All Related Articles

Designing a Territorial Tax System: A Review of OECD Systems

A well-designed territorial tax system would reduce the incentive for companies to invert, encourage businesses to invest in and expand operations throughout the world, and allow capital to flow more freely back to the U.S., but would also come with some new challenges.

28 min read

Arkansas: The Road Map to Tax Reform

8 min read

2016 International Tax Competitiveness Index

12 min read

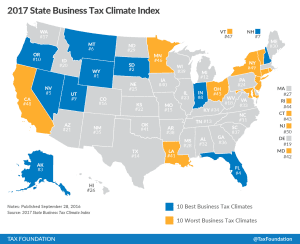

2017 State Business Tax Climate Index

16 min read

A Twenty-First Century Tax Code for Nebraska

30 min read

Options for Reforming America’s Tax Code

2 min read