Countries Eye Environmental Taxation

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read

Implemented in 1991, Sweden’s carbon tax was one of the first in the world. Since then, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Today, Sweden levies the highest carbon tax rate in the world and its carbon tax revenues have been decreasing slightly over the last decade.

21 min read

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

The highway trust fund is on track to run out of money by 2021, states are struggling to cover their transportation spending, and increased fuel economy, plus inflation, is chipping away at gas tax revenue year. How can Congress and state governments ensure they have the revenue necessary to fund our highways? One solution is the vehicle miles traveled (VMT) tax.

35 min read

One under-discussed part of the CARES Act, passed in March to provide economic relief during the COVID-19 epidemic, is a correction to a drafting error in the Tax Cuts and Jobs Act of 2017, often known as the “retail glitch.”

3 min read

First, the introduction of the wealth tax would significantly impact international capital flows and cause large economic dislocations in the short term. Second, provinces that are looking at raising their corporate tax rates might hinder capital attraction, growth, and economic recovery.

4 min read

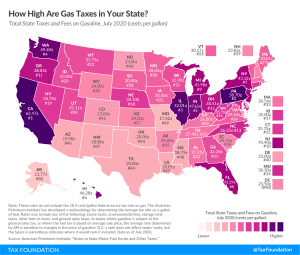

California pumps out the highest tax rate of 62.47 cents per gallon, followed by Pennsylvania (58.7 cpg), Illinois (52.01 cpg), and Washington (49.4 cpg).

2 min read

Rather than limit improvements to certain sectors, lawmakers could pursue a broader policy of full expensing for all capital investment and neutral cost recovery for structures and clear the tax policy hurdles that currently stand in the way of private investment.

3 min read

Nineteen states had notable tax changes take effect on July 1, 2020. Pandemic-shortened sessions contributed to less—and different—activity on the tax front than is seen in most years, and will likely yield an unusually active summer and autumn, with many legislatures considering new measures during special sessions.

12 min read

Our analysis shows that the economic benefits of federal investment in productivity-enhancing infrastructure may be undercut by the negative effects of the financing of those investments, such as when the corporate income tax is increased.

6 min read

Based on the CBO’s assessment of the economic and budgetary effects of federal investment, lawmakers should look to spur private sector investment rather than try to enact a massive federal infrastructure bill.

5 min read

The lockdowns imposed in response to the COVID-19 pandemic induced an increase in demand for broadband internet, as work from home and other social distancing measures pushed people to spend more time online. As broadband becomes a more important piece of America’s infrastructure, it makes sense to look at tax policy that will help drive more investment and better service.

2 min read

Alesina’s work suggests that raising taxes to reduce the federal deficit and national debt would be an economic mistake. The less economically damaging path is to cut spending, what some have called austerity policies.

3 min read

Alaska and North Dakota collect revenue primarily from oil-related taxes. These states must start thinking about how to plan for an era of reduced oil revenue.

5 min read