All Related Articles

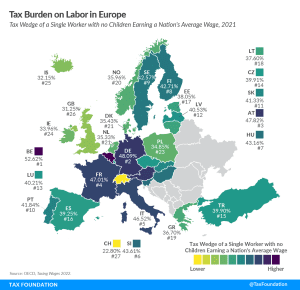

Tax Burden on Labor in Europe, 2022

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Carbon Taxes in the Global Market: Changes on the Way?

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read

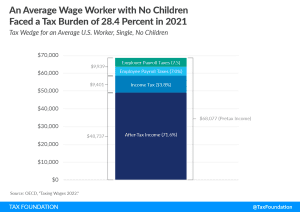

The U.S. Tax Burden on Labor, 2022

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay nearly 30 percent of their wages in taxes.

4 min read

Sources of Government Revenue in the OECD, 2022

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

Corporate Tax Rates around the World, 2021

A new report shows that corporate tax rates around the world continue to level off. “We aren’t seeing a race to the bottom, we’re seeing a race toward the middle,” said Sean Bray, global policy analyst at the Tax Foundation.

24 min read

International Tax Competitiveness Index 2021

A well-structured tax code (that’s both competitive and neutral) is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

40 min read

The Impact of the Biden Administration’s Tax Proposals by State and Congressional District

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

A Comparison of the Tax Burden on Labor in the OECD, 2021

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

21 min read

Location Matters 2021: The State Tax Costs of Doing Business

A landmark comparison of corporate tax costs in all 50 states, Location Matters provides a comprehensive calculation of real-world tax burdens, going beyond headline rates to demonstrate how tax codes impact businesses and offering policymakers a road map to improvement.

8 min read