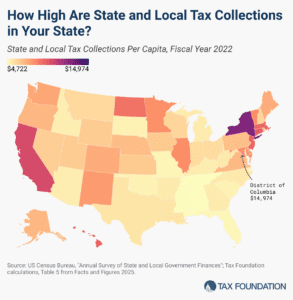

Oklahoma Continues to Pursue Pro-Growth Tax Reforms, but the Job Is Not Done

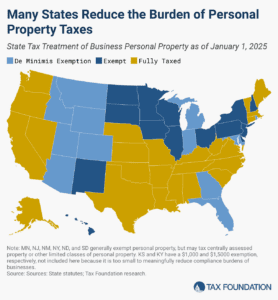

Oklahoma can continue to enhance its competitiveness by pursuing a variety of reforms to the corporate and individual income tax, but it should avoid policies that would negatively impact the economy, like enacting a wholesale elimination of the property tax.

6 min read