All Related Articles

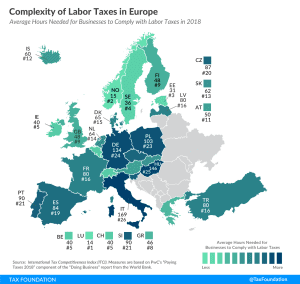

Complexity of Labor Taxes in Europe

3 min read

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

Unequal Tax Treatment Is Contributing to Rising Debt Levels for Entrepreneurs

A recent paper discusses two main trends related to U.S. entrepreneurs: the decrease in the number of entrepreneurs and the increase in their borrowing. Entrepreneurs have increased their debt holdings relative to their assets over the past three decades.

3 min read

South Carolina: A Road Map For Tax Reform

South Carolina is by no means a high tax state, though it can feel that way for certain taxpayers. The problems with South Carolina’s tax code come down to poor tax structure. Explore our new comprehensive guide to see how South Carolina can achieve meaningful tax reform.

16 min read

State Tax Implications of Federal Tax Reform in Virginia

Virginia has an opportunity to improve its tax competitiveness following the Tax Cuts and Jobs Act. Inaction will result in higher taxes.

14 min read

New Letter Says the “Retail Glitch” is Discouraging Business Investment

Retail groups sent a letter to Congress explaining that the “retail glitch” in the Tax Cuts and Jobs Act would discourage business investment.

3 min read

Sales Tax Complexity: Diaper Edition

3 min read

Inversions under the New Tax Law

The Tax Cuts and Jobs Act was meant to boost growth and deter corporate inversions. What does it mean that an Ohio company is still moving its HQ to the UK?

5 min read

Tax Foundation Brief in Wayfair Online Sales Tax Case: SCOTUS Should Set Meaningful Limits on State Taxing Power

In the South Dakota v. Wayfair online sales tax case, the U.S. Supreme Court should ensure that state sales tax laws don’t burden interstate commerce.

3 min read

Idaho Tax Reform Bill Advances

3 min read

The ‘Grain Glitch’ Needs to Be Fixed

The Tax Cuts and Jobs Act tax preference for farm co-ops would distort agricultural activity and create tax planning opportunities for wealthy taxpayers.

9 min read

Statement on Final Passage of the Tax Cuts and Jobs Act

With the Tax Cuts and Jobs Act, Congress took a historic step toward rewriting the U.S. tax code for the first time since 1986.

1 min read