Taxes, Fiscal Policy, and Inflation

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

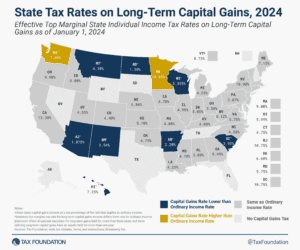

Savings and investment are critical activities, both for individuals’ and families’ financial security and for the health of the national economy as a whole. As such, policymakers should consider how they can help mitigate—rather than add to—tax codes’ biases against saving and investment.

5 min read

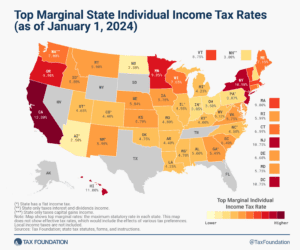

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read

Nebraskans need property tax relief and there are sound ways to provide it. However, increasing the sales tax rate to the highest in the country and dramatically increasing cigarette excises is not sound tax policy.

5 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

What historical lessons of wartime finance can Ukrainian and EU policymakers learn to put Ukraine’s economy on a path to success during, and especially after, the war?

5 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

Policymakers on Capitol Hill should prioritize permanent pro-growth policy in the coming years as the economy struggles with inflation and the recovery from the pandemic.

4 min read

At the most recent Republican primary debate, former governor and United Nations ambassador Nikki Haley (R-SC) proposed eliminating the federal gas tax to lower fuel prices for consumers.

3 min read

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

One year after its enactment, there are concerns about the Inflation Reduction Acts overall fiscal impact, the additional complexity it introduces to the tax system, and the sustainability of its initiatives.

GDP stands for gross domestic product and is calculated by measuring a country’s total consumption, government spending, investments, and net exports.

2 min read

Congress should reconsider key elements of the IRA, including the book minimum tax and the green energy credits, with an eye towards simplification and fiscal responsibility.

46 min read

Details and analysis of the latest House GOP tax plan, the American Families and Jobs Act. Learn more about the House Republican tax plan.

7 min read

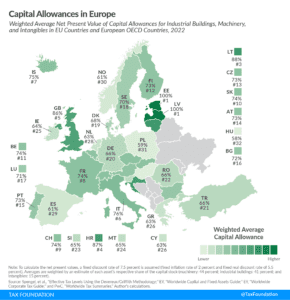

Capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min read

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read