Written Testimony Submitted to the U.S. House Committee on Ways and Means

The problems with the current corporate income tax are well-known. The current corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. discourages investment, creates an incentive to finance spending with debt over equity, encourages companies to shift profits and headquarters overseas, and is overly complex.

In June 2016, the House Republicans released a tax reform plan, titled “A Better Way.”[1] Part of this tax reform proposal was a fundamental restructuring of business taxation that would eliminate most if not all the current issues with the corporate income tax.

The plan would replace the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. with a 20 percent “destination-based cash-flow tax.” This tax is different than the current corporate tax in four key ways:[2]

- Businesses would be able to fully expense their capital investments rather than being required to depreciate them over a number of years or decades.

- Businesses would no longer be able to deduct their net interest expense against their taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. .

- Foreign profits would no longer be subject to domestic taxation.

- The tax would be “destination-based,” meaning that the plan would make the U.S. income tax border-adjustable.

The most novel change the House GOP plan makes to the current tax code is that it applies the destination principle to the U.S. business income tax. This is done by enacting a “border adjustment.” Under the plan, businesses in the United States would no longer be able to deduct the cost of purchases from abroad, or imports. At the same time, businesses would no longer be taxed on the revenue attributable to sales abroad, or exports.

By itself, the border adjustment directly addresses two major problems with the corporate income tax. First, it eliminates the ability and incentive for corporations to shift their profits out of the United States. Second, it would greatly simplify business taxation by eliminating the need for complex current-law transfer pricing rules and anti-base erosion provisions. In addition, the border adjustment would raise additional revenue over the next decade, which would help fund the transition to a cash-flow business tax. The components of the cash-flow tax (most notably, expensing) would greatly improve the incentive for companies to invest and would grow the long-run size of the U.S. economy.

A Brief Overview of the Border Adjustment

The most basic way to understand the border adjustment is to understand the change it makes to the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. .[3]

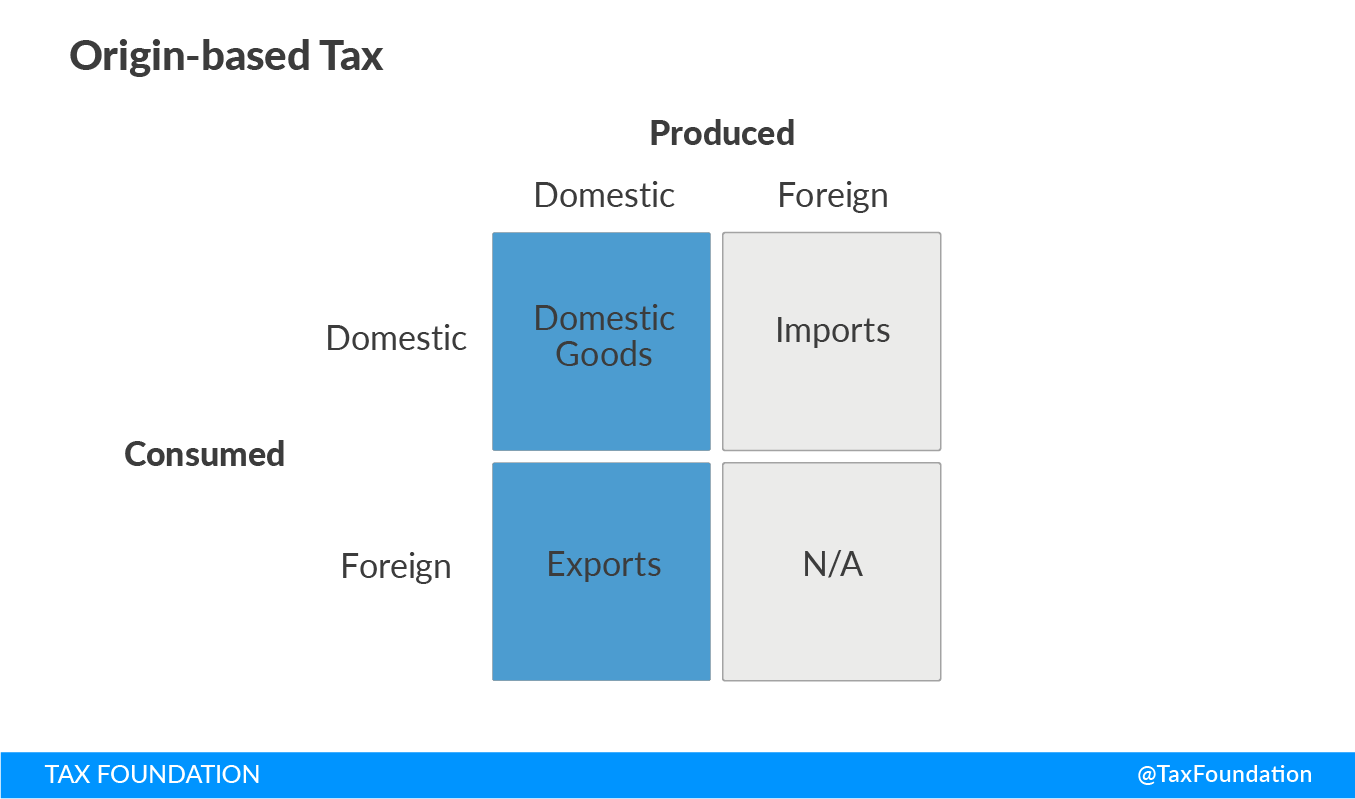

Generally, a country has two options when setting a tax base. It can levy an origin-based tax, a tax on the production of goods and services in a country. Or, a country can levy a destination-based tax, a tax on the sale of goods and services in a country.

An origin-based tax is one that taxes goods based on where they are produced, regardless of where they are consumed. As such, an origin-based tax applies to goods produced and consumed domestically (purely domestic goods) and to goods produced in the U.S. and consumed in foreign countries (exports). In the two-by-two matrix (below), an origin-based tax is applied to the top and bottom boxes on the left.

Generally, the current corporate income tax is an origin-based tax: the tax falls on the production of goods in the United States, regardless of where they end up.

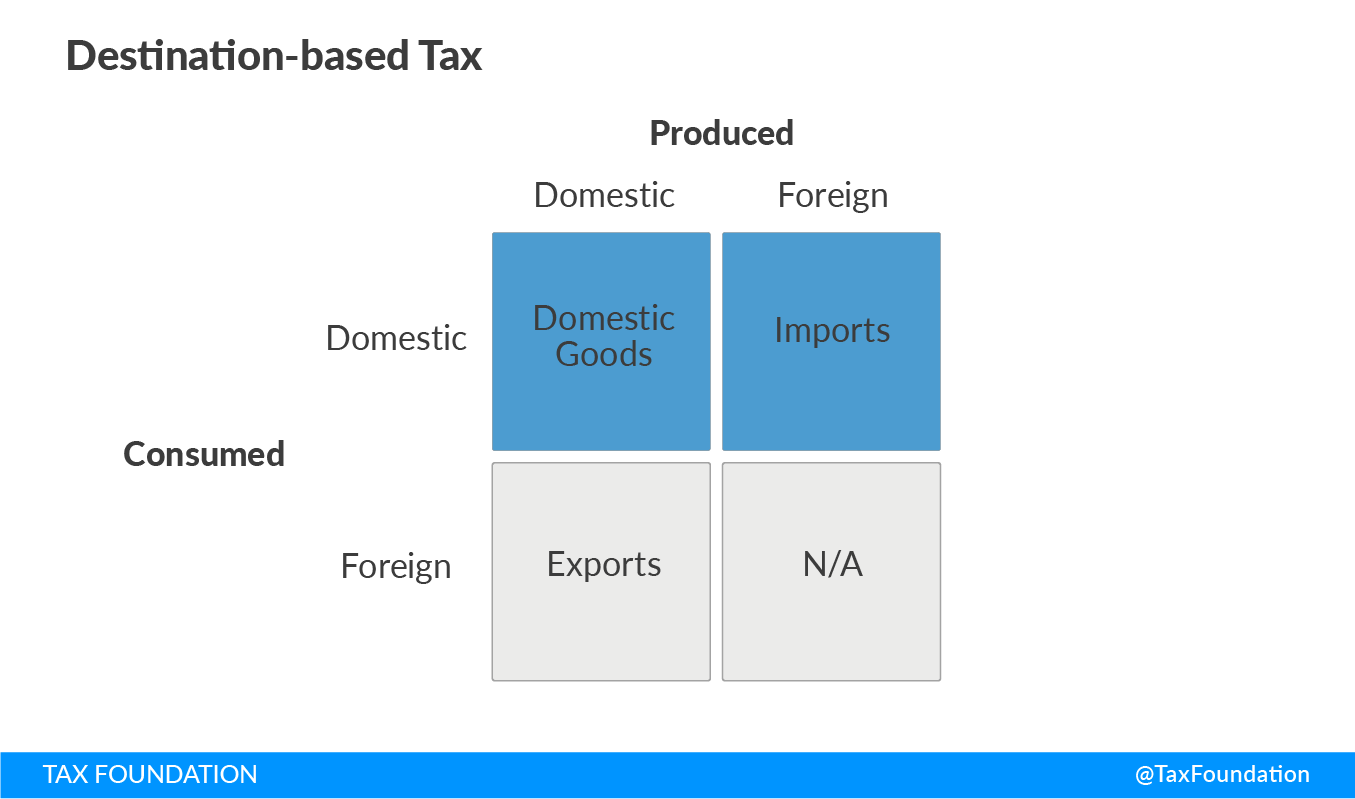

The border adjustment switches the tax base to what is called a “destination-based” tax. A destination-based tax is one that taxes goods and services based on where they are consumed, regardless of where they are produced. In our two-by-two matrix, a destination-based tax system is levied on goods and services in the two top boxes: goods produced and sold domestically (purely domestic products) and goods produced in foreign countries and sold domestically (imports).

In the United States, the most common example of a destination-based tax is the retail sales tax. These state-level taxes are applied to all goods (and sometimes services) sold in a state, regardless of where they were produced. Goods produced in a state and exported to another state are exempt from the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. . (However, they may face sales tax in the state in which they are ultimately sold to a consumer.)

The specific mechanism by which the House GOP has proposed applying the border adjustment would be to eliminate the deduction for purchases from overseas, effectively applying the tax to imports, and to exclude revenue from the sale of goods and services overseas, effectively removing any tax on exports. It is worth noting that a destination-based tax is not the same as a tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. .[4] As the diagram above shows, a destination-based tax falls on all domestic consumption, whether it is produced in the United States or produced in a foreign country. While a destination-based tax applies to imports, it also falls on domestically produced goods as well. By contrast, a tariff applies only to imports, creating a higher price for traded goods relative to domestic goods. While destination-based taxes are neutral, tariffs are not.

The Border Adjustment Eliminates the Ability for Corporations to Shift Their Profits Overseas

Fundamentally, corporate income taxes are prone to base erosion and profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. because they are levied on a base that is extremely hard to measure in today’s globalized world: domestic production.[5]

The location of production can be extremely difficult to figure out.[6] This is because production processes stretch across numerous jurisdictions and include not only physical processes, but also intangible ones that are difficult to price. Take, for example, the production of the movie Star Wars: The Force Awakens. The movie used intellectual property (IP) located in the United States; actors from the United Kingdom and the United States; and special effects developed in San Francisco, Singapore, London, and Vancouver. The movie was shot in the UAE, the U.K., Iceland, and Ireland, and tickets for the movie were sold throughout the world.

Companies with multinational production processes take deductions and report revenues throughout the world to allocate their profits. As such, it is very hard to determine exactly how much profit should be taxed in a given country. This leaves room for companies to take advantage of the complexity of cross-border pricing to allocate revenues and costs in tax jurisdictions in a way that can limit their worldwide tax liability. Specifically, companies face incentives to realize revenue in low-tax jurisdictions and incur costs in high-tax jurisdictions.

With the border adjustment, the transactions that allow a reduction in tax liability through profit shifting are eliminated. Since the cost of imports cannot be deducted, it doesn’t matter what a company charges its affiliates; it cannot deduct its import costs and thus cannot change its domestic tax liability. Likewise, exports are excluded from taxable income, so a company charging its affiliates $1 or $1 billion for an export has no bearing on its U.S. tax liability.

In fact, the incentives would go the other way under this tax system. Profit shifting would not change a company’s U.S. tax liability, but it would still change its foreign tax liability. As such, companies would have an incentive to locate profits in the United States. These profits would not be taxed in a foreign jurisdiction, and would only be taxed in the United States to the extent of a company’s U.S. sales. This could have a slight positive economic benefit to the extent that companies shift real activity to the United States along with their profits.

The Border Adjustment Greatly Simplifies International Taxation

The inability of firms to shift profits out of the United States would also mean that large portions of the U.S. tax code that deal with international taxation could be eliminated. The border adjustment would eliminate the need for complex anti-base erosion provisions such as Subpart F, which currently attempts to prevent companies from using highly mobile income to avoid U.S. taxation.

One common goal of tax reform is to move from the U.S.’s current worldwide tax systemA worldwide tax system for corporations, as opposed to a territorial tax system, includes foreign-earned income in the domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. to a territorial tax systemTerritorial taxation is a system that excludes foreign earnings from a country’s domestic tax base. This is common throughout the world and is the opposite of worldwide taxation, where foreign earnings are included in the domestic tax base. . A territorial tax system, which exempts foreign-source income from domestic taxation, is superior to current law, which requires corporations to pay tax on their worldwide profits. Moving to a territorial system would eliminate the incentives for corporations to shift their headquarters out of the United States.

However, territorial tax systems do suffer from base erosion concerns. Under a pure territorial system, companies that successfully shift profits out of the U.S. and repatriate those profits tax-free can reduce their U.S. tax burden. This is why the vast majority of developed countries that have moved to territorial tax systems have also enacted limits on their territorial tax systems and have kept strict rules to prevent companies from avoiding domestic tax liability. The goal of the Organisation for Economic Cooperation and Development’s (OECD) Base Erosion Profit Shifting (BEPS) initiative is to help countries prevent profit shifting under their origin-based corporate income taxes.

In 2016, 29 of the 35 member nations of the OECD had territorial tax systems that exempted between 95 and 100 percent of foreign profits from domestic tax liability.[7] Of these 29 countries, 17 placed limitations on their territorial tax system by either requiring the foreign profits to face some minimum tax rate, or by limiting the countries in which the territorial treatment applies. For example, Greece only exempts the profits of multinational firms if those profits are earned in EU member states.

In addition, 20 of the 39 nations with territorial tax systems have what are called “Controlled Foreign Corporations Rules” or CFC Rules. CFC rules are intended to prevent corporations from shifting their pre-tax profits from a high-tax country to a low-tax country by using highly liquid forms of income. If a foreign entity or subsidiary is deemed “controlled,” these regulations may subject the foreign corporation’s passive income (rent, royalties, interest) and sometimes active income to the tax rate of the home country of the subsidiary’s parent corporation. In the U.S., these are called Subpart F rules.[8]

Only four nations have enacted territorial tax systems without any official international tax rules. However, these countries typically apply general anti-abuse rules to international transactions.[9] It is also worth noting that even countries with low and competitive corporate tax rates have anti-abuse rules. For example, the United Kingdom has a competitive tax rate of 20 percent, but still applies complex CFC rules that attempt to tax profits that are believed to have been diverted from the United Kingdom to low-tax jurisdictions. In addition, the UK recently introduced a “diverted profits tax,” or the “Google Tax,” to further prevent profit shifting. In other words, a low corporate income tax rate would not automatically solve all concerns about profit shifting.9

| Source: 2016 International Tax Competitiveness Index | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Country | Corporate Tax Rate | Territorial (Participation Exemption)* | Limitations on Territorial Treatment of Foreign Profits | CFC Rules | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 30.0% | 100% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Austria | 25.0% | 100% | 15 Percent Minimum Taxation Condition | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Belgium | 34.0% | 95% | Taxation Condition | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canada | 26.7% | 100% | Treaty Countries Only | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chile | 24.0% | No | N/A | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Czech Republic | 19.0% | 100% | EU Member States | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denmark | 22.0% | 100% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estonia | 20.0% | 100% | Taxation Condition | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Finland | 20.0% | 100% | 10 Percent Taxation Condition and EU Member States | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| France | 34.4% | 95% | Non-Blacklist Countries | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Germany | 30.2% | 95% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greece | 29.0% | 100% | EU Member States | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hungary | 19.0% | 100% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Iceland | 20.0% | 100% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ireland | 12.5% | No | EU Member States | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Israel | 25.0% | No | N/A | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Italy | 31.3% | 95% | Non-Blacklist Countries | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Japan | 30.0% | 95% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Korea | 24.2% | No | N/A | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Latvia | 15.0% | 100% | None | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Luxembourg | 29.2% | 100% | 10.5 Percent Taxation Condition | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mexico | 30.0% | No | N/A | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Netherlands | 25.0% | 100% | None | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Zealand | 28.0% | 100% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Norway | 25.0% | 97% | Taxation Condition or EEA Member Countries | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Poland | 19.0% | 100% | EU and EEA Member States and Switzerland | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portugal | 29.5% | 100% | Non-Blacklist Countries and Taxation Condition | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Slovak Republic | 22.0% | 100% | None | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Slovenia | 17.0% | 95% | EU Member and White-List Countries and Taxation Condition | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Spain | 25.0% | 100% | Countries with Similar Tax to Spanish Corporate Income Tax | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sweden | 22.0% | 100% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Switzerland | 21.2% | 100% | None | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Turkey | 20.0% | 100% | Taxation Condition | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United Kingdom | 20.0% | 100% | None | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United States | 38.9% | No | N/A | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A border adjustment would make these complex anti-abuse rules unnecessary by essentially eliminating cross-border transactions from the business tax. Under a border adjustment, the United States could move to a territorial tax system without having to enact any new anti-abuse rules. In fact, the U.S. could even eliminate current base-erosion rules such as “Subpart F” and transfer pricing rules. Eliminating these rules could potentially reduce compliance costs significantly and generally improve the tax code. The Tax Foundation found that if the U.S. replaced our current international tax regulations with the border adjustment, it would give the U.S. the second best international tax regime among OECD member nations.[10]

| Source: Tax Foundation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Law | Blueprint | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate Income Tax | 35th | 4th | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumption Taxes | 4th | 4th | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Property Taxes | 30th | 21st | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Income Taxes | 25th | 18th | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| International Tax System | 34th | 2nd | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Combined Ranking | 31st | 3rd | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Border Adjustment Raises Revenue to Transition to a More Efficient Cash-Flow Tax

Besides the direct improvements the border adjustment makes to the tax code, it is an important component of the proposed tax reform because it raises revenue to help fund the transition to cash-flow business taxation, which would have a significant, positive impact on the long-run size of the U.S. economy. Without the border adjustment, lawmakers would either need to make the tax reform temporary, scale back the size of the rate cuts in the tax plan, or abandon the cash-flow model in reform. Any of these approaches would have significant downsides.

Using the Tax Foundation’s Taxes and Growth Model, we isolated the effect of the business portion of the House GOP Blueprint. We estimate that converting the 35 percent corporate income tax into a 20 percent destination-based cash-flow tax (DBCFT) would grow the long-run size of GDP by 5.8 percent: in other words, it would add roughly another 0.6 pe2cent of GDP growth per year over the next decade (Table 3).

| Source: Tax Foundation Taxes and Growth Model, March 2017 | ||

| *Assumes broader base from individual income tax reform in GOP Blueprint | ||

| Revenue (2017-2026) | Long-run GDP Impact | |

|---|---|---|

| Full Expensing of Capital Investments | -$2,472 | 4.3% |

| Territorial Tax System | -$171 | 0.0% |

| Reduce Corporate Rate to 20 percent | -$1,251 | 1.5% |

| 25 percent Pass-Through Rate | -$678 | 0.3% |

| Total Tax Cuts | -$4,572 | 6.1% |

| Eliminate Interest Deduction | $1,141 | -0.2% |

| Border Adjustment | $1,244 | 0.0% |

| Eliminate Business Deductions and Credits | $735 | -0.1% |

| Enact Deemed Repatriation | $185 | 0.0% |

| Total Base Broadeners | $3,305 | -0.3% |

| Total Static | -$1,267 | |

| Total Static without Border Adjustment | -$2,511 | |

| Additional Revenue from Economic Growth* | $1,589 | |

| Total Dynamic | $322 | 5.8% |

| Total Dynamic without Border Adjustment | -$922 | 5.8% |

The two components of the DBCFT that contribute the most to growth are full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. of capital investments (4.3 percent over the long run) and the 20 percent corporate income tax rate (1.5 percent over the long run). However, these two components, combined with moving to a territorial tax system and a special lower rate on pass-through businesses, would reduce revenue by $4.5 trillion over the next decade. Even accounting for the additional dynamic revenue of $1.5 trillion, these tax cuts would reduce revenue by $3 trillion over the next decade.

The GOP’s business reform offsets the cost of these tax cuts with four base changes that raises $3.3 trillion over the next decade. The largest of these is the border adjustment, which would raise $1.2 trillion, followed by the elimination of the deduction for net interest expense ($1.1 trillion), the eliminations of most business credits and deductions ($735 billion), and deemed repatriation ($185 billion).

In total, the DBCFT would reduce federal revenue by $1.2 trillion over the next decade. However, accounting for the higher output over the next decade and the broader tax base, the DBCFT would end up raising revenue by $322 billion over the same period. This means that the case could be made that the business provisions are roughly revenue-neutral and could comply with the Byrd Rule in a reconciliation package.

Without the border adjustment, the static cost would increase from $1.2 trillion to $2.5 trillion over the next decade and the dynamic estimate would go from raising $322 billion to losing $922 billion without changing the plan’s impact on the long-run economy. The plan would no longer be close to revenue-neutral on either a static or a dynamic basis. The plan would no longer comply with the Byrd Rule and would likely need to be temporary if passed through reconciliation. This would significantly mute the potential growth from the reform and could introduce uncertainty into the business community.

To avoid making tax reform temporary without the border adjustment, the plan could be brought closer to revenue neutrality by scaling down the size of the tax cut. One option would be to raise the corporate tax rate from 20 percent to 28 percent. However, with a much higher corporate rate and no border adjustment, the plan would reintroduce concerns about base erosion and profit shifting and necessitate reintroducing complex international tax regulations. The plan would also not generate as much growth.

Alternatively, the plan could keep the rate close to 20 percent, but abandon the move to a cash-flow tax base by not moving to full expensing or eliminating the deduction for net interest expense. While this would bring the revenue numbers more in line with the original plan, it would significantly reduce the growth from the tax reform. As mentioned previously, full expensing, by itself, would grow long-run GDP by 4.3 percent, which is more than half of the total GDP impact of the business tax reform. Again, since it eliminated the border adjustment, this option would necessitate reintroduction of international tax regulations.

Conclusion

The House GOP’s tax reform proposal would replace the current 35 percent corporate income tax with a 20 percent “destination-based cash-flow tax.” Part of this tax would be the “border adjustment,” which would apply the tax to all goods and services sold in the United States. The border adjustment would be an elegant way to eliminate base erosion and profit shifting by multinational corporations. It would also allow for the elimination of complex anti-base erosion provisions, which would improve the competitiveness of the U.S. tax code. It would also raise revenue over the budget window, which helps fund the transition to a cash-flow tax, which we estimate would boost the long-run size of the economy by 5.8 percent.

[1] “A Better Way, Our Vision for a Confident America: Tax,” House Republicans. June 2016. https://abetterway.speaker.gov/_assets/pdf/ABetterWay-Tax-PolicyPaper.pdf

[2] Kyle Pomerleau and Steve Entin, “The House GOP’s Destination-Based Cash Flow Tax, Explained,” Tax Foundation. June 30, 2016. https://taxfoundation.org/house-gop-s-destination-based-cash-flow-tax-explained/

[3] Kyle Pomerleau, “Understanding the House GOP’s Border Adjustment,” Tax Foundation. February 15, 2017. https://taxfoundation.org/understanding-house-gop-border-adjustment/

[4] A long line of academic literature has found that border adjustments are trade-neutral. See: European Coal and Steel Community, High Authority, “Report on the problems raised by the different turnover tax systems within the Common Market” (Tinbergen Report) (European Coal and Steel Community, High Authority, 1953).

Shibata, Hirofumi, “The theory of economic unions: A comparative analysis of customs unions, free trade areas, and tax unions,” in Carl S. Shoup ed., Fiscal Harmonization in Common Markets, Vol. l: Theory (New York: Columbia University Press, 1967), 145-264.

Johnson, Harry and Mel Krauss, “Border taxes, border tax adjustments, comparative advantage, and the balance of payments,” Canadian Journal of Economics. November 1970, 3 (4), 595-602.

Meade, James E., “A note on border-tax adjustments,” Journal of Political Economy. September-October 1974, 82 (5), 1013-1015.

Floyd, Robert H., “Some long-run implications of border tax adjustments for factor taxes,”

Quarterly Journal of Economics. November 1977, 91 (4), 555-578.

Grossman, Gene M., “Border tax adjustments: Do they distort trade?” Journal of International Economics. February 1980, 10 (1), 117-128.

Feldstein, Martin and Paul Krugman, “International trade effects of value-added taxation,” in Assaf Razin and Joel Slemrod eds., Taxation in the Global Economy (Chicago: University of Chicago Press, 1990), 263-278.

Alan Auerbach, “The Future of Fundamental Tax Reform,” The American Economic Review. May 1997.

[5] Although there is debate over the degree of profit shifting being done by multinational corporations, there is unanimous agreement that profit shifting occurs on a regular basis. See: Cederwall, Eric, “Making Sense of Profit Shifting,” Tax Foundation. May 26, 2015. https://taxfoundation.org/making-sense-profit-shifting-halftime-report-part-1

[6] Kyle Pomerleau, “How a Destination-based Tax System Reduces Tax Avoidance,” Tax Foundation. April 4, 2017. https://taxfoundation.org/destination-based-tax-system-reduces-tax-avoidance

[7] PwC Worldwide Tax Summaries, Corporate Taxes 2016/2017

[8] Kyle Pomerleau, “International Tax Competitiveness Index 2016,” Tax Foundation. September 2017. https://taxfoundation.org/publications/international-tax-competitiveness-index/

[9] PwC Worldwide Tax Summaries, Corporate Taxes 2016/2017.

[10] Kyle Pomerleau, “Grading the House GOP Blueprint with the International Tax Competitiveness,” Tax Foundation. February 14, 2017. https://taxfoundation.org/grading-house-gop-blueprint-international-tax-competitiveness-index/