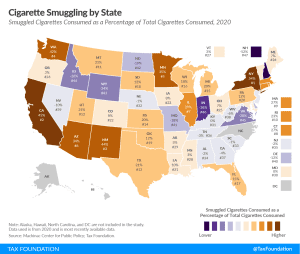

Cigarette Taxes and Cigarette Smuggling by State, 2020

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

19 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

People respond to incentives. As tax rates increase or products are banned from sale, consumers and producers search for ways around these penalties and restrictions.

19 min read

Later this week, the European Union is expected to release a new Tobacco Tax Directive, the first update in more than a decade. Early reports indicate that the EU will propose a significant increase to the existing minimum cigarette tax rates levied across the Union and expand the product categories that are taxed, including a block-wide vaping tax.

7 min read

History is clear. Lowering budget deficits via spending restraint frees resources for additional private output and jobs. Lowering them by raising taxes on business investment and labor services makes it harder to dis-inflate without a recession.

7 min read

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

the Inflation Reduction Act gives us a glimpse into a future where the U.S. and EU opt for protectionist tax and trade policies rather than implementing principled tax policies and reducing trade barriers between allies.

5 min read

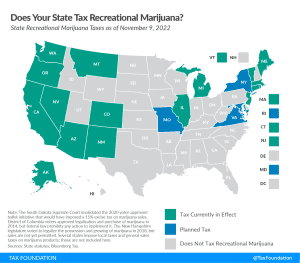

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 19 states have implemented legislation to legalize and tax recreational marijuana sales.

6 min read

The first-in-the-nation digital advertising tax was recently struck down by a Maryland circuit court on three separate grounds. Other states might want to avoid getting themselves into this situation in the first place.

5 min read

A border-adjusted carbon tax that uses some of the revenue for pro-investment tax reform could improve U.S. more competitiveness while also addressing concerns with a carbon tax.

29 min read

While changes to federal cannabis law are slow, changes at the state level are accelerating. Recreational cannabis is on the ballot in five states this November—Arkansas, Maryland, Missouri, North Dakota, and South Dakota—giving voters the ability to join 19 states that have already legalized recreational marijuana.

5 min read

Every policy has trade-offs, but a well-designed carbon tax has the potential to protect the environment without harming consumers, jobs, or businesses.

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

6 min read

California is no stranger to high taxes, and the state has enough going for it that its economy can withstand higher tax burdens than would be viable in other parts of the country. But there’s always a tipping point.

6 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

Alaska policymakers are understandably concerned about the long-term viability of the state’s overwhelming reliance on the oil and gas industry for revenue, but the state’s unique economy and geography, and low population density make some of the “traditional” taxes less efficient than they might be elsewhere.

55 min read

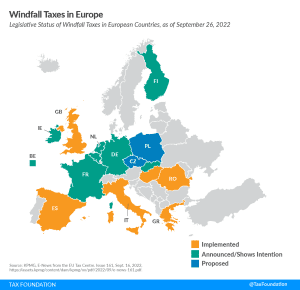

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read

The Inflation Reduction Act primarily uses carrots, not sticks, to incentivize reductions in carbon emissions. It creates or expands tax credits for various low- or no-emission technologies, rather than imposing a generalized penalty for emissions, such as a carbon tax.

5 min read

The Inflation Reduction Act created numerous tax subsidy programs intended to accelerate the transition to a greener economy.

8 min read