Vapor products have been growing in popularity since they entered the market in 2007, and taxation on such items has been following suit. Many states may also be looking toward vapor and other excise taxes to fill budget holes caused by the coronavirus crisis. While those areas may represent untapped revenue sources for many states, taxing those activities is unlikely to raise much revenue in the short term.

Vapor products can deliver nicotine, the addictive component of cigarettes, without the combustion and inhalation of tar that is a part of smoking cigarettes and are thus thought to be considerably less harmful than conventional cigarettes. Vapor products and cigarettes can be economic substitutes. That means high excise taxes on harm-reducing vapor products risk harming public health by pushing vapers to go back to smoking. A recent publication found that 32,400 smokers in Minnesota were deterred from quitting cigarettes after the state implemented a 95 percent excise tax on vapor products.

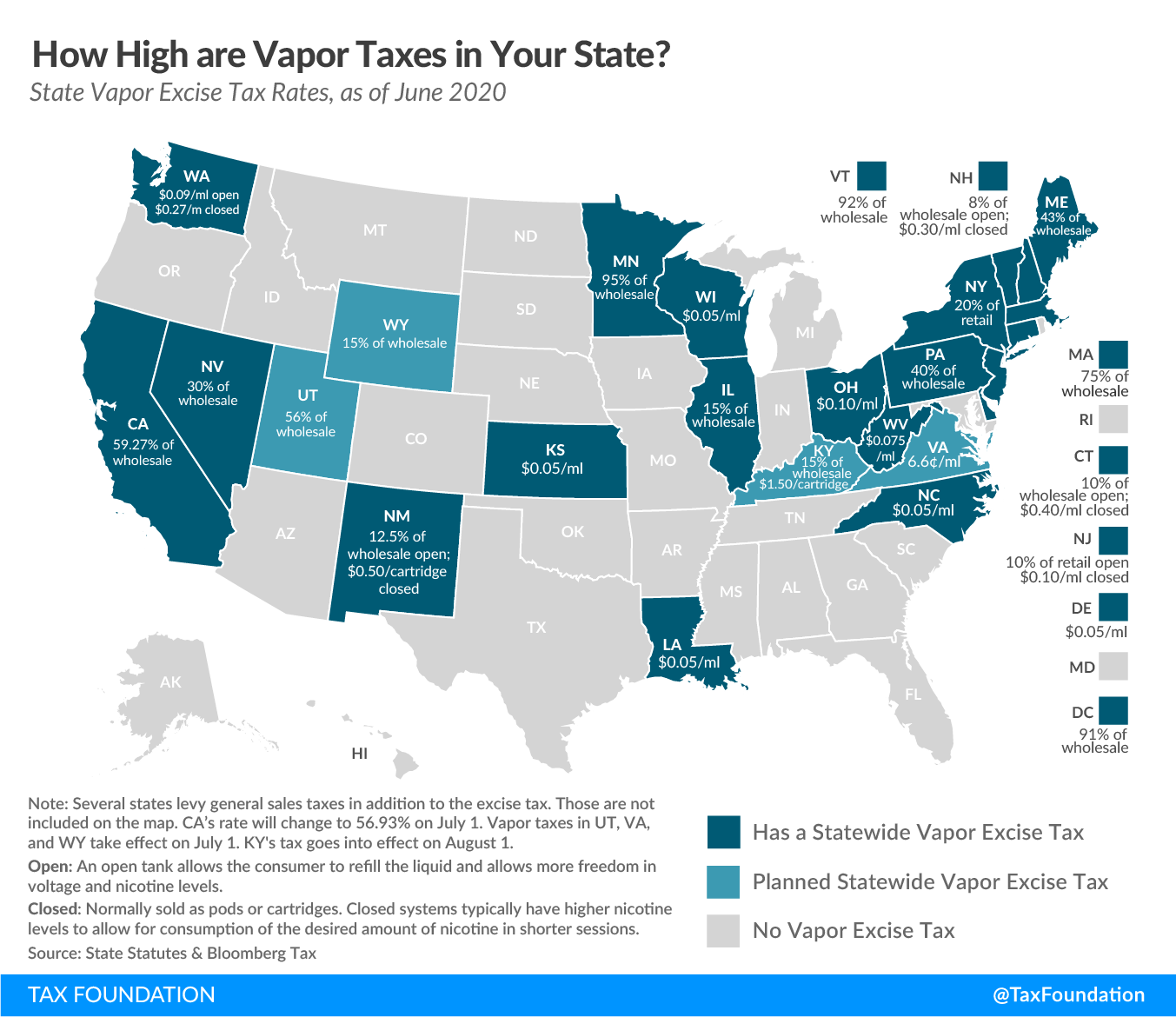

As such products fall outside the domain of cigarette taxes, several states and localities have created specific vapor product excise taxes, and some have simply expanded their definitions of “tobacco products” to include vapor products. Twenty-one states and the District of Columbia levy taxes on these products, while several localities levy the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. independently from their states. There is no federal tax on vapor products.

This week’s map shows where state vapor taxes stand as of June 1, 2020.

Vapor taxing methods vary. Authorities tax based on price (ad valorem), volume (specific), or with a bifurcated system that has different rates for open and closed tank systems. Taxation based on volume is the simplest way to tax these goods, as it requires neither valuation nor expensive tax administration.

Of those that tax wholesale values, Minnesota tops the list with a 95 percent rate, but the District of Columbia comes in second at 91 percent. Massachusetts follows at 75 percent.

Delaware, Kansas, Louisiana, and North Carolina all share the lowest per milliliter rate ($0.05).

Connecticut, New Hampshire, New Jersey, New Mexico, and Washington have bifurcated rates, but Washington is the only state to have specific rates for both open and closed systems.

Under an automatic adjustment, California’s wholesale rate will lower from 59.27 percent to 56.93 percent on July 1. Some states have also passed laws that will take effect later this summer. Laws in Utah, Virginia, and Wyoming will also go into effect on July 1, while Kentucky’s rate of 15 percent of wholesale and $1.50 per cartridge will take effect on August 1.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe