Two Important Issues that Must Be Resolved in “Global Tax Reform”

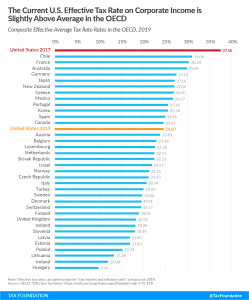

If the U.S. is suggesting a 15 percent effective rate as the minimum acceptable rate for a global agreement, then the tax bases of the various minimum taxes adopted as part of the agreement should be aligned to minimize complexities and unintended consequences.

5 min read