The Future of BEAT

Even when international relations are frayed, there is value in finding ways to combat corporate profit shifting while also fostering a healthy commercial atmosphere and positive trade relations.

7 min read

Even when international relations are frayed, there is value in finding ways to combat corporate profit shifting while also fostering a healthy commercial atmosphere and positive trade relations.

7 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The administration has a strong desire to boost manufacturing investment and there are many provisions in the new tax bill that support this aim. But the administration’s erratic trade policy is driving up the costs of key inputs that manufacturers rely on to build things in the US.

Several major new tax breaks are scheduled to expire at the end of 2028, setting the stage for another tax fight to either extend them or allow them to expire.

5 min read

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

4 min read

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

4 min read

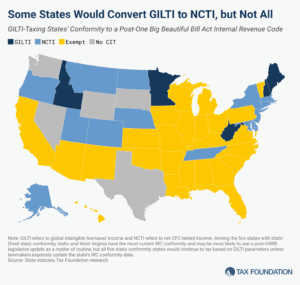

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

10 min read

The BEPS project’s 15 actions were decisive responses to real problems in cross-border taxation, offering real benefits but also real costs. A decade of implementation experience has revealed a critical side effect: sharply higher compliance costs for both tax administrations and the business community.

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

The Senate draft overall makes more changes to international tax policy than the House draft. On net the changes are positive.

8 min read

The final House bill makes impressive cuts to the IRA green energy tax credits, but it does so in part by introducing more complexity.

5 min read

Rather than permanently expanding a complicated, nonneutral tax break, Congress should prioritize permanence for the most neutral and pro-growth policies like bonus depreciation and R&D expensing.

6 min read

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

The House-passed “One Big Beautiful Bill” includes a new 3.5 percent tax on remittances, or non-commercial transfers of money that people in the US send to people abroad.

7 min read

The House tax and spending bill leaves in place a long-standing provision that exempts credit unions from federal and state income tax, allowing them to compete unfairly with banks and, increasingly, to buy them.

6 min read