Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

In addition to its economic impact on Maryland businesses and the likelihood of serious legal challenges, Maryland’s proposed digital advertising tax is incredibly vague on vital definitions, creating uncertainty about where revenue is sourced and when it is subject to the tax.

17 min read

Unless the legislature acts, businesses that have received PPP loans and related federal assistance will face $457 million in state taxes through 2024—with more than half of those taxes coming due this spring—despite Wisconsin being on track to see continued general fund revenue growth even amid the pandemic.

4 min read

As Congress works to provide another round of emergency economic relief, it is a good time to step back and consider how tax policy affects entrepreneurs and small businesses.

3 min read

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

Policymakers should consider finding ways to simplify the administration of relief during future crises. This will help ensure the relief is timely and targeted, key components of any successful relief package for this crisis or crises in the future.

3 min read

It’s important for Poland to understand the main lesson of the Estonian approach: taxes should be designed with an overarching approach to maximize neutrality and minimize complexity and distortions. Instead of simply adopting a preference for small businesses, the Polish government should instead overhaul its corporate tax rules and truly adopt the Estonian approach to taxation.

2 min read

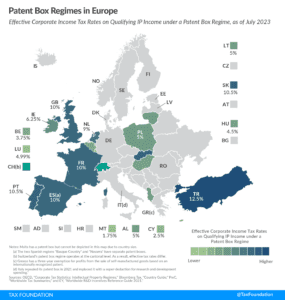

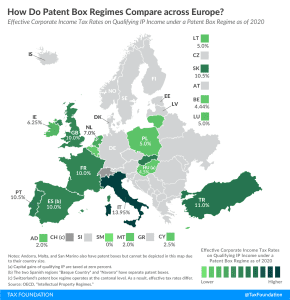

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min read

President Biden may make greater use of regulatory changes to modify how tax law is interpreted and administered. There are several areas where a Biden Treasury Department, likely led by former Federal Reserve Chair Janet Yellen, may focus.

3 min read

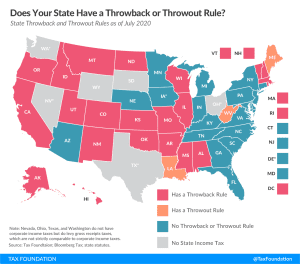

State throwback and throwout rules may not be widely understood, but they have a notable impact on business location and investment decisions and reduce economic efficiency for the states which impose such rules.

3 min read

Joe Biden recently released a piece reviewing his tax proposals, contrasting them with President Donald Trump’s tax ideas. A major theme within this piece can be summarized in the title: “A Tale of Two Tax Policies: Trump Rewards Wealth, Biden Rewards Work.”

4 min read

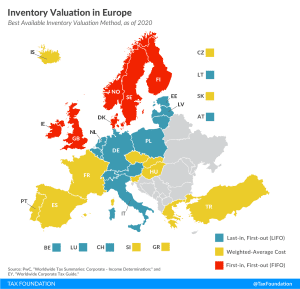

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

Brazil has one of the world’s most complex tax systems. Brazil has the opportunity to implement a simple consumption tax and foster tax progressivity at the same time.

5 min read