IRS Report Shows Closing the Tax Gap Would Not Close the Deficit

The latest tax gap report from the IRS has generated much media attention—and much misunderstanding.

6 min read

The latest tax gap report from the IRS has generated much media attention—and much misunderstanding.

6 min read

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

Can an organization rightfully be called a “nonprofit” if it almost always makes money? And what if most of that organization’s income comes from “business income,” should it legitimately be considered a “charity”?

7 min read

A major case pending before the U.S. Supreme Court (Moore v. United States) is calling into question provisions on large portions of the U.S. tax base which could quickly become legally uncertain, putting significant revenue at stake.

7 min read

One year after its enactment, there are concerns about the Inflation Reduction Acts overall fiscal impact, the additional complexity it introduces to the tax system, and the sustainability of its initiatives.

Moving from one athletic conference to another can mean millions in additional revenue sharing from lucrative broadcasting contracts and other revenue streams, all tax-free.

6 min read

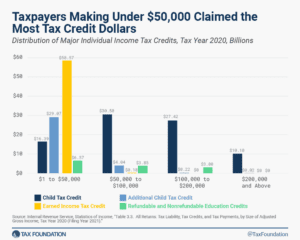

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

Congress should reconsider key elements of the IRA, including the book minimum tax and the green energy credits, with an eye towards simplification and fiscal responsibility.

46 min read

Starting on September 1st, federal student loan payments will resume after a three-and-a-half-year pause on payments and accrued interest following the onset of the COVID-19 pandemic.

6 min read

Details and analysis of the latest House GOP tax plan, the American Families and Jobs Act. Learn more about the House Republican tax plan.

7 min read

Explore IRS clean energy tax credits, including Direct Pay, the IRA and CHIPS Act tax provisions, and Section 1603 grant program. See more.

7 min read

It is hard to imagine the IRS Direct e-File Program operating seamlessly with the complexity of the current U.S. tax system. Instead, lawmakers should first address the more fundamental problem that causes taxpayer frustration: our highly complicated tax code.

4 min read

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

What both parties ignore: The IRS does not need more money for enforcement; it needs fewer things to enforce.

Lawmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code.

7 min read

To address the more challenging parts of the budget, especially the unsustainable growth in mandatory spending, lawmakers should follow up on this debt ceiling agreement with a focus on long-term fiscal sustainability.

6 min read

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

While the IRS hopes to increase revenue collection and minimize additional burdens on taxpayers, uncertainty remains regarding its ability to deliver, particularly on the latter. Furthermore, some concerns about the original funding package are already surfacing, specifically around insufficient funding for taxpayer services.

6 min read