Evidence Suggests that Tax Rates Influence Migration Decisions

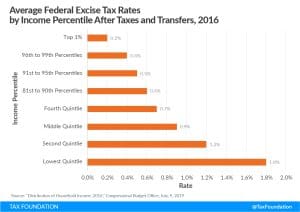

Individuals respond to taxes by changing their behavior. Hence, when there are tax differences between countries, some might respond by moving to a lower-tax area. For higher-income individuals, the benefits of moving as a result of higher taxes are greater because they have more income or wealth at stake.

4 min read