All Related Articles

Sources of Government Revenue in the OECD, 2021

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

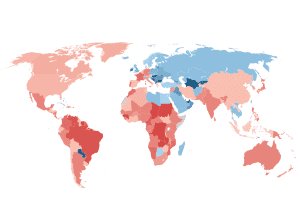

Corporate Tax Rates Around the World

What is driving the downward trend in corporate tax rates and will it continue? Is it truly a race to the bottom? Why do corporate tax rates matter in the first place? How does the U.S. rate compare and could that change in the coming years?

Corporate Tax Rates around the World, 2020

Corporate tax rates have been declining in every region around the world over the past four decades as countries have recognized their negative impact on business investment. Our new report explores the latest corporate tax trends and compares corporate tax rates by country.

22 min read

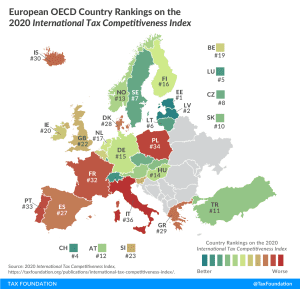

International Tax Competitiveness Index 2020

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

The U.S. Tax Burden on Labor, 2020

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay about 30 percent of their wages in taxes.

15 min read

A Comparison of the Tax Burden on Labor in the OECD, 2020

A higher tax burden on labor often leads to lower employment rates and wages. That’s important for policymakers to remember as they look for ways to help their economies recover from coronavirus-induced shutdowns. If their goal is to encourage employment, policies that lower the tax burden on labor could prove a powerful tool.

20 min read

Capital Cost Recovery across the OECD, 2020

Although sometimes overlooked in discussions about corporate taxation, capital cost recovery plays an important role in defining a business’s tax base and can impact investment decisions—with far-reaching economic consequences.

27 min read

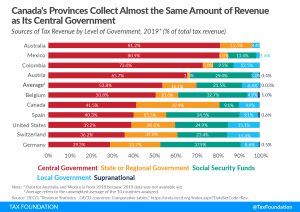

Sources of Government Revenue in the OECD, 2020

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

13 min read

Corporate Tax Rates around the World, 2019

Since 1980, corporate tax rates have consistently declined on a global basis. More countries have shifted to taxing corporations at rates lower than 30 percent, with the United States following this trend with its tax changes at the end of 2017.

15 min read

International Tax Competitiveness Index 2019

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read

The U.S. Tax Burden on Labor, 2019

13 min read

Sources of Government Revenue in the OECD, 2019

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

10 min read

Capital Cost Recovery across the OECD, 2019

Capital cost recovery, though often overlooked, can have a significant impact on investment decisions—with far-reaching economic consequences.

24 min read

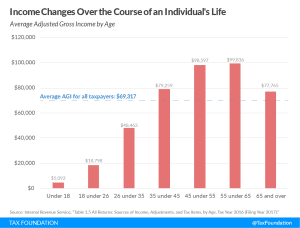

Average Income Tends to Rise with Age

Average income tends to rise dramatically as someone ages and gains education and experience. Viewing just one year of income tax data without digging any deeper misses some crucial context.

2 min read

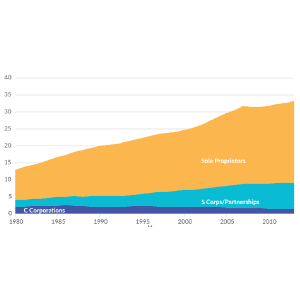

Increasing Individual Income Tax Rates Would Impact a Majority of US Businesses

Since most U.S. businesses are pass-through businesses, such as partnerships, S corporations, LLCs, and sole proprietorships, changes to the individual income tax, especially to top marginal rates, can affect a business’s incentives to invest, hire, and produce.

4 min read

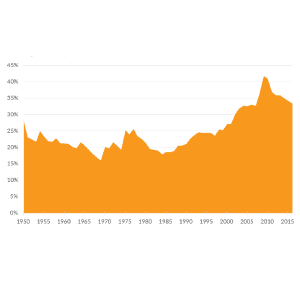

A Growing Percentage of Americans Have Zero Income Tax Liability

From 1986 to 2016, the top 1 percent’s share of income taxes rose from 25.8 percent to 37.3 percent, while the bottom 90 percent’s share fell from 45.3 percent to 30.5 percent.

4 min read