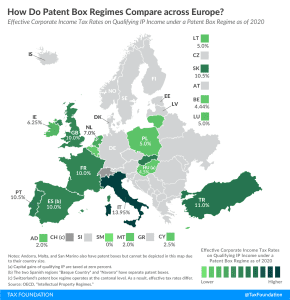

Patent Box Regimes in Europe, 2020

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min readDaniel Bunn is President and CEO of the Tax Foundation. Daniel has been with the organization since 2018 and, prior to becoming President, successfully built its Center for Global Tax Policy, expanding the Tax Foundation’s reach and impact around the world.

Prior to joining the Tax Foundation, Daniel worked in the United States Senate at the Joint Economic Committee as part of Senator Mike Lee’s (R-UT) Social Capital Project and on the policy staff for both Senator Lee and Senator Tim Scott (R-SC). In his time in the Senate, Daniel developed legislative initiatives on tax, trade, regulatory, and budget policy.

He has a master’s degree in Economic Policy from Central European University in Budapest, Hungary, and a bachelor’s degree in Business Administration from North Greenville University in South Carolina.

Daniel lives in Halethorpe, Maryland, with his wife and their three children.

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min read

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

The UN tax committee will be considering a change to the UN’s model tax treaty that, if adopted and implemented, could result in digital companies paying more taxes in countries where their customers are located even if those companies do not have physical locations there.

5 min read

The difference that the OECD presents between the potential impact in the context of agreement compared to a harmful tax and trade war should show policymakers the value of continuing multilateral discussions.

6 min read

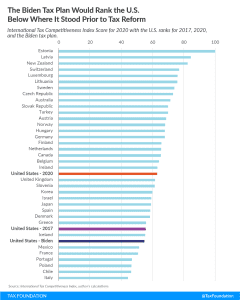

While the Biden campaign is certainly focused on increasing taxes on U.S. businesses and high-income earners, it is important that policymakers also understand what that reversal might do to U.S. competitiveness, and the competitive global environment in which U.S. companies and U.S. workers operate.

3 min read

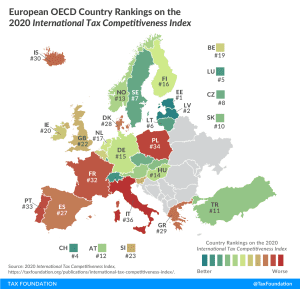

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

The OECD released blueprints for proposals on changing international tax rules alongside an impact assessment based on the overall design of the proposals. While the blueprints cover proposals both for changing where large multinationals owe corporate tax and designing a global minimum tax, there are still many unanswered questions. In the meantime, other digital tax proposals are moving forward and have the potential to result in a harmful tax and trade war.

4 min read

The design and implementation of a global minimum tax is not simple and straightforward. There are dozens of challenging issues that policymakers will need to consider. So, when it comes to the way the minimum tax treats new investment, it seems clear that incorporating full expensing into the design would have significant benefits.

6 min read

Even during a crisis when budgets are squeezed, policymakers should put their efforts into serious reforms of existing income and consumption taxes rather than leaving good tax policy behind for an excise state of mind.

6 min read

If the goal of the Biden campaign is to bring new investment and jobs to the U.S., it is doubtful that these new tax rules will contribute to that goal.

4 min read

The fiscal response to the COVID-19 pandemic will require policymakers to consider what revenue resources should be used to fill budget gaps. Tax policy experts have proposed wealth taxes, (global) corporate minimum taxes, excess profits taxes, and digital taxes as opportunities for governments to raise new revenues.

20 min read

When developing tax policy, lawmakers often ignore the incidence of a tax, or who actually pays the tax. Many times, this is different from who is legally required to pay the tax. Just because a 2 percent revenue tax applies to large digital companies does not mean that the companies will bear the entire cost of the tax.

1 min read

The European Council recently agreed on a new multiannual budget and a recovery program, which sets EU budget levels for 2021-2027 totals €1 trillion (US $1.2 trillion). The lack of details on the various tax proposals and the eventual need for revenue sources to finance new EU debt mean there is a lot of work left for policymakers in Brussels to do.

4 min read

The USTR announced new tariffs in response to the French digital services tax of 25% on $1.3 billion worth of goods. The tariffs would apply to several make-up products, handbags, and assorted soaps.

1 min read

Corporate taxation has evolved significantly, with rates coming down significantly over the last several decades. Countries have redesigned their tax bases by changing the treatment of losses, interest, and capital costs. A recent OECD report highlights the general stabilization of corporate tax revenues and statutory rates alongside major changes to address profit-shifting opportunities.

4 min read

While much of Germany’s EU presidency agenda is focused on policies to ensure economic stability and recovery from the COVID-19 pandemic, there’s a pair of tax proposals that the country is planning to develop and move forward at the EU level: a financial transaction tax and a minimum effective tax.

5 min read

We recently hosted an exclusive webinar discussion to get up to speed on recent digital tax developments and gain insight from leading international tax experts on the OECD’s BEPS project.

9 min read

The U.S. has called for a pause in global digital tax negotiations, dealing a blow to Pillar 1 of the OECD’s international tax project. What happens next could be very harmful for the global economy.

3 min read

Transfer pricing rules are under stress given the current economic crisis. The OECD should provide transfer pricing guidance during the coronavirus crisis.

13 min read