax Foundation’s Center for State Tax Policy. She is the lead researcher on the annual State Business Tax Climate Index and was one of the lead authors of Pro-Growth Tax Reform for Oklahoma. Her work has been cited in The New York Times, the Associated Press, Bloomberg, and numerous state media outlets across the country.

Before joining the Tax Foundation team, Janelle interned at the Mackinac Center for Public Policy, the Reason Foundation, and the Illinois Policy Institute. She graduated from Dordt College (Sioux Center, Iowa) with a bachelor’s degree in English with a writing emphasis and a minor in Chemistry.

Janelle was born and raised in Midland, Michigan, which is near Lake Huron and about halfway up the “mitten.” In her free time, she enjoys rock climbing, hiking, swing dancing, and singing. You’ll also find her rocking out to metal in Roxanne, her bright yellow Celica.

Latest Work

Vaping Taxes by State, 2019

3 min read

Distilled Spirits Taxes by State, 2019

3 min read

How High Are Wine Taxes in Your State?

2 min read

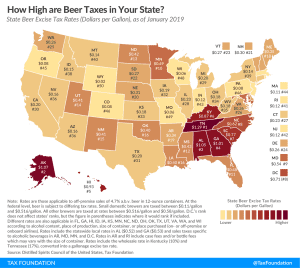

Beer Taxes by State, 2019

4 min read

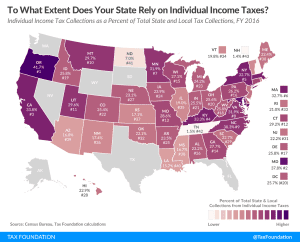

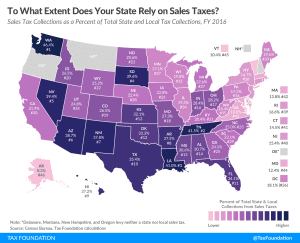

To What Extent Does Your State Rely on Sales Taxes?

Many states are seeing a significant narrowing of their bases as lawmakers continue to carve out exemptions, and as consumption patterns shift ever more towards relatively-untaxed services.

4 min read

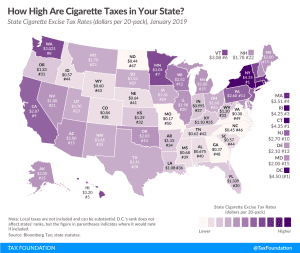

How High Are Cigarette Taxes in Your State?

Cigarette taxes around the country are levied on top of the federal rate of $1.0066 per 20-pack of cigarettes. As of 2016, taxes accounted for almost half of the retail cost of a pack of cigarettes.

2 min read

Facts and Figures 2019: How Does Your State Compare?

Our updated 2019 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read