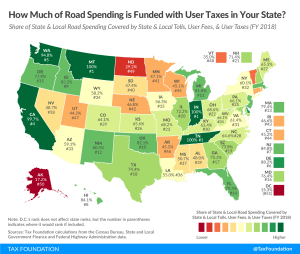

Broad-Based Taxes on Consumption and User Fees Are Efficient Ways to Raise Federal Revenue for Infrastructure

Rather than relying on damaging corporate tax hikes, policymakers should consider user fees and consumption taxes as options for financing new infrastructure to ensure that a compromise does not end up being a net negative for the U.S. economy.

2 min read