All Related Articles

National Taxpayer Advocate’s Report Is a Road Map to Simpler Pandemic Relief Provisions

The size and scope of the tax changes within the CARES Act created significant administrative challenges for the IRS. Lawmakers should prioritize simplicity in the next round of relief.

3 min read

GAO Report Reveals Need to Simplify Next Round of Rebates

A new Government Accountability Office (GAO) report revealed that almost a half-million taxpayers missed their total rebate payment due to complications over disbursing funds to non-filers with eligible dependents. Administrability is just as important as rebate design and simplicity is just as important as speed.

3 min read

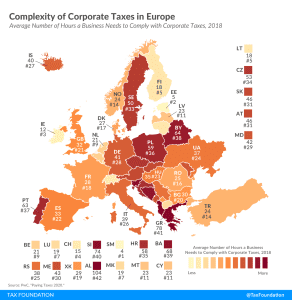

Complexity of Corporate Taxes in Europe

3 min read

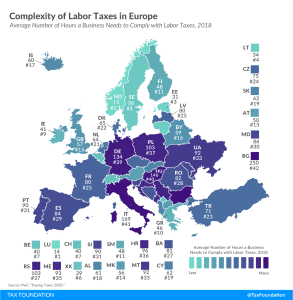

Complexity of Labor Taxes in Europe

2 min read

Reviewing the Economic and Revenue Implications of Cost Recovery Options

Permanent full expensing for all types of investment is an effective policy change lawmakers can use to encourage additional investment and economic growth.

9 min read

Two Years After Passage, Treasury Regulations for the Tax Cuts and Jobs Act Surpass 1,000 Pages

Treasury released final regulations on the base erosion and anti-abuse tax (BEAT), which is meant to dissuade firms from engaging in profit shifting abroad. Other high-profile releases from 2019 include final regulations guiding enforcement of Section 199A, commonly known as the pass-through deduction; final regulations on enforcing the new tax on global intangible low-tax income (GILTI); and final regulations on state-level workarounds to the $10,000 limit on the state and local tax deduction (SALT).

5 min read

Improving the Federal Tax System for Gig Economy Participants

Advances in technology have enabled workers to connect with customers via online platform applications for work ranging from ridesharing to home repair services. The rise of gig economy work has reduced barriers to self-employment, bringing tax challenges like tax complexity and taxpayer noncompliance.

32 min read