Testimony: Prioritizing Comprehensive Tax Modernization in Nebraska

The Nebraska legislature has an excellent opportunity to make progress toward a simpler, stabler, less burdensome, and more competitive tax code.

The Nebraska legislature has an excellent opportunity to make progress toward a simpler, stabler, less burdensome, and more competitive tax code.

Policy changes to attract foreigners are not without benefits, but governments should carefully weigh the costs of the tax incentives against opportunities to implement broader tax reforms. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

4 min read

The international experience with wealth taxes should serve as a warning to the U.S. A wealth tax would reduce the size of the economy, shrink national income, and significantly distort international capital flows.

4 min read

Mississippi has an opportunity to become the 10th state without an individual income tax and to do so with sales tax rates which, while certainly high, are in line with regional competitors. For such a momentous undertaking, however, policymakers should be equipped with reliable revenue projections and a detailed accounting of how much revenue is projected to come from each offsetting change. A change worth doing is worth doing right.

15 min read

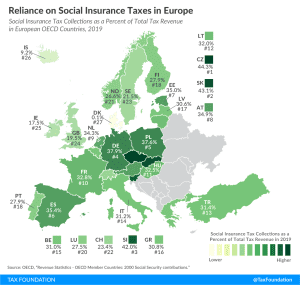

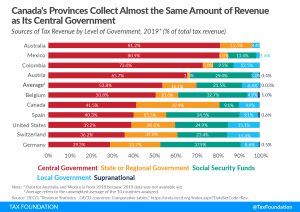

Social insurance taxes are the second largest tax revenue source in European OECD countries, at an average of 29.5 percent of total tax revenue.

2 min read

A new study illustrates how overlooking an important element of the tax system—the structure of the tax base—can lead to an incomplete understanding of how tax reform impacts the economy.

4 min read

Under the budget introduced by Gov. Tom Wolf, Pennsylvania’s flat personal income tax rate would increase by 46 percent, partially offset by an outsized increase in the poverty credit, which would see a family of four eligible for partial relief due to poverty until they reached $100,000 in taxable income—four times the poverty line.

6 min read

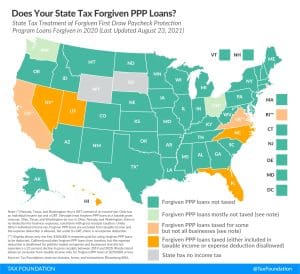

Congress chose to exempt forgiven Paycheck Protection Program (PPP) loans from federal income taxation. Many states, however, remain on track to tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both.

11 min read

Learn more about the recent Alabama tax reform measures (House Bill 170), which combines pandemic-era tax policy responses with broader tax policy reforms.

4 min read

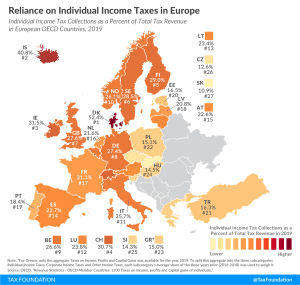

Denmark relies the most on revenue from individual income taxes, at 52.4 percent of total tax revenue, followed by Iceland and Ireland at 40.8 percent and 31.5 percent, respectively.

1 min read

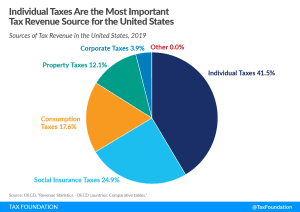

In the United States, individual income taxes (federal, state, and local) are the primary source of tax revenue, at 41.5 percent of total tax revenue. Social insurance taxes make up the second-largest share, at 24.9 percent, followed by consumption taxes, at 17.6 percent, and property taxes, at 12.1 percent.

4 min read

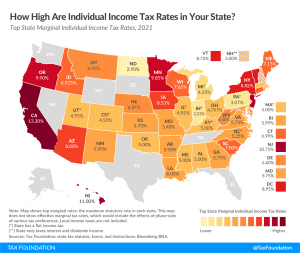

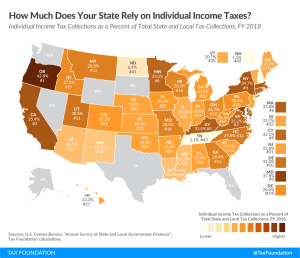

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

22 min read

The coronavirus relief legislation passed out of the House Ways and Means Committee would significantly expand the child tax credit for 2021, from its current $2,000 maximum to a fully refundable $3,600 for children 6 and under and $3,000 for children over 6.

4 min read

Sen. Mitt Romney’s Family Security Act would replace the Child Tax Credit with a monthly child allowance administered by the Social Security Administration, making the benefit more generous and accessible to low-income households without earned income.

4 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus pandemic, as different tax types have differing volatility and economic impact—although even beyond these unique circumstances, it is important for policymakers to understand the trade-offs associated with different sources of tax revenue.

4 min read

The House Ways and Means Committee measures would further extend the relief measures created by the CARES Act and the Consolidated Appropriations Act of 2021, and would go further by significantly expanding existing tax credits and making changes to the international tax system.

7 min read

The potential override of Gov. Larry Hogan’s (R) veto of a digital advertising tax (HB732) looms large over the current legislative session in Maryland, though it is only one of many tax proposals under consideration in the state.

7 min read

House Ways and Means Democrats recently released a proposal to expand the child tax credit for one year as part of President Biden’s larger $1.9 trillion economic relief package.

5 min read