Testimony to the Joint Standing Committee on Appropriations and Financial Affairs

Senators Hamper and Dow, Representatives Gattine and Tipping, and distinguished members of the Joint Standing Committee on Appropriations and Financial Affairs and Joint Standing Committee on Taxation: My name is Morgan Scarboro, and I’m a policy analyst at the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation. For those unfamiliar with us, we are a nonpartisan, nonprofit research organization that has monitored fiscal policy at all levels of government since 1937. We have produced the Facts & Figures handbook since 1941, we calculate Tax Freedom Day each year, we produce the State Business Tax Climate Index, and we have a wealth of other data, rankings, and information at our website, www.TaxFoundation.org.

I’m pleased to testify today on several tax reform proposals in the state of Maine. While we take no position on legislation, I plan to share some of our research on tax policy across the country and the related economic evidence.

Adoption of a Flat Income Tax

At a current top rate of 10.15 percent, Maine has a relatively high top marginal income tax rate, both regionally and nationally. Taxation should be neutral; however, high individual income tax rates can distort decision making.

There is a wealth of economic literature on individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates. In an OECD study that analyzed 21 countries, Jens Arnold (2008) found that individual and corporate income taxes are some of the most harmful for economic growth because of their tendency to disincentivize both savings (in the form of interest or dividends) and labor. Arnold et. al. also find that consumption and property taxes are among the least harmful tax types.

Additionally, it’s important to recognize that many businesses are subject to the individual income tax rate. Pass-through businesses, organizations where the owner “passes on” profits through to their individual income tax returns (such as LLCs, S-Corporations, sole proprietorships, and partnerships), make up 76 percent of private businesses in the state. This means that many business owners, and particularly small business owners, in the state are subject to the individual income tax rate, not the corporate income tax rate.

| Note: *Count includes Corporations, S-Corporations, individual proprietorships, and partnerships. Count does not include nonprofits, government, or other noncorporate legal forms of organization. This is the most recent data available from the Census Bureau. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Number of Establishments |

Paid employees |

Percent of Total Establishments |

Percent of Total Employees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Corporations |

8,636 |

173,259 |

24% |

45% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

S-Corps |

17,323 |

148,641 |

49% |

39% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Individual Proprietorships |

6,389 |

20,767 |

18% |

5% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Partnerships |

3,327 |

40,334 |

9% |

11% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total* |

35,675 |

383,001 |

100* |

100% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Tax Foundation’s Taxes and Growth model (TAG) is a tax-scoring model that evaluates the impact taxes have on the economy. The TAG model estimates the impact tax changes have on wages, jobs, cost of capital, distribution of income, federal revenue, and the overall size of the economy. This information helps members of Congress, journalists, and citizens better understand tax proposals.

The model cannot produce Maine specific results, but in our book Options for Reforming America’s Tax Code, we modeled lowering marginal income tax rates across the board by 20 percent. Under a dynamic score, long-run GDP would increase by 2.1 percent and create 1.8 million new jobs. While the magnitude of these changes are not directly comparable to Maine, we estimate that the direction of increased GDP and employment would remain.

Elimination of the Estate Tax

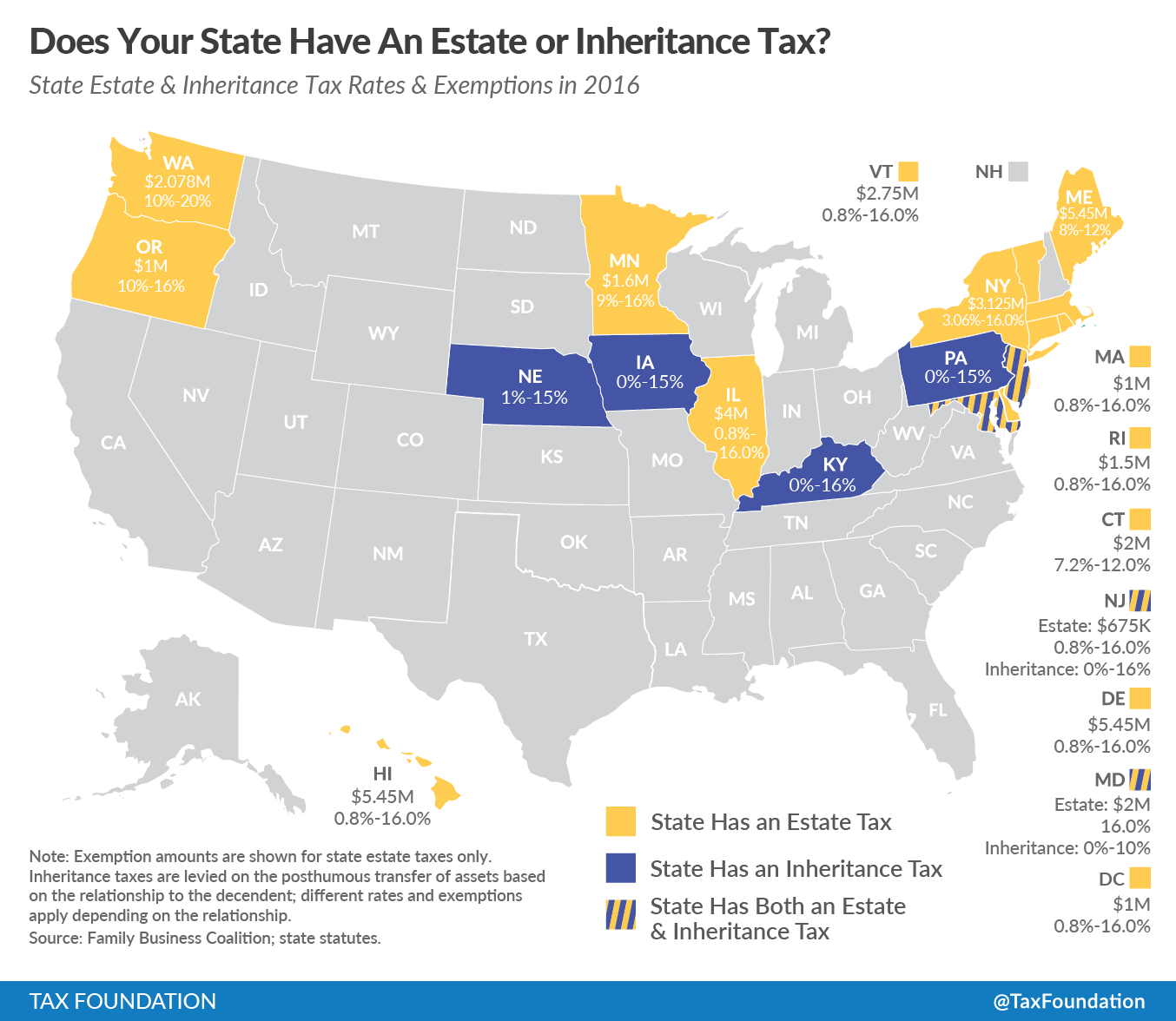

Few states still have an estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. . Maine is one of only 14 states and the District of Columbia that has an estate tax. Rates vary from 8 to 12 percent in Maine. This is in addition to the federal estate tax of 40 percent. In total, Maine filers could face estate tax rates as high as 52 percent.

Nationwide, trends in state tax policy have pointed toward either eliminating or repealing estate and inheritance taxes. New Jersey will fully phase out its estate tax by 2018 and other states have been working to increase the size of their exemption.

The estate tax can disincentivize business investment, both in terms of business equipment and land. A business owner planning for the estate tax may avoid purchasing new business equipment and keep the business smaller or opt for smaller, less costly business equipment. The estate tax can discourage families from acquiring more land or lower their willingness to pay a higher price per acre.

Similar to individual income tax changes, the TAG model has produced results for a repeal of the federal estate tax. Repealing the federal estate tax would cost $240 billion over 10 years on a static basis, but after taking into account behavioral changes and macroeconomic impacts, the loss decreases to only $19 billion over 10 years. Wage rates would rise by 0.7 percent and we would see the creation of 159,000 full-time jobs. Again, these results are not directly comparable to Maine, but the trend would be similar.

The estate tax harms Maine’s ranking in the Tax Foundation’s State Business Tax Climate Index. Higher scores are awarded to states that do not impose an estate tax.

Note: Minnesota’s 2017 exemption level is $1.8 million.

Expansion of the Sales Tax

Though the public and policymakers often focus largely on tax rates, there are two components of every tax: the rate and the tax base. The tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. should be an important consideration, particularly in the discussion about sales taxes. States are facing an alarming trend: the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. base is shrinking, reducing sales tax revenues. This is largely because states do not tax personal services.

The exclusion of services from the sales tax is somewhat of a historical accident. Mississippi was the first state to create a state sales tax in 1930; however, if you consider Mississippi’s economy in 1930, it was comprised mostly of goods and no notable service sector. As other states started to adopt sales taxes, they largely copied the language of Mississippi. Today, however, most states’ economies are comprised more heavily of services than goods, meaning sales taxes are missing a large portion of consumer consumption. A shrinking sales tax base means tax rates have to be raised in order to generate the same amount of revenue. Expanding the sales tax base to include all final consumer goods and services is the proper tax treatment.

Though Governor LePage’s budget proposal does not bide down the sales tax rate, it does use the base expansion to replace the revenue from some other tax cuts.

Lowering the Corporate Income TaxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. Rate

Finally, Maine also has a relatively high corporate tax rate with a top rate of 8.93 percent. High corporate rates can deter the formation of new businesses within a state. Within the debate about business taxes, it’s important to recognize that businesses pay more than just corporate income taxes.

According to “Total state and local business taxes,” a study from the Council on State Taxation and Ernst & Young, Maine businesses in fiscal year 2015 paid $3.2 billion in state and local taxes. Just $0.2 billion of that was in corporate income taxes; the rest was in property taxes ($1.8 billion), sales taxes ($0.5 billion), excise taxes ($0.3 billion), unemployment insurance taxes ($0.2 billion), individual income taxes on business income ($0.1 billion), and licenses and other taxes ($0.2 billion). This is an important framework to keep in mind through the conversation on business taxes.

State Business Tax Climate Index Changes

Currently, Maine is ranked 30th in the Tax Foundation’s State Business Tax Climate Index. That rank uses data from 2016 and does not include the new 3% individual income surtax. When the 101.15% top rate is included in next year’s edition, Maine’s ranking will fall. The Index measures 114 variables to score a state’s tax structure. Currently, Maine gets penalized on its ranking in large part due to its poor corporate, unemployment insurance, and property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. structures. Under the plan to adopt a flat income tax of 5.75 percent, lower the corporate tax rate to 8.33 percent, expand the sales tax, and eliminate the estate tax, Maine would rise to 17th in the country in the Index.

|

|

Current Score |

Proposed Plan |

|---|---|---|

|

Corporate Tax Rank |

41 |

39 |

|

Individual Income Tax Rank |

25 |

18 |

|

Sales Tax Rank |

8 |

7 |

|

Unemployment Insurance Tax Rank |

44 |

44 |

|

Property Tax Rank |

41 |

39 |

|

Total |

30 |

17 |

Conclusion

Maine residents pay 10.2 percent of their personal income in state and local taxes, ranking 13th in the country. Tax reform is needed in the state. The current proposals follow sound principles of tax policy: neutrality and simplicity. Reforming the tax code in Maine will make the state more economically competitive on both a regional and national scale. Thank you for your consideration, and I am happy to stand for questions at the appropriate time.