Who Benefits from Itemized Deductions?

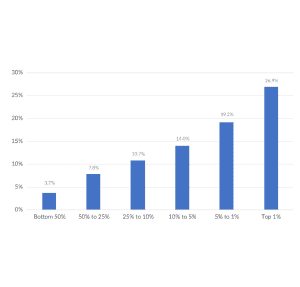

While some tax preferences like the earned income tax credit (EITC) and child tax credit benefit lower- and middle-income households, others, like itemized deductions, benefit high-income households.

4 min read

While some tax preferences like the earned income tax credit (EITC) and child tax credit benefit lower- and middle-income households, others, like itemized deductions, benefit high-income households.

4 min read

In the 1950s, when the top marginal income tax rate reached 92 percent, the top 1 percent of taxpayers paid an effective rate of only 16.9 percent. As top marginal rates have fallen, the tax burden on the rich has risen.

5 min read

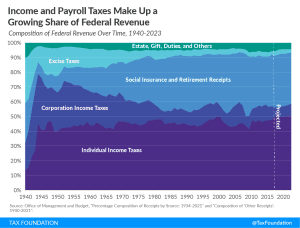

The federal income tax and federal payroll tax make up a growing share of federal revenue. Individual income taxes have become a central pillar of the federal revenue system, now comprising nearly half of all revenue.

2 min read

Recent plans to increase the tax burden on wealthy Americans, such as higher marginal income tax rates and wealth taxes, are flawed in several ways, including in their lack of understanding of tax history.

4 min read

Recent interest in raising the tax burden on high-income individuals glosses over the fact that the U.S. federal tax code is already progressive.

3 min read

Since 1980, the worldwide average statutory corporate tax rate has consistently decreased as countries have realized the negative impact that corporate taxes have on business investment decisions.

11 min read

The structure of a country’s tax code is an important determinant of its economic performance. Our 2018 international tax rankings provide a road map for each of the 35 OECD countries to improve the structure of their tax codes and achieve a more neutral, more competitive tax system.

11 min read

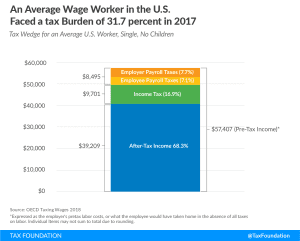

Before accounting for state and local sales taxes, the tax burden that a single average wage earner faces in the U.S. is 31.7 percent of pretax earnings, amounting to $18,198 in taxes in 2017.

18 min read

One hundred percent expensing for short-life business investments was a great start but needs to be enacted on a permanent basis for it to have an impact on long-term decision-making.

15 min read

The TCJA is projected to improve the United States’ current ranking from 30th among the 35 Organisation for Economic Co-operation and Development (OECD) countries to 25th, an improvement of five places.

4 min read

Considered as a whole, this plan would make the U.S. substantially more competitive, not only due to lower rates but also due to a better tax structure.

2 min read

Hampered by high marginal tax rates and complex business tax rules, the United States again ranks towards the bottom of the pack on our 2017 International Tax Competitiveness Index, placing 30 out of 35 OECD countries.

11 min read

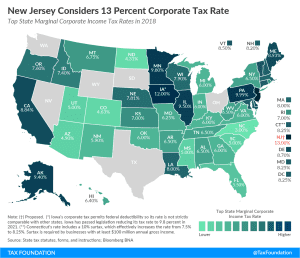

The last time the U.S. reduced its federal corporate income tax rate was in 1986. Since then, countries throughout the world have significantly reduced their rates, leaving the U.S. with the fourth highest statutory corporate tax rate in the world and an overall uncompetitive tax system.

11 min read