Last month, the Wisconsin Department of Revenue released data showing the state’s general fund taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections for fiscal year (FY) 2019 were up nearly $1.2 billion, or 7.4 percent, from FY 2018, and nearly $703 million higher than anticipated when the state’s FY 2018-19 budget was adopted.

As noted in a memo from Wisconsin Revenue Secretary Peter Barca, much of this collections influx is attributable to a one-time phenomenon in which many businesses, where feasible, postponed earnings from 2017 until 2018 to take advantage of the new, lower federal corporate tax rate under the Tax Cuts and Jobs Act (TCJA). This contributed to a drop in state corporate tax collections in FY 2018 and an influx in collections in FY 2019, not just in Wisconsin, but across much of the country.

Some Revenue has already been dedicated to the Budget Stabilization Fund and Individual Income Tax Cuts

In any fiscal year in which actual tax collections exceed estimates, current Wisconsin law requires half the excess be deposited into the state’s budget stabilization fund to provide an important cushion for future recessions or other unanticipated revenue shortfalls. Notably, legislation enacted in 2017 excludes from this calculation excess sales and use tax revenue attributable to the influx in online sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. collections following the U.S. Supreme Court’s 2018 South Dakota v. Wayfair decision. That recurring revenue has since been dedicated to corresponding reductions to the state’s two lowest statutory marginal individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates.

As a result, an estimated $321.7 million will be sent to the budget stabilization fund for FY 2019, which will nearly double the fund’s current balance of $327.4 million. An additional $59.2 million in FY 2019 Wayfair revenue will be dedicated to downward adjustments to the two lowest marginal individual income tax rates for tax year 2019, as prescribed by 2019 Wisconsin Act 10.

Wisconsin Should Consider Dedicating Remaining Revenue to Expensing Reform

After these allocations to the budget stabilization fund and individual income tax rate reductions are made, the general fund is expected to have a balance of $74.05 million in undedicated funds. In the past, surplus revenues have sometimes been used to offer one-time tax cuts to Wisconsinites. With Wisconsin having the 15th highest state tax collections per capita, it is understandable that policymakers would seek to return surplus revenue to taxpayers. It’s important to keep in mind, however, that strategic, permanent structural reforms–not temporary tax cuts–are the types of changes that foster long-term economic growth.

Our recent guide to tax reform in Wisconsin outlines four approximately revenue-neutral options for comprehensive tax reform that rely on sales tax base broadening to bring down overall rates and significantly improve the state’s economic competitiveness. Short of comprehensive reform, however, there are still plenty of ways the state can make incremental improvements to its tax structure to increase the state’s attractiveness as a destination for investment in the Midwest region and in the nation at large.

One especially pro-growth reform would be to conform to Internal Revenue Code (IRC) Section 168(k), which allows investments in short-lived assets (machinery and equipment) to be fully claimed as an expense in the first year, rather than incrementally over the depreciable life of the asset. By removing a barrier that currently hinders investment, a full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. provision would make it easier for businesses to purchase new machinery and equipment in the short-term, thus promoting growth and enhancing productivity over the medium- and long-term. Unofficial estimates from the Wisconsin Department of Revenue have indicated conformity with IRC Sec. 168(k) would carry modest short-term costs but that the fiscal effect would turn positive after a few short years. It is worth noting that the federal Section 168(k) expensing provision is scheduled to phase out between 2023 and 2027, so Wisconsin would be well-advised to decouple from the phase-out and simply provide full expensing on a permanent basis.

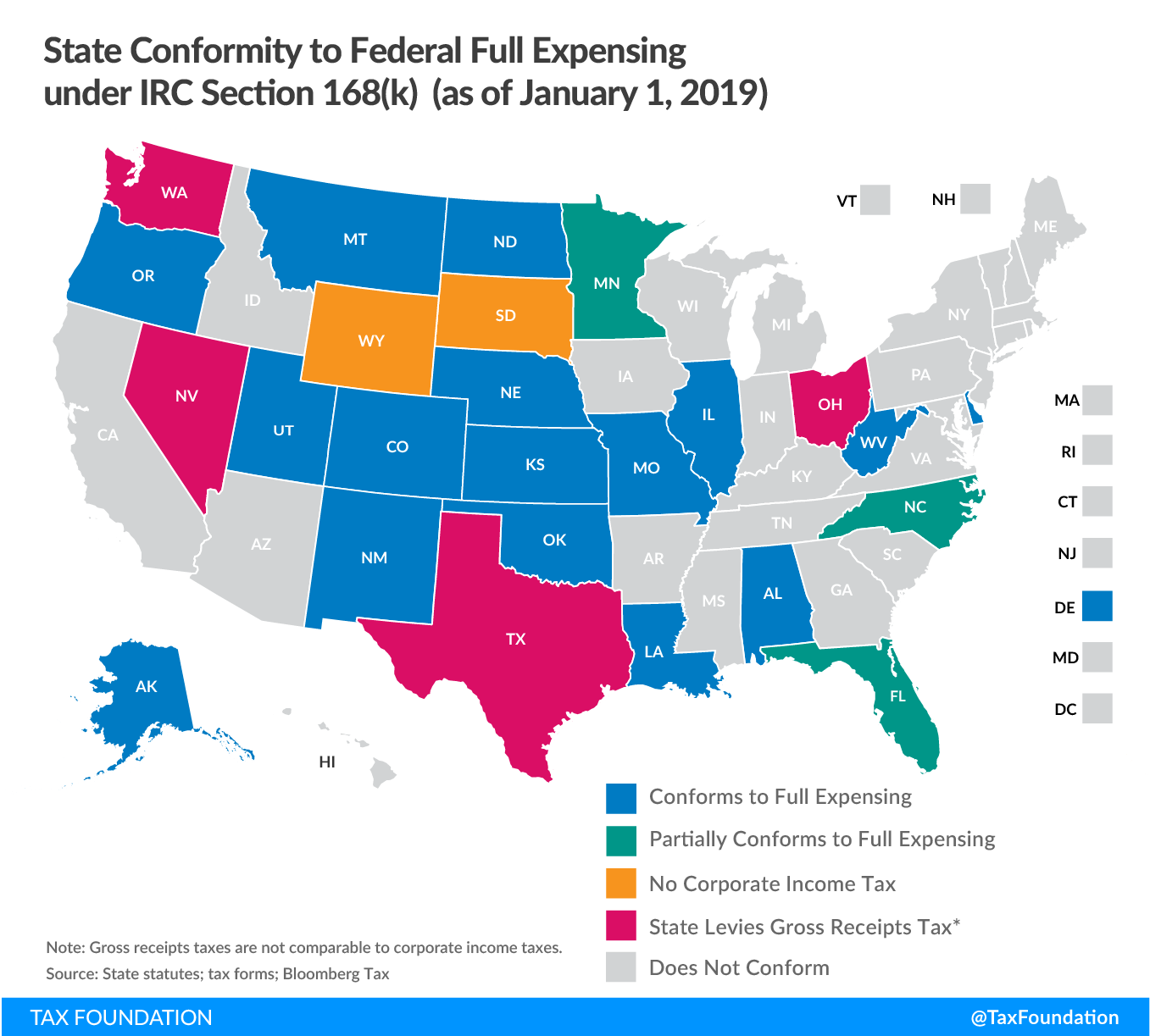

As of January 2019, 16 states (including neighboring Illinois) conform to the federal provision, thus allowing immediate expensing of short-lived assets at the state level. Three additional states (including neighboring Minnesota) conform to the federal provision with partial addbacks, allowing a given percentage of the bonus depreciation offered at the federal level.

If policymakers wish to supplement the forthcoming Wayfair-related individual income tax rate reductions with a permanent, pro-growth structural reform, offering immediate expensing of investments in machinery and equipment is one of the best changes the state can make. Conforming to Sec. 168(k) would improve Wisconsin’s overall tax structure and create a tax code that is more competitive for decades to come.

Share this article