Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

For most Americans, saving is a taxing experience. Our neighbors to the north have found a better solution—and U.S. lawmakers should take note.

5 min read

From a revenue standpoint, about $9 billion of the $11.7 billion in lost revenue would accrue to joint filers earning more than $200,000.

5 min read

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

In a rare change of pace, tax legislation passed out of the Ways and Means Committee last week with overwhelming, bipartisan support. In a more common turn of events, it may not get much further thanks to a small group of passionate, but misled lawmakers known as the “SALT Caucus.”

Financial literacy is a problem that educators around the country are trying to tackle. Today, we’re speaking with Jed Collins, a former NFL player, who is leading the charge in the financial education arena by guiding high school and college students, as well as professional athletes, through the world of finance.

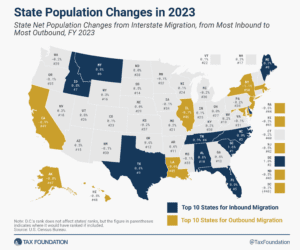

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Virginia Governor Youngkin unveiled the contours of a tax reform plan incorporated into his forthcoming budget, which includes three major structural elements: a reduction in the individual income tax rate, a 0.9 percentage point increase in the sales tax rate, and the broadening of the sales tax base to include some “new economy” digital services.

6 min read

In the end, the best way for the EU to support Ukraine’s post-war recovery is to guarantee its tax sovereignty, not just its territorial sovereignty.

5 min read

With Secure 2.0, lawmakers recognized and addressed several flaws in the tax code’s treatment of saving and retirement, but there is continued work to be done simplifying and expanding savings and retirement options for taxpayers.

5 min read

Americans are saving less. While the U.S. saving rate has regularly lagged behind its peers, it has yet to return to pre-pandemic levels. Increasingly, people are turning to credit cards to fill the gaps in their budgets.

What historical lessons of wartime finance can Ukrainian and EU policymakers learn to put Ukraine’s economy on a path to success during, and especially after, the war?

5 min read

The fate of the $10,000 cap on state and local tax (SALT) deductions remains uncertain, with some policymakers pushing for an increase or repeal of the cap before its scheduled expiration in 2026.

6 min read

When it comes to comprehensive tax reform, poorly designed local tax policies can offset any improvements brought about by state tax policies.

6 min read

At first glance, a ruling for the plaintiffs in Moore might seem to solve some of the timing problems with the U.S. tax system. Unfortunately, upon greater inspection, such a ruling might create new timing problems. And the more rigid the ruling, the harder it would be to fix the timing problems it would create.

5 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read