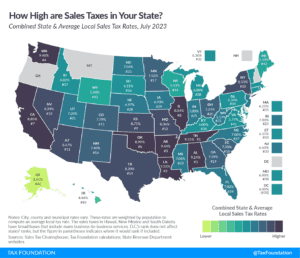

State and Local Sales Tax Rates, Midyear 2023

Compare the latest 2023 sales tax rates as of July 1st. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

8 min read

Compare the latest 2023 sales tax rates as of July 1st. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

8 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

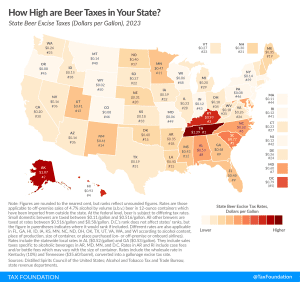

Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.

3 min read

It’s the 5th anniversary of the groundbreaking Wayfair Supreme Court decision–a ruling that marked a new era of sales tax collection and changed how we think about taxation in the digital age.

As fiscal year 2023 draws to a close, North Carolina’s House and Senate have each passed their own versions of the biennial budget for fiscal years 2024-25. While legislative leaders have generally agreed to overall spending levels, negotiations remain ongoing to resolve different approaches to tax policy.

7 min read

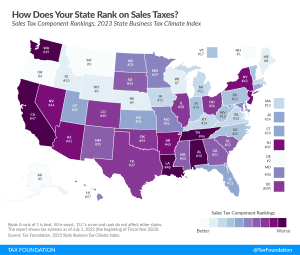

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate.

5 min read

The FairTax, on paper, sounds simple. But when you pull back the curtains, this proposal leads to more questions than answers.

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Adopting the sound tax reforms still pending in Santa Fe is an opportunity for New Mexico to keep up with the pack or risk falling further behind.

7 min read

As final negotiations occur between the House and Senate, legislators should avoid adopting new policies that would jeopardize Kentucky’s business tax competitiveness.

5 min read

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

As Kansas legislators consider additional tax policy changes this legislative session, they should prioritize economic growth and a structurally sound tax code.

7 min read

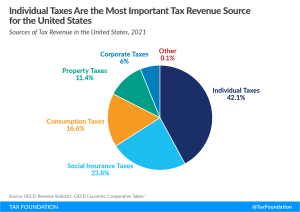

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

A growing number of cities, in red states like Arkansas and Texas, blue states like California and New Jersey, and purple states like Georgia and Nevada, have pursued streaming taxes in recent years.

7 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

With other states upping their game to attract ever-more-mobile people and businesses, lawmakers and the governor are not content to leave Tennessee’s business taxes in their current, uncompetitive form.

7 min read